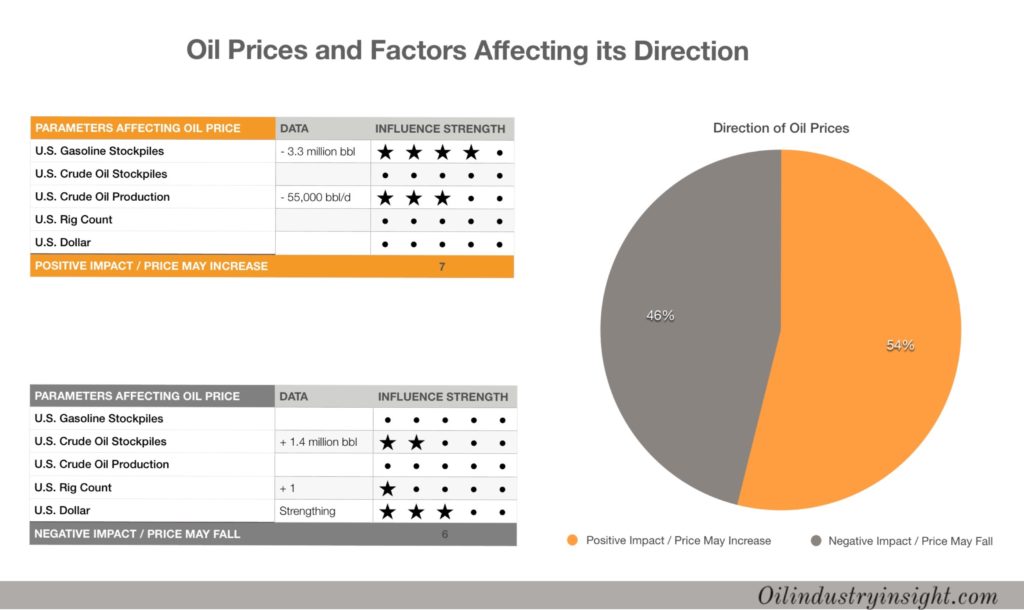

As expected in our last week’s Oil Price Commentary, crude oil prices fell sharply earlier last week with WTI breaking below the $40/bbl threshold. However, oil prices spiked on Wednesday after the EIA reported a sharp fall in U.S. gasoline inventories, a huge decline of 3.3 million barrels.

Oil prices were also supported by a robust decline of 55,000 barrels/day in U.S. crude oil production to the week ending July 29.

U.S. Gasoline Stocks, Source: EIA

Both Brent and WTI crude closed the week well above $44/bbl and $41/bbl respectively. The rebound in oil prices was limited by a strengthening U.S. dollar following a better than expected job growth in the United States reported on Friday.

According to the Labor Department’s job report, U.S. economy added 255,000 jobs versus 180000 expected. The report raises the expectations for a rate hike which could strengthen the U.S. dollar and consequently will have a negative impact on oil prices.

Last Week Data and How It Will Impact Oil Prices this week:

The performance of crude oil prices this week will be highly influenced by the direction of U.S. dollar. However, the decline in gasoline inventories and U.S. crude oil production reported by EIA last week will definitely support oil prices and could diminish the negative impact of more strengths on the U.S. dollar.

Generally, based on the current market data, the direction of oil prices is positive. Oil prices could increase this week, especially if more positive data are reported by IEA for more declines in U.S. crude inventories, gasoline stockpiles and oil production.

Despite the positive oil market sentiments which support oil prices, U.S. dollar poses a considerable threat to oil prices this week. Therefore, traders should keep a close eye on the performance of U.S. dollar. It will play an important role in determining the direction of oil prices in the short term.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.