Oil Prices Overview:

Driven by a steep rise in U.S. oil rig count and a worse-than expected buildup in U.S. crude inventories reported by API, last week oil prices fell from their three-year highs during the first two days of trading. While oil price was boosted by market optimism and news of OPEC/non-OPEC compliance to oil output cut on Thursday and early Friday, it fell again on Friday. Oil price closed last week down by more than 2 percent on stronger U.S. dollar and Baker Hughes rig count report that showed U.S. drillers added 6 oil rigs to the week ending February 2, 2018.

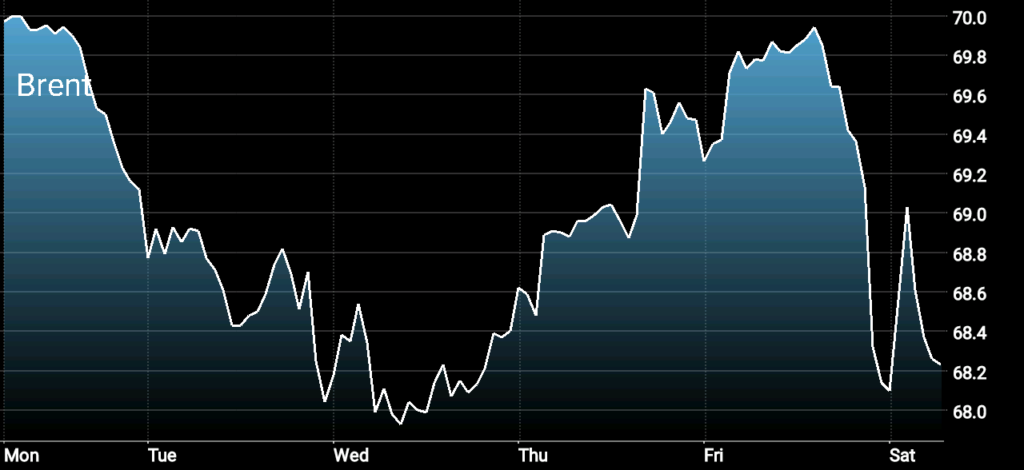

Brent Crude Oil Price for the Week Ending February 2, 2018

Brent crude and WTI closed last week, February 2, at $68.23 per barrel and $65.14 per barrel, down by more than 2 percent and 1 percent respectively.

Where is Oil Price Heading this Week?

Crude Oil Price and Factors Affecting its Direction for the Week Starting February 5:

The Week Ahead for Crude Oil:

Oil price is expected to be under pressure this week. Despite the support to oil price coming from OPEC/non-OPEC oil output cut deal and the current high level of optimism in the oil market, this week, oil price has more reasons to fall than to go up. Beginning with last week’s growth in U.S. crude oil production and oil rig count, both parameters are expected to put a huge pressure on oil price this week. In addition, the recent increase in U.S. crude oil inventories seen last week would also put more pressure on oil prices especially if the EIA reported another buildup in U.S. stockpiles this week.

Adding to the pressure, the recent strength in U.S. dollar is expected to further drag oil prices down this week. For the last a few weeks oil price has been supported by the weakness in the greenback as it continued to lose value. However, with last week’s strong Jobs report in the United States, we expect that is no longer the case at least for the short-term.

Looking ahead at oil price movement this week, oil price is expected to fall by 1 percent during the first two days of trading. The downward movement is expected to intensify on Wednesday as the EIA is expected to report an increase in U.S. crude oil production and another buildup in U.S. crude inventories. Brent crude and WTI are expected close the week on Friday February 9, down by 1.5 to 2 percent respectively.

Oil Prices Movers to Watch for This Week:

- Fourth quarter 2017 earnings reports from oil companies

- API and EIA data of U.S. crude oil inventories.

- U.S. dollar movement throughout the week.

- U.S. crude oil production data.

- Canada and U.S. oil rig count data.

Remark: The expectations of oil prices movements in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the movements of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.