Last Week Oil Market Data:

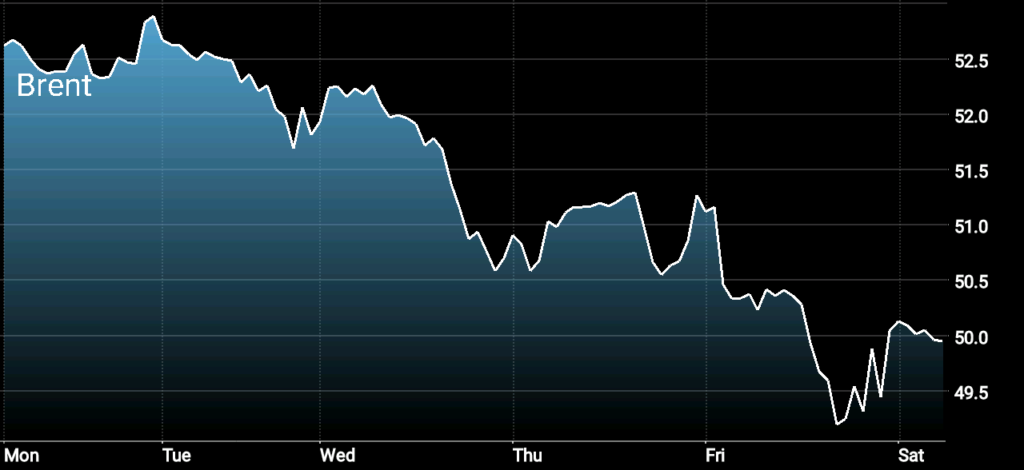

Last Week Crude Oil Price Movement: Oil prices were under pressure last week as expected in our last Week’s Oil Price Commentary. Brent crude and WTI started the week around $52.8/bbl $49.8/bbl and closed the week 5 percent lower on concerns over growing U.S. crude oil output and rig count, and the increase in May’s OPEC oil output as cut-exempt Nigeria and Libya pump more oil.

Brent Crude Oil Price

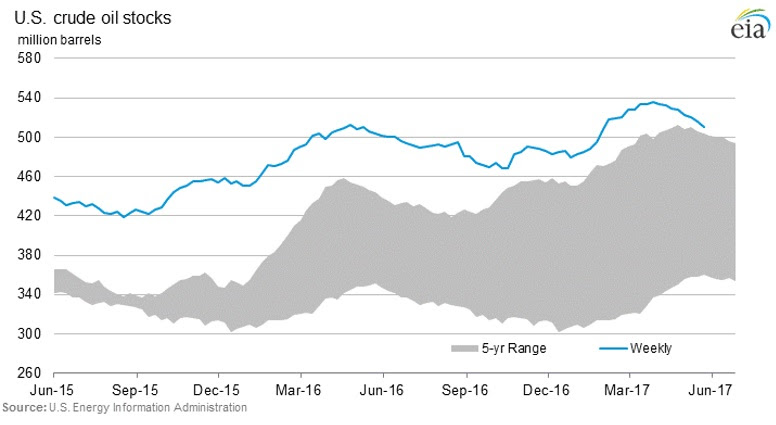

U.S. Crude Oil Inventories: U.S. crude oil inventories continued its decline for the eighth weeks falling by 6.4 million barrel to the week ending May 26. The fall in U.S. crude inventories supported oil prices on Wednesday, however, that didn’t last for long as the impact of other market parameters including the EIA data that showed an increase in U.S. crude oil production reversed the direction of oil prices, pushing it down below $50/bbl on Friday.

US Crude Oil Stockpiles

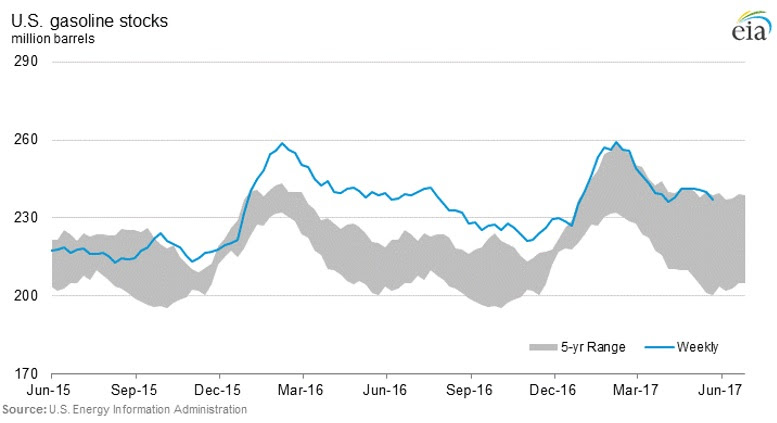

U.S. Gasoline Stocks: U.S. gasoline inventories fell again last week for the third week by 2.9 million bbl. The fall in U.S. gasoline stocks as well as U.S. crude inventories supported oil prices on Wednesday, however negative sentiments eroded this support and drove oil prices down.

US Gasoline Stockpiles

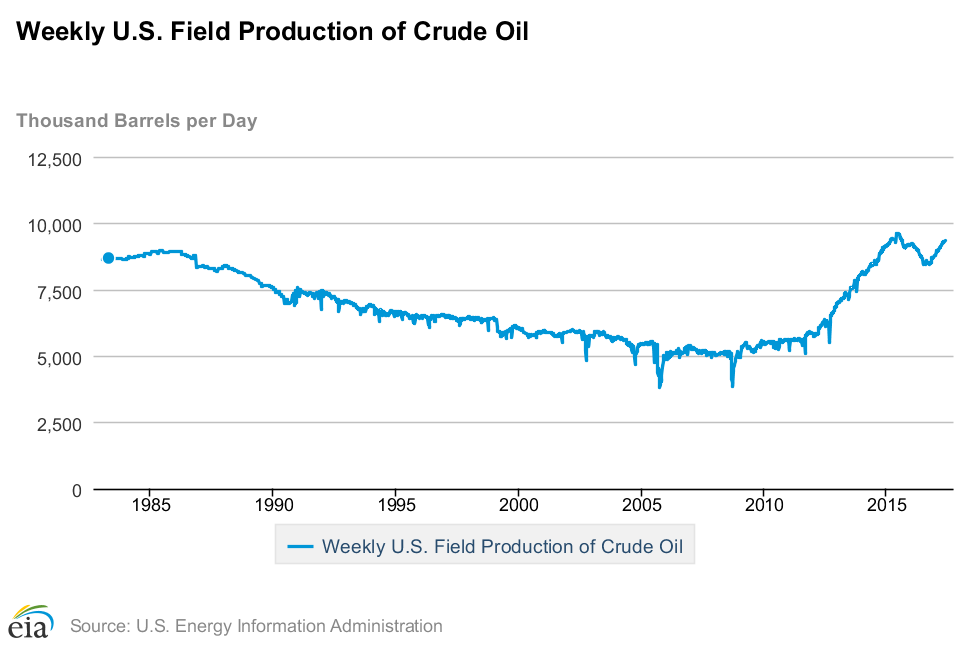

Weekly U.S. Crude Oil Production: For the week ending May 26, U.S. crude oil production increased by 22,000 bbl/day. At its current level, U.S. crude oil production stands at 9,342,000 bbl/day, up by 607,000 bbl/day from the same time a year ago, and 643,000 bpd up since OPEC decided to cut oil output in November 2016.

Looking at the current growth in U.S. crude oil supply and drilling activities, we see the followings:

1- U.S. crude oil production will continue to increase in the second half of 2017 even in a much faster pace than it did in the first half of 2017.

2- The current growth in U.S. crude oil production is a threat to oil prices sustainability above $50/bbl as well as to the efforts made by OPEC and non-OPEC’s members to balance the oil market.

3- The growth in U.S. crude oil supply could drive oil prices down to levels close to $40/bbl in the second half of 2017.

Us Crude Oil Production

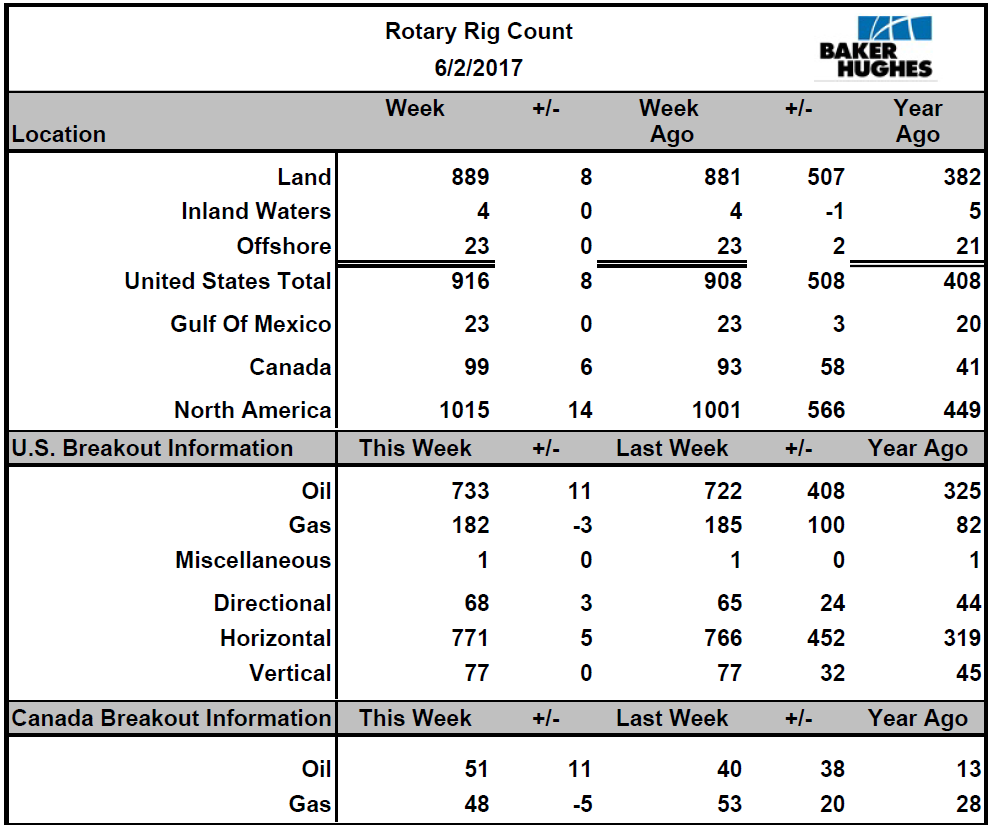

U.S. Rig Count: Last week, U.S rig count increased by 8 rigs to 916. Oil rig count was up by 11 rigs to 733, while gas rig count was down by 3 rigs to 182. U.S. rig count is currently 508 up from the same time a year ago.

US Rig Count

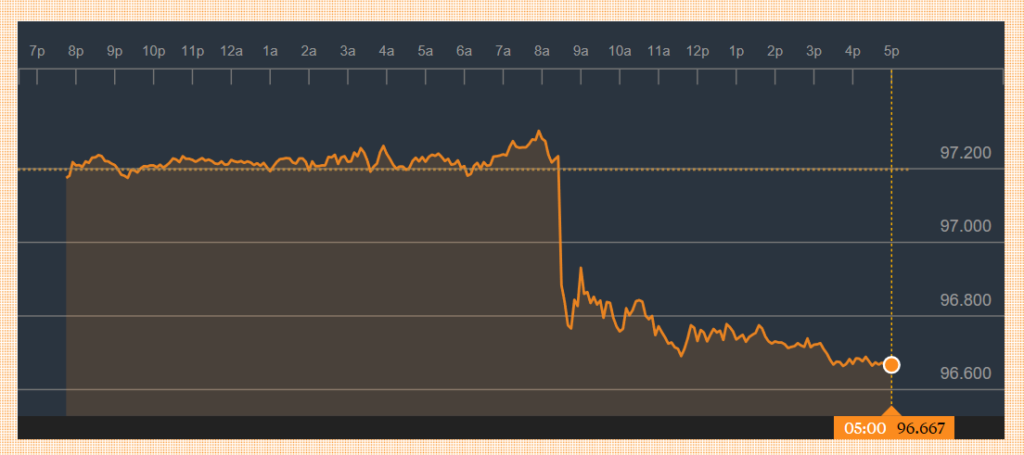

U.S. Dollar: U.S. dollar fell on Friday to multi-month low following May’s jobs report as the it was less than what was expected. U.S. added around 138,000 new jobs in May compared to the 185,000 anticipated. The less than expected jobs report led to the fall in the greenback and raising concerns about economic growth and the pace of Fed’s plans for more rate hikes this year. The weakening US dollar gave some support to oil prices on Friday and could support oil prices this week as well.

US Dollar Index, Source: Bloomberg

Last Week’s Takeaways:

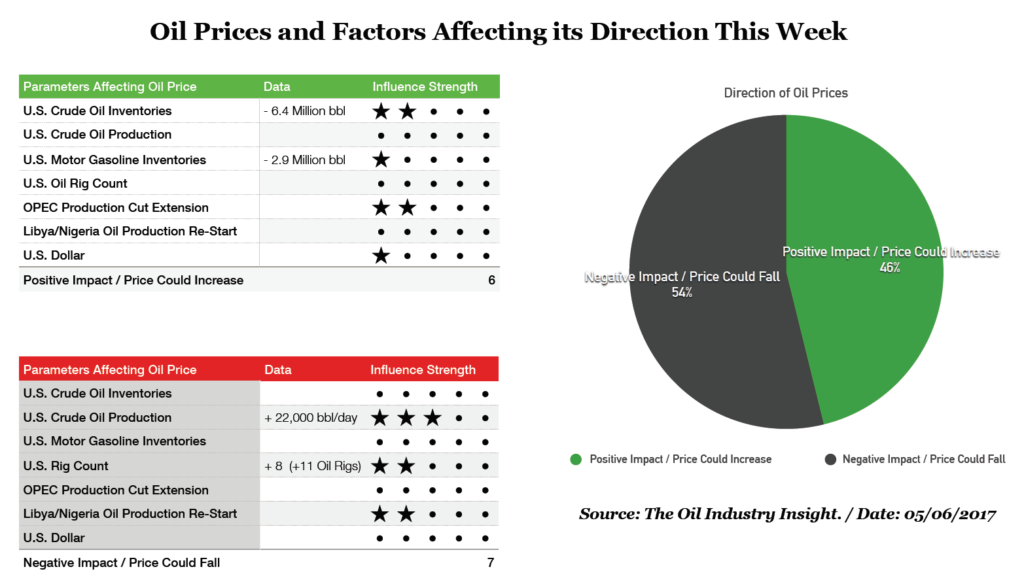

Looking at last week’s oil market data and news, we can see that they were a mix of positive and negative data and news; however, it is important to note that the oil market now is more focused on negative sentiments such as the increase in U.S. crude oil supply and the return of Libyan and Nigerian oil outputs, and that is the reason why oil prices fell by 5 percent last week.

Prior to OPEC’s meeting, U.S. crude oil supply and rig count were increasing, however the market chose to ignore these negative sentiments as the focus was more into the outcomes of OPEC’s meeting with regards to OPEC’s oil output cut extension. Now that OPEC meeting is over and we know that OPEC and few of non-OPEC oil producers are extending their oil output cuts util March 2018, the focus is now shifting to U.S. oil supply growth and rig count increase as well as production growth from other oil producing countries. These factors will have a huge impact on oil prices in the coming days and will impact oil prices negatively and could possibly drive prices below $45/bbl in the coming weeks.

This Week Oil Price Forecast:

Oil prices are expected to remain under pressure this week following last week’s negative oil market data and news and anticipated negative market data for this week as well. Looking at last week’s oil market data and news, Brent crude and WTI are expected to be trading around their current levels of $49.95/bbl and $47.69/bbl respectively in the first two days of trading and could fall by around 1 percent. A weakening U.S. dollar could provide some support to oil prices this week and prevent prices from falling, but the support from weakening U.S. dollar will not be to a big extent as the market is focused on other market data and news which are directly related to supply and demand such as the growth in U.S. crude oil production and rig count.

Oil Price Forecast, Sources: The Oil Industry Insight.

On Wednesday, oil prices are expected to get some support from data about U.S. crude oil and gasoline inventories as both are expected to continue to fall this week as well. However, the support to oil prices from these data could be eroded by expected increase in U.S. crude oil output, and rig count increase later at the end of the week. Oil prices are expected to end the week 1 to 2 percent lower than where they started.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.