Overview of Oil Prices:

Last week was a bad week for crude oil prices, and this week does not seem to be any better. Oil prices fell sharply last week on various negative data and news. Earlier in the week, oil prices fell sharply after traders and investors realized that the colossal drawdown in U.S. crude stockpiles the week before was a result of the hurricane that disrupted shipments in the Gulf of Mexico. The fall in oil prices was intensified on Tuesday following the release of the International Energy Agency’s Oil Market Report in which says that the process of oil market’s balance could take longer than expected.

In its report, the IEA said that global oil demand is not growing at a pace that was previously expected. As a result, the IEA lowered its global oil demand forecast for 2016 to just 1.3 million bbl/day- a downgrade of 0.1 million bbl/day on its previous forecast. Taking this downgrade into account, the IEA expects a delay in the oil market’s balance further into 2017. This news hit the already struggling oil market hard last week. In fact, IEA’s report crushed the hopes of oil market traders and investors, and the negative impact of its report on oil prices will not be limited to last week.

Last Week Data/News & This Week Crude Oil Prices Forecast:

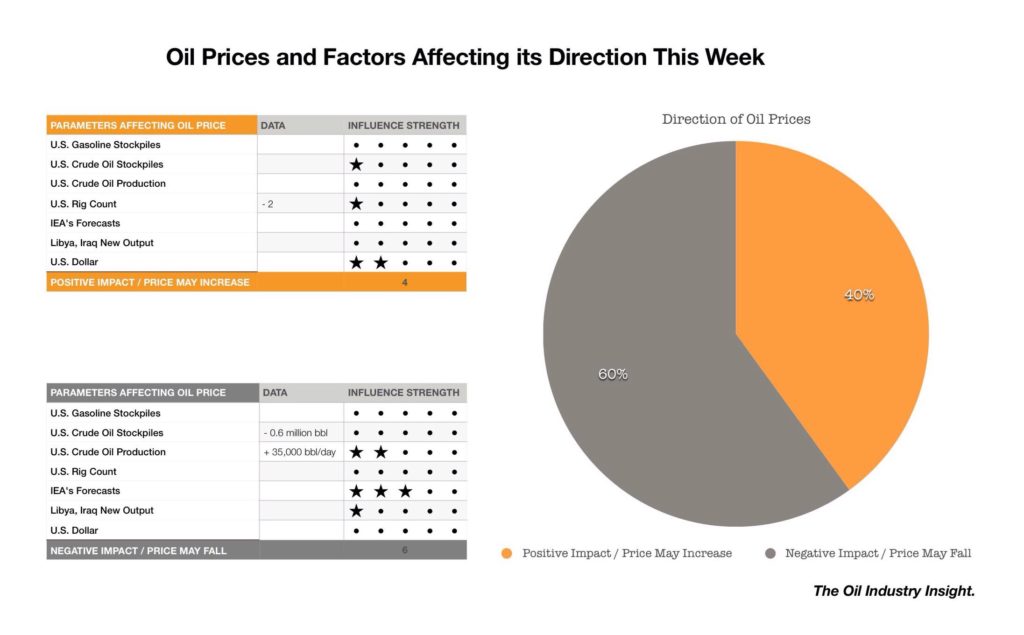

Crude oil prices are at a huge risk of falling further this week as negative sentiments and concerns over supply glut are intensifying. Fundamentally, the oil market does not seem to be heading toward balance anytime soon. U.S. crude oil production is increasing. Last week EIA reported an increase in U.S. crude oil production of around 35,000 bbl/day. Production from Saudi Arabia, Iraq and Iran is also increasing. And oil production from Libya and Nigeria is also expected to be back sooner than many are expecting.

Adding to the downward pressure, last week’s forecast by the IEA will also put a huge pressure on oil prices this week. After IEA expected a delay in the oil market’s balance, traders and investors are left with no hope of a strong oil prices recovery in the near future. With such negative emotions dominating the oil market, we will see a continuous increase in short positions which consequently will drive oil prices further down.

An additional downward pressure to oil prices could also come from a strengthening U.S. dollar at the beginning of the week prior to the Feds’ meeting on Tuesday and Wednesday. And if the Feds agreed to increase interest rate this week, oil prices could fall sharply as U.S. dollar will gain strength. But the good news is; the Feds’ meeting could also prevent oil prices from a sharp fall if interest rate hike this month is held off to a later time this year which seems highly likely according to consensus among economists and futures markets.

The overall crude oil prices outlook for this week is negative. Bent and WTI crude oil prices are at risk of losing around 1% during the first two days of the week. The fall in oil prices could further intensify on Tuesday and Wednesday on the result of the Feds’ meeting. The two days will be critical for oil prices in which it will determine if oil prices will be heading further down or may slightly recover. Traders should keep close eye on the green-back and any comments that may drive either up or down prior to the Feds’ meeting.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The forecasts of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.