Oil Price Overview:

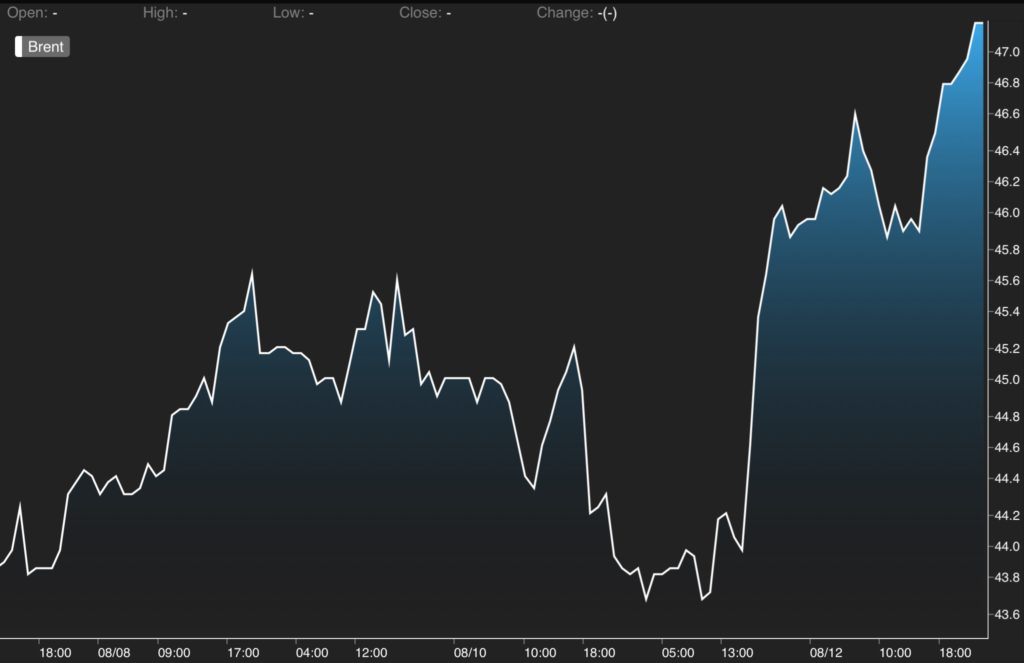

As expected in our previous week’s Oil Price Commentary, crude oil prices started its movement last week in a positive upward trend supported by positive data from the week before. Both Brent and WTI crude prices reached to $45/bbl and $43/bbl respectively on Monday and Tuesday before prices retreated back on Wednesday as U.S. crude oil inventories increased by 1.1 million barrels.

But the fall in oil prices was small and short lived as oil prices staged a strong rally on Thursday moving up by more than 4%. Brent crude and WTI ended the week well above $47/bbl and $44/bbl respectively. The rally in oil prices was due to a combination of supportive forecasts from the International Energy Administration (IEA), and positive comments from some of OPEC’s members.

The IEA reported that their balances show no oversupply during the second half of the year which is due to falling crude oil production from non-OPEC producers and a healthy demand growth in many parts of the world. Adding to optimism, both Saudi Arabia and Venezuela’s officials signaled a possible oil output freeze talk by OPEC’s members next month to work together to support oil prices.

Last Week Data and How It Will Affect Oil Prices this week:

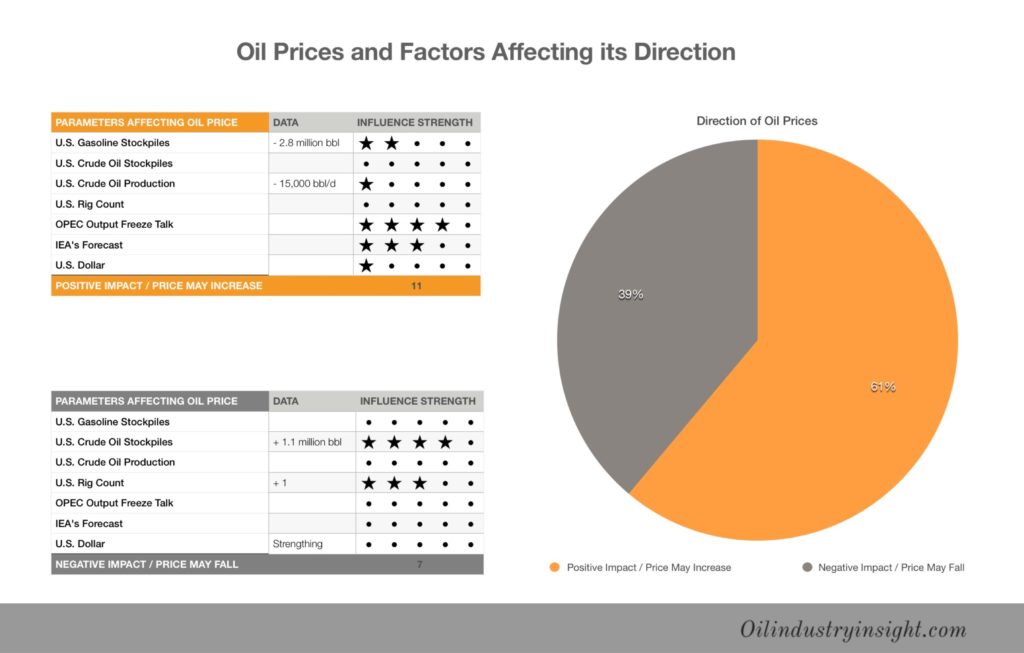

The performance of crude oil prices this week will be highly influenced by the data and news from last week. Support to oil prices this week will come from the positive comments from OPEC’s members on a possible oil output freeze talk, and IEA’s recent forecasts.

Oil prices may also be supported by a weaker U.S. dollar which gave a little push to oil prices last week as U.S. Treasury yields fell resulting in a weakening U.S. dollar. Adding to support, both declines of around 15,000 bbl/day in U.S. oil production and around 2.8 million barrels in U.S. gasoline inventories may also give a little support to oil prices.

On the risk side, last week’s U.S. rig count addition of around 17 rigs reported by Baker Hughes and the 1.1 million barrel increase in U.S. crude inventories could weigh on oil prices this week. In fact, if it was not for the support the oil prices received from the positive news from OPEC’s members and IEA’s forecasts, these news could have brought oil prices below $40/bbl.

The overall oil prices outlook for this week is positive. Oil prices will increase further this week. And if supported by positive U.S. inventories and gasoline stockpiles data, it could reach to $50/bbl by the end of the week. However, if there are new increase in U.S. crude inventories and slow decline in gasoline inventories, it could limit how high oil prices can go.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.