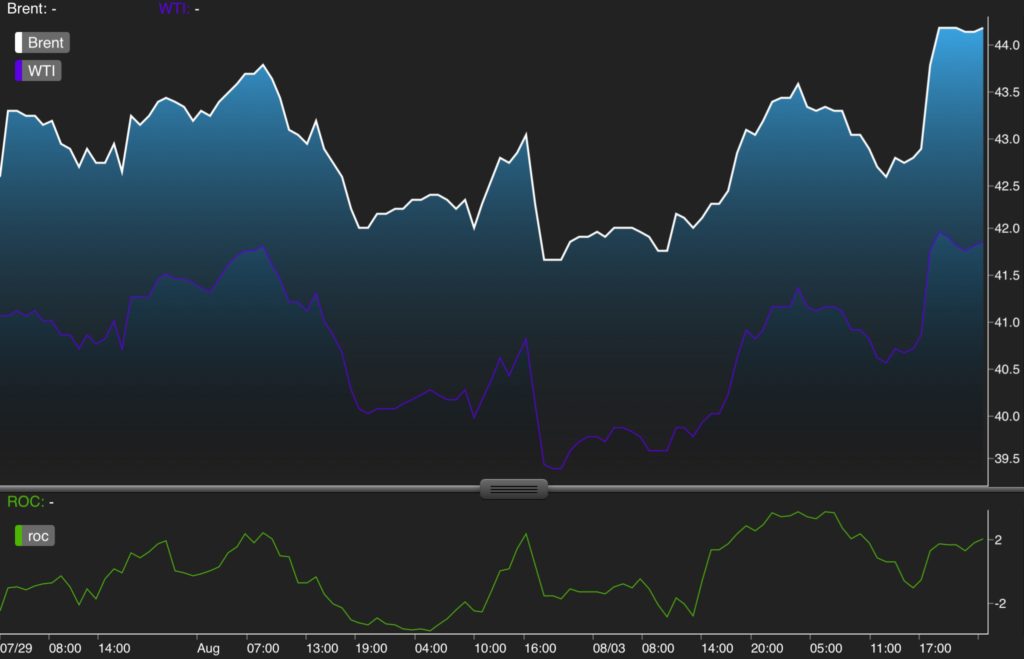

This week, crude oil prices broke below the $40/bbl threshold. TWI crude fell to nearly $39.5/bbl on Tuesday. The fall in oil prices below $40/bbl was a result of a huge pressure from many negative oil market data and news during the previous week. During the week ending July 29, IEA reported increases on both U.S. crude oil stockpiles, and U.S. crude oil production by 1.6 million barrel and 21000 barrel/day respectively.

These data along with a small uptick in gasoline stockpiles and the recent shift of hedge fund managers from long to shorts positions on oil have pressured oil prices to dip below $40/bbl. However, on Wednesday crude oil prices spiked after the IEA reported a huge draw in U.S. gasoline inventories around 3.3 million barrels. It should be noted that the IEA reported 1.4 million barrels increase in U.S. crude inventories as well, however, traders chose to ignore this bearish news and focus only on the draw in gasoline inventories.

Another support to oil prices this week came from the decline in U.S. crude oil production reported by IEA after few consecutive weeks of increase oil production. U.S. Crude oil production fell by 55,000 barrel/day to the week ending July 29. This sharp decline has supported oil prices as well. Today Brent and WTI crude are well above the $44/bbl and $41/bbl respectively.