In January 2018, during an Energy Panel in Davos, Khalid Al-Falih, Saudi Arabia’s energy minister criticized the International Energy Agency (IEA) over its remarks that the explosive expansion in shale oil production will continue through 2018 to 2019, and that U.S. crude oil production is in course to overtake Saudi Arabia and rival Russia. Al-Falih accused the IEA of overhyping the growth potential of shale oil production and its impact on the oil market and oil price direction.

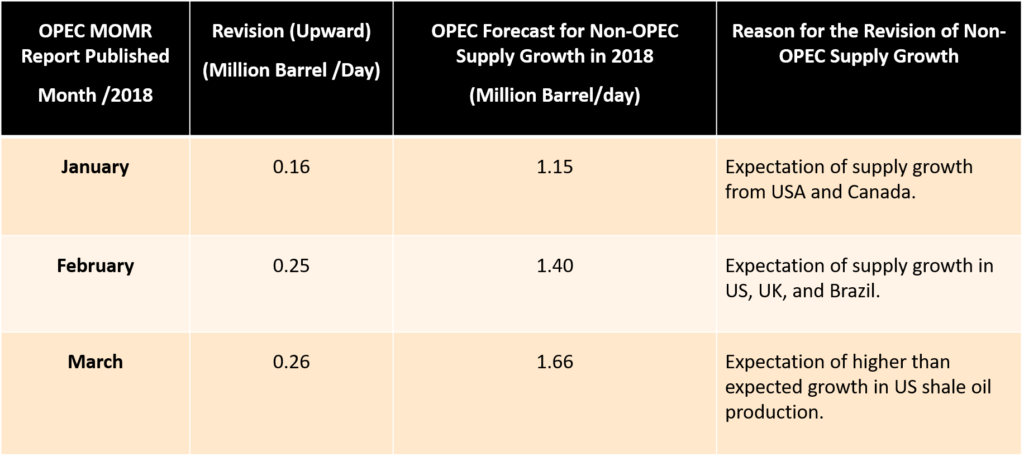

Today, after almost two months, OPEC seems to be admitting the fact that U.S. crude oil production is growing in a faster than expected pace, according to OPEC Monthly Oil Market Report (MOMR), published last week. In fact, in its Monthly Oil Market Reports for the last three months (January, February and March 2018), OPEC has revised upward its forecasts for non-OPEC oil supply growth to accommodate the fast pace of growth in non-OPEC oil supply growth particularly, the growth of U.S. shale oil production.

OPEC Upward Revisions for Non-OPEC Supply Growth Jan, Feb and March 2018

The most recent upward revision for non-OPEC supply growth was reported by OPEC last week. In its March’s MOMR, OPEC revised up its forecast for U.S. shale oil production growth for 2018 by 260,000 barrel per day due to higher than expected growth in U.S. shale oil production. OPEC now expects non-OPEC oil supply growth for 2018 to stand at 1.66 million barrel per day. Given this revision, OPEC sees the total global oil supply to rise faster than demand, which the cartel expected it to stand at 1.60 million barrel for 2018.

Despite these bearish forecasts by OPEC, the cartel members especially Saudi Arabia are still supporting the oil output cut deal and the irony is, they still think that it may eventually succeed in balancing the supply and demand. One thing to note here is that, the enthusiasm of the cartel’s members and the confidence that we have seen in the last two years that their oil output cut deal would succeed in balancing the oil market supply and demand is no longer there. In fact, many of the cartel’s members recently stated that they are now in a “wait and watch” state to observe where the market is heading.

Unfortunately for them, the oil market is heading in a direction that they do not like, that is; faster growth in non-OPEC oil supply and lower oil prices. For the cartel’s members to see the oil market heading where they want to, they would probably have to sacrifice more market share. The question now is, are they willing to do that? I don’t think so.