Oil Prices Overview:

Oil prices rally had taken Brent Crude and WTI – the global benchmarks to three-year highs last week. On Tuesday last week, Brent crude touched the $70 per barrel threshold following a preliminary data published by the API on the decline of U.S. crude oil inventories ahead of EIA data. However, oil prices ended down on Friday breaking a 4 week rally due to the growing concern over re-emerging U.S. production growth in 2018 that could threaten the ongoing oil market balance effort and drives oil prices down. Forecasts and expectations of a potential shale oil supply growth in 2018 published by both OPEC and IEA contributed to the bearish sentiments that pushed down oil prices.

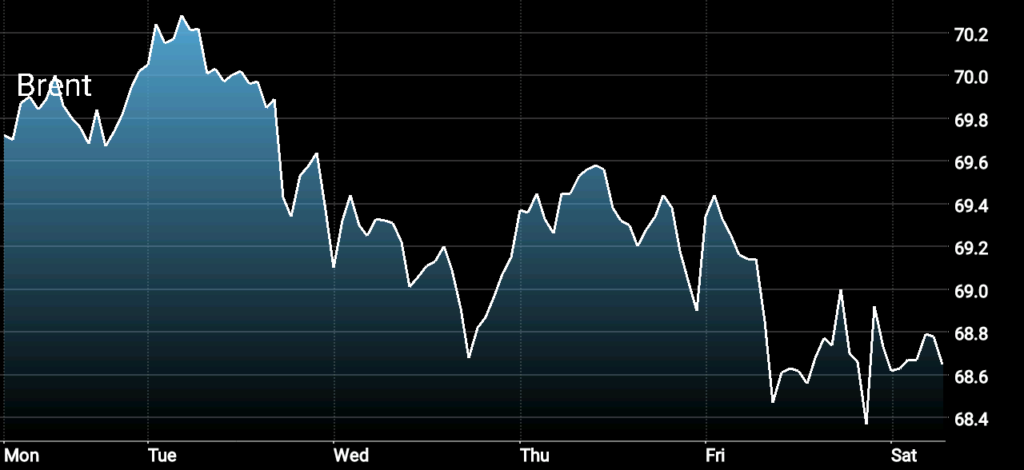

Brent Crude Oil Futures

Looking at oil prices throughout last week, Brent settled 1.8 percent lower to $68.65/bbl while WTI was down 1.5 percent to $63.41/bbl.

Oil Prices and Factors Affecting its Directions This Week:

Oil Prices Forecast for the Week Ahead:

Looking ahead for next week, oil prices are expected to remain around their current levels throughout the week with a slight upward movement of 1 percent in the first and second day of trading due to last week data published by Baker Hughes showing a decline in U.S. oil rig count by 5 rigs to 747 rigs. API data on U.S. crude oil inventories for this week will also support oil prices on Tuesday as it is expected that U.S. crude oil inventories could also decline again this week.

Oil prices are expected to reverse course on Wednesday through Friday, and pressure on oil prices could resume as U.S. crude oil production and oil rig count are expected to increase next week.

Adding to the pressure, the recent upward revisions for the potential growth in shale oil production for 2018 by IEA, EIA and OPEC will also continue to put more pressure on oil prices going forward especially if the EIA weekly oil production data continues to show increases in U.S. crude oil production. The ramp-up of drilling activities both in Canada and the United States is also another factor that will continue to pressure oil prices as well.

While the threat to oil prices sustainability around its current levels continue to grow, the main factor that will continue to support oil prices going forward will remain the production cut by major producers led by the Organization of the Petroleum Exporting Countries (OPEC) and Russia since January last year. How effective this support is in driving oil prices up will be determined by how fast the threat to oil prices from non-OPEC supply growth continue to grow.

Oil Prices Movers to Watch for This Week:

- API data of U.S. crude oil inventories data published on Tuesday.

- EIA data of U.S. gasoline and crude oil inventories.

- U.S. crude oil production data

- Canada and U.S. rig count data

Remark: The expectation of oil prices direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.