Oil Prices Overview:

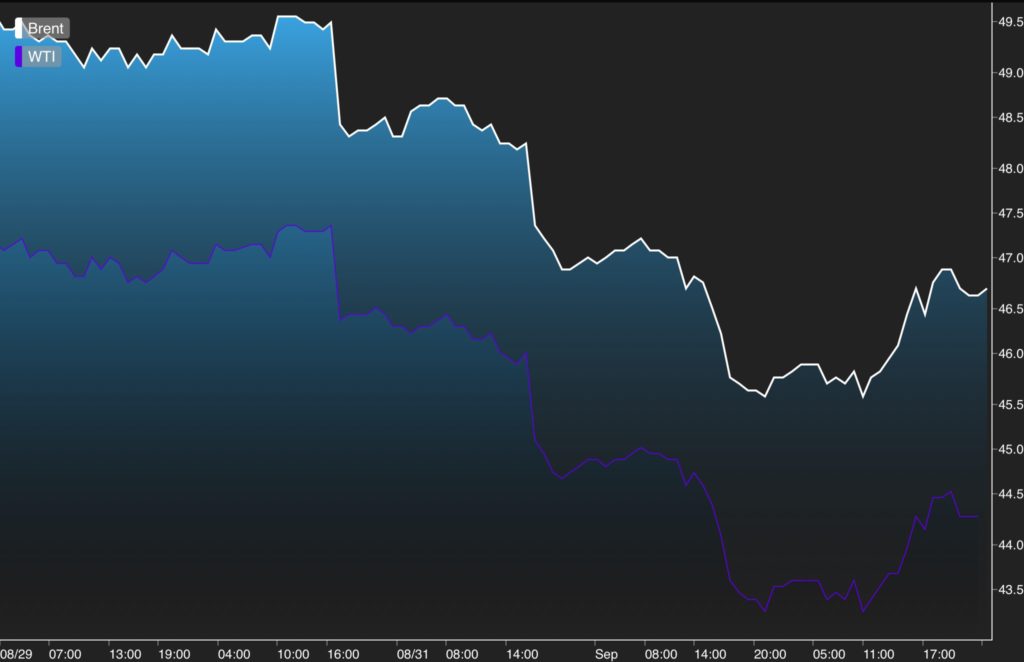

Las week, the pressure on oil prices was too high and prices fell sharply as expected in our previous oil prices forecast. Oil prices started the week moving slightly downward. However, on Wednesday the oil prices begun a sharp decline following another significant increase in U.S. crude stockpiles reported by the EIA. By the end of the week, particularly on Friday, Brent Crude and WTI oil prices were below $46/bbl and $44/bbl down from around $49/bbl and $47/bbl respectively earlier on Monday.

Brent Crude & WTI Oil Prices

But oil prices did not close the week at these low levels. In fact, on Friday, oil prices settled up nearly 3 percent. The support to oil prices on Friday came from two factors. First was less than expected U.S. jobs numbers which hurt the dollar and supported oil prices. The second reason was the barrage of comments from OPEC and Russian officials to boost the oil output freeze deal last week after its sharp fall.

As we have seen in the past few weeks, when oil prices start to collapse sharply, OPEC’s members will give comments to boost the output freeze deal in order to support oil prices. But last week the support didn’t come from OPEC’s members only as in the previous weeks. On Friday, the Russian President Vladimir Putin called on oil-producing countries to cap production levels at a meeting later this month.

Adding to the support from Putin’s comment, the output freeze deal received support from several comments from Iraqi Prime minister Haider al-Abadi recent comment which support the output freeze deal. A move which could give a huge boost to the output freeze deal as Iraq initially rejected the idea of participating in any production cap agreement.

Despite the changing sentiments and how OPEC and Russia seem to be warming the idea of output freeze deal, the odds that OPEC and Russia agree to cap oil production is still not strong enough. In fact, it should not be taken as a ground to plan for a medium term investment with expectation that the oil price could be sustained above $50/bbl or increases more than $60/bbl.

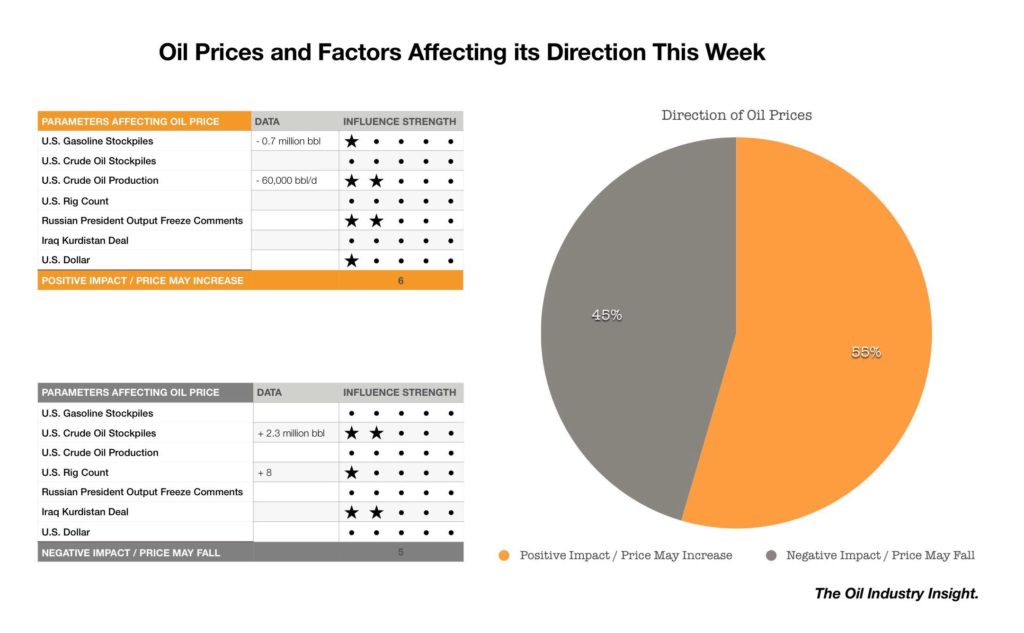

Last Week Data/News & This Week Oil Price Forecast:

The overall performance for oil prices this week is at a better state than the last two weeks. And despite the fact that fundamentals are still posing a huge threat to oil prices and increasing the probability of oil prices to fall again, the oil market traders and investors are hope seekers and that is what could prevent oil prices from falling this week.

Oil Price Forecast for This Week

In the last two weeks, investors and traders started to doubt OPEC’s talk to bring any meaningful outcomes, and that was the main reason that allowed oil prices to fall sharply last week despite few supportive comments from OPEC’s members to support the output freeze talk. However, the barrage of last week comments from OPEC and and especially from the Russian officials will definitely increase the oil market confidence that an output freeze deal could be reached by the end of this month.

Adding to the support, last week’s oil industry reports and data could support oil prices this week. U.S. crude oil production sharply decreased by 60,000 bbl/day to 8,488,000 million bbl/day as reported by the EIA. U.S. rig count could support oil prices this week as well. While Baker Hughes rig count for the U.S. reported an increase of 8 rigs last week, only one rig from this addition was an oil rig. After being unchanged to the week ending August 26, and only one rig addition this week, U.S. oil rig count appears to be steadying. This trend could support oil prices in the coming weeks if maintained.

Adding to the positive support, U.S. dollar could also support oil prices this week. In fact not only this week. Following the release of U.S. jobs report which showed that the U.S. created 151,000 jobs in August versus 180,000 jobs expected, U.S. dollar started its upward momentum last week. The report came at a critical time as the Feds are watching jobs numbers closely. August jobs number is not bad, but it probably pull off this month off the table for any interest rate hike. This news will support oil prices at this critical time.

Despite all these positive data and news which could support oil prices this week, the gains in oil prices this week will be limited by concerns over the continuous increase in U.S. crude oil stockpiles. In fact, if this week U.S. crude stockpiles increased again, oil prices could experience a slight fall.

The overall oil prices outlook for this week is positive. Bent and WTI crude oil prices could make some gains earlier in the week. However, U.S. crude stockpiles data for this week will further determine the overall direction of oil prices. We also expect more support from other OPEC’s member this week to assure the oil market that an out freeze deal could be reached.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.