Oil Price Performance Over the Week:

As expected in my previous Weekly Oil Price Commentary, oil prices edged up by 2 percent last week supported by positive oil market sentiments. Crude oil prices were also supported by the Energy Information Administration (EIA)’s reports that were published on Wednesday last week.

In its weekly reports, the EIA reported declines in U.S. crude oil inventories and gasoline inventories by approximately 6.1 million barrels and 2.3 million barrels respectively. These declines along with an unchanged crude oil production output from the United States which stood at 11 million barrels per day as reported by the EIA gave some support to oil prices throughout the rest of week.

Despite the increase in the number of rigs drilling for oil in the United States last week by 3 rigs as reported in Baker Hughes Rig Count on Friday, crude oil prices closed the week higher by more than 2 percent on support from a weaker U.S. dollar due to a weaker-than-expected GDP data.

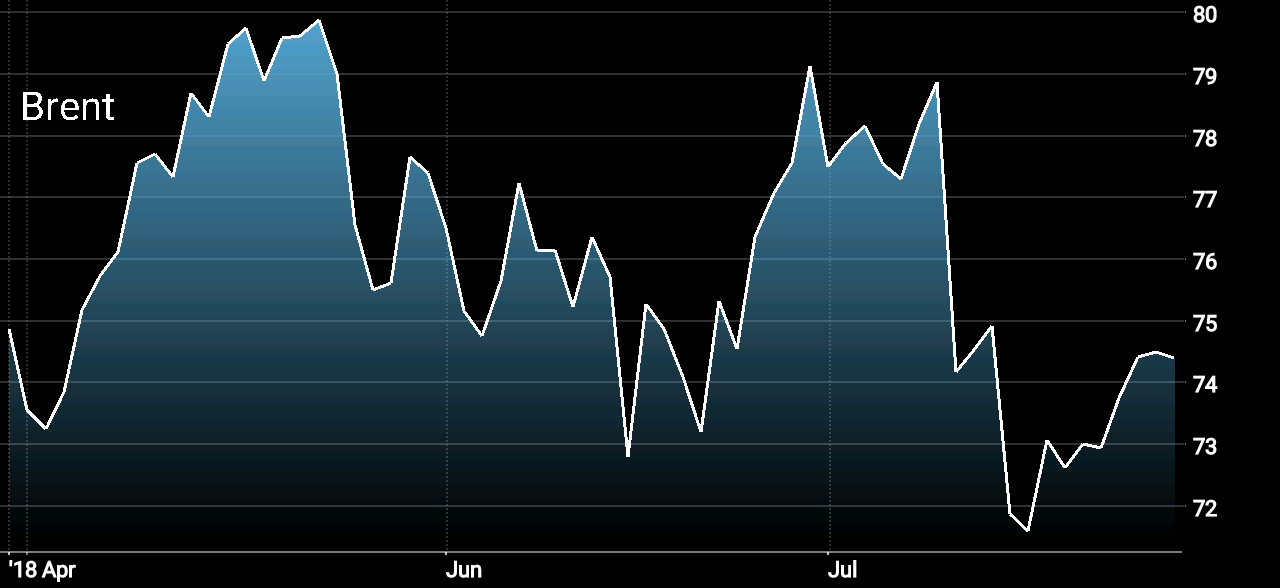

Brent Crude and WTI closed last week around $74.92/bbl and $67.19/bbl respectively.

Oil Market Data and Factors Influencing Oil Price Direction

Where is Oil Price Heading this Week?

Crude Oil Price and Factors Affecting its Direction for the Week Starting July 30:

The Week Ahead for Crude Oil:

In a similar trend to that of last week, crude oil price is expected to be trading in the green this week. Crude oil price will be supported by various oil market parameters this week including but not limited to; a decline in U.S. crude oil and gasoline inventories, unchanged U.S. crude oil production output, a weaker U.S. dollar, and an escalating tension in the Middle East that resulted in Saudi Arabia halting its oil transport through Bab el-Mandeb in the Red Sea after its oil tankers were attacked by Iran-backed Houthi militants in Yemen.

Despite this positive outlook, oil is expected to fall slightly on Monday to reflect the negative impact of an increase in the number of rigs drilling for oil in the United States as well as news that hedge funds managers are cutting their bullish positions on oil futures. However, the downward pressure will not last for long, and we expect oil prices to edge up by 1 to 2 percent again this week.

The upward movement in oil prices will also depend on EIA reports that will be published this week, which if it shows decline in U.S. crude oil inventories will support oil prices edge up by 3 percent.

The upward movement in oil prices will continue to be limited by concerns of supply glut as Middle East’s oil producers are prepared to ramp up their oil output in anticipation of U.S. sanctions on Iran, and trade war between U.S. and China.

Oil Prices Movers to Watch for This Week:

- API and EIA data of U.S. crude oil inventories, (Tuesday & Wednesday)

- U.S. dollar movement (FED Meeting and its impact on US dollar index)

- U.S./China trade war news

- U.S. crude oil production data, (Wednesday)

- Baker Hughes rig count data

Remark: The expectations of oil prices movements in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the movements of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.