Oil Price Overview:

Unlike what I expected in my previous Weekly Oil Price Commentary, last week oil price posted a weekly rise despite various negative oil market sentiments which I expected to drive oil prices down. The main driver for the unexpected rebound in oil price was the comments by Saudi Arabia Oil Minister, Khalid Al-Falih on Wednesday following the Eighth IEA-IEF-OPEC Symposium on Energy Outlooks that took place in Riyadh last week.

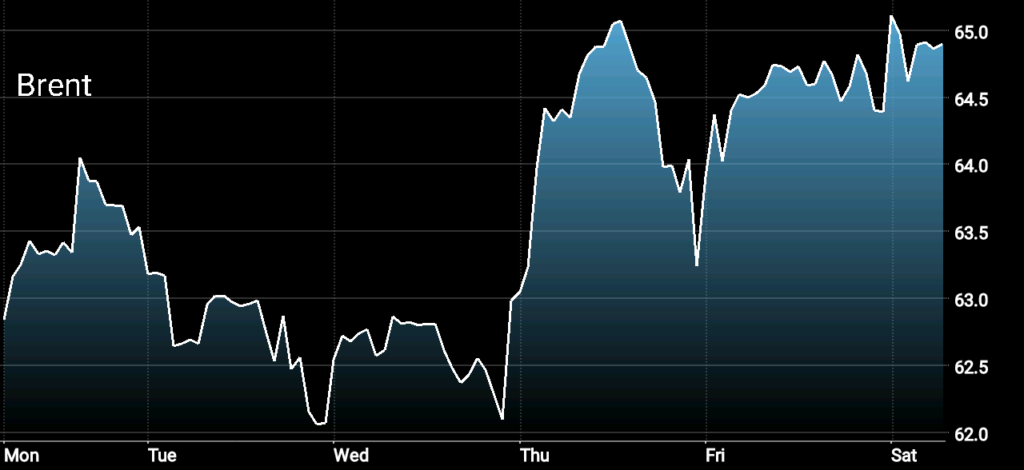

In a statement that was meant to provide support to falling oil prices and reassure the oil market on the longevity of OPEC cuts to prevent further decline to oil prices, Al-Falih said “If we have to err on over-balancing the market a little bit, so be it,”. Al-Falih also said “Rather than quitting too early and finding out we were dealing with less reliable information … Stay the course and make sure that inventories are where the industry needs them,”. Following his comments, Brent crude futures climbed from around $62/bbl on Wednesday to nearly $65/bbl on Thursday.

Reading between the lines -from Al-Falih’s comments, one could sense that OPEC members including Saudi Arabia have started to think that continuing to support oil prices through oil output cut strategy is creating the perfect environment that will lead to falling oil prices. However, since the weekly EIA data of U.S. crude oil production is not confirmed yet, which he may have referred to as “less reliable information” in his statement, OPEC, led by Saudi Arabia will continue to support oil prices by maintaining the current oil output cut deal.

Besides the comments from the Saudi Oil Minister, last week oil price was also supported by stocks recovery as the stock market has continued to stabilize and the consequent decline in U.S. dollar index which also provided some support to oil price.

Brent Crude Oil Price for the Week Ending February 16

Driven by these positive parameters, Brent crude and WTI closed last week on February 16, up by approximately 4 percent to $64.90/bbl, and $61.57/bbl respectively.

Oil Market Data and Factors Influencing Oil Price Direction

Where is Oil Price Heading this Week?

Crude Oil Price and Factors Affecting its Direction for the Week Starting February 19:

The Week Ahead for Crude Oil:

Oil price direction for this week and the next couple of weeks will highly depend on how far can the oil market continue to ignore alarming oil market fundamentals and rely on “COMMENTS” made by Saudi Oil Minister to support the oil price rally.

I continue to watch the oil market closely, and I can see that the current state of the oil market is exactly like a drowning man who tries to clutch at a straw. While U.S. crude oil production and rig count continue to increase rapidly and U.S. crude stocks recently reversed a course and has continued to increase for the third consecutive week, when a positive comment is made by one of OPEC’s members, the market forgets about all these negative sentiments and only focus on that positive comment which was meant to drive the oil price upward.

It is understood that the current state of the oil market is more into optimism, and that many players in the oil market right now are trying to maintain this optimism. However, one can not ignore the fundamentals and where the oil market is heading. Yes, OPEC and non-OPEC producers -through their oil output cut deal- has managed to reduce the global oil inventories and drove oil prices to a higher level, but while doing so, they have encouraged the comeback of U.S. shale oil producers as oil price has remained above $50/bbl. And now they only have two options, to continue to support oil prices and lose market share or let the oil output cut deal fall apart and see oil prices falling below $50/bbl again. Apparently, we will not have to wait for a long time to see what they will choose.

Having said that, and looking ahead at oil price movement this week, Brent crude and WTI are expected to fluctuate around their current levels. Supported by the recovery of the stock market, falling U.S. dollar index, and Saudi Arabia oil minister’s comments, oil price is expected to go up by 1 percent during the first two days of trading.

On Wednesday through Friday, support to oil prices is expected to be offset by negative data and news coming from the EIA and Baker Hughes rig count which I expect to report growth in U.S. crude oil production, and stockpiles, and an increase in U.S. oil rig count. Brent crude and WTI are expected to close this week down by 1 to 2 percent.

Oil Prices Movers to Watch for This Week:

- API and EIA data of U.S. crude oil inventories, (Tuesday & Wednesday)

- U.S. dollar movement, and stock market stability

- U.S. crude oil production data, (Wednesday)

- Canada and U.S. oil rig count data, (Friday)

Remark: The expectations of oil prices movements in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the movements of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.