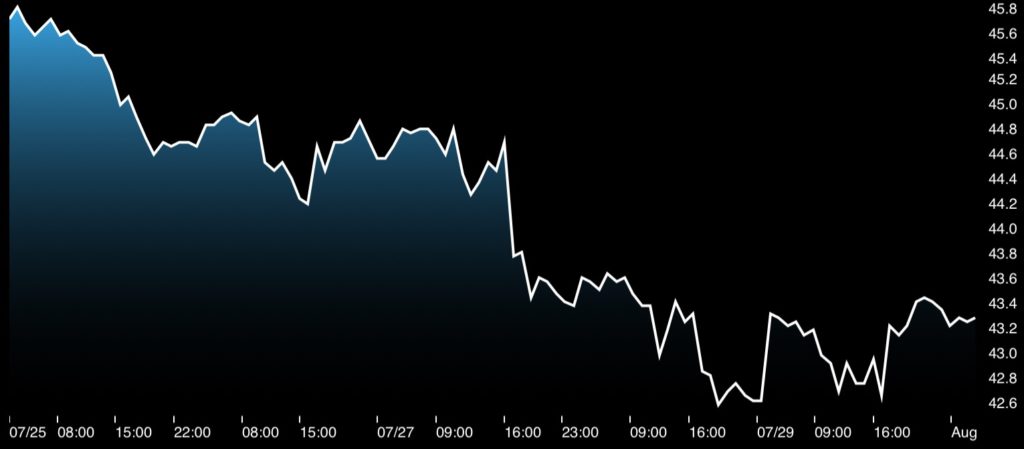

Last week crude oil price ended the week settling up well above the low levels it fell to earlier in the week after an unexpected 1.7 million barrel increase in U.S. crude inventories as well as another small uptick in gasoline stocks reported by the EIA. Brent crude and WTI closed out the week just a bit above $43/bbl and $41/bbl respectively after they were sliding toward $40/bbl.

Brent Crude Oil Price

The support to oil prices last week came from a falling U.S. dollar aimed weak economic growth data from the United States. Oil prices were supposed to continue sliding as oil market data and figures were all negative, however a weaker dollar provided a slight boost to crude prices. Given the current negative oil market sentiments, and despite its current support to oil prices, the U.S. dollar poses the highest threat to oil prices more than any other parameters. If U.S. dollar strengthens in the coming days, it could send oil prices below $40/bbl.

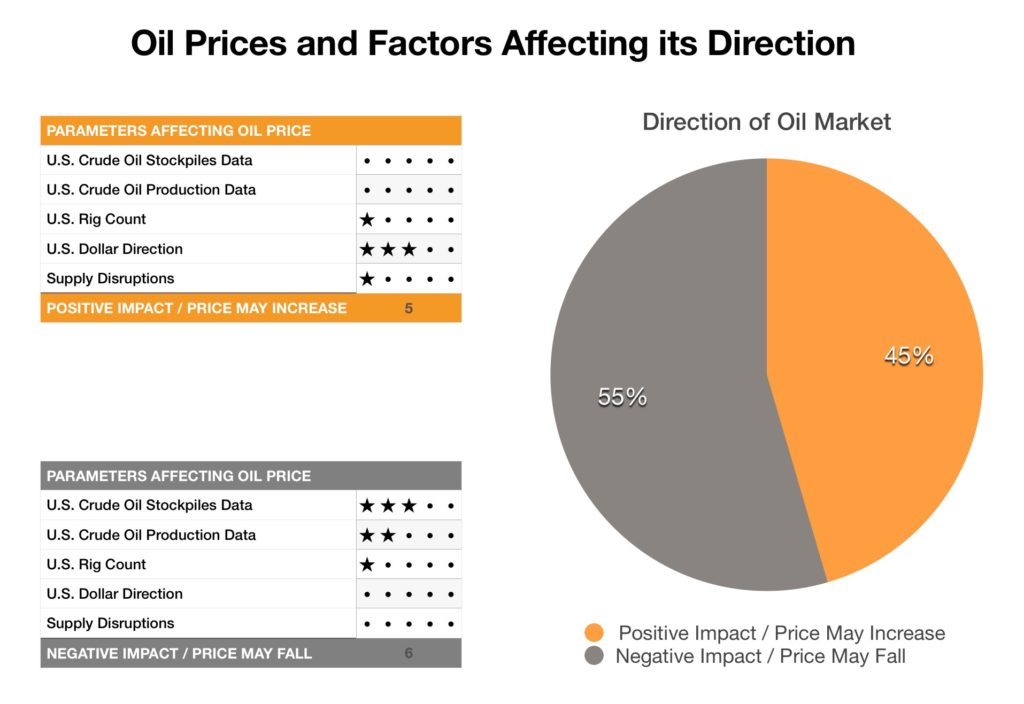

Last Week Oil Industry Data and The Direction of Oil Prices This Week

Last week oil industry and market data do not seem to support oil prices. Following its report about the surprise uptick in U.S. crude oil inventories on Wednesday, the IEA reported another increase in U.S. crude oil production on Friday. According to IEA, U.S. crud oil production increased by 21,000 barrel/day to 8,515,000 million bbl/d for the week ending 22/07. Baker Hughes also reported another 1 rig addition in the U.S. Both U.S. oil production and rig count have been increasing during the last few weeks.

These data along with painful numbers of the second quarter earnings revealed by most of the oil majors last Friday would impact oil prices negatively this week. U.S. dollar remains the only factor that could support oil prices this week, however, if U.S. dollar stengthened, oil prices could fall below $40/bbl.