Oil Market Update:

As expected in the Weekly Oil Price Commentary published on Monday, January 29, oil prices were under pressure early this week due to worse-than expected increase in U.S. oil rig count of around 12 rigs to stand at 759 rigs for the week ending January 26, 2018 according to Baker Hughes rig count. However, unlike what I have expected, U.S. crude oil inventories reversed a course as the EIA reported a huge increase in U.S. crude inventories which indicates a strong growth in American crude oil production, putting a lot of pressure on oil prices.

Now that EIA data for U.S. crude oil inventories and oil production for this week are out and the Fed’s meeting is done, here are the most important data and parameters driving oil prices ahead:

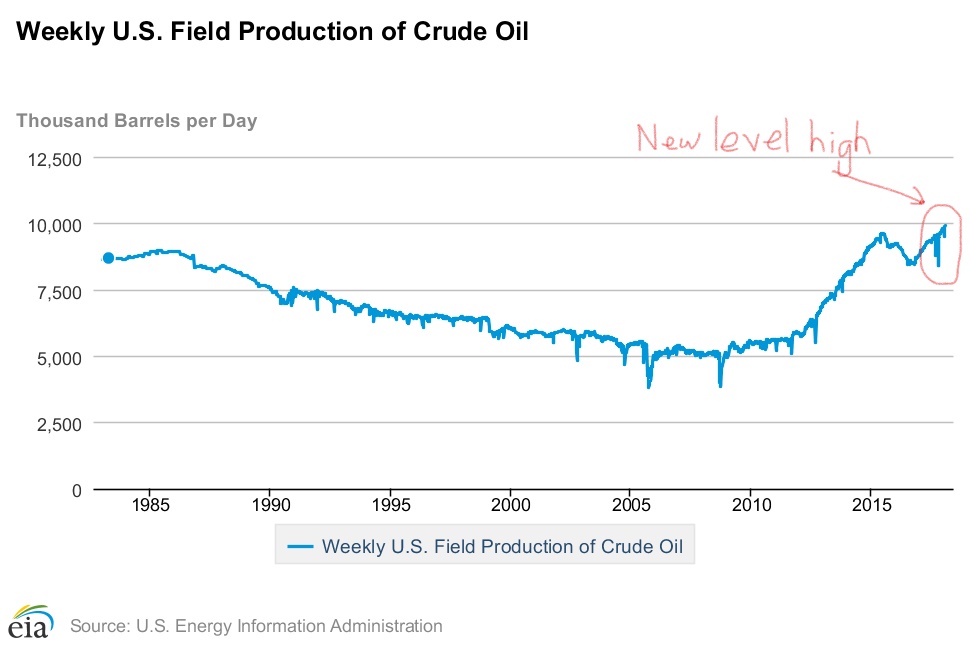

U.S. Crude Oil Production

According to the EIA, U.S. crude oil production increased by 41,000 barrels per day from 9,878,000 barrels per day to reach a new high of 9,919,000 barrels per day as of January 26. At its current level, U.S. crude oil production is growing faster than expected, and this growth is expected to accelerate if oil prices remain around $70/bbl. The current explosive growth in U.S. crude oil output would push the country ahead of Saudi Arabia and Russia and put it in a position to become the world top oil producer.

U.S. Crude Oil Inventories

U.S. crude oil inventories reversed a course this week as the EIA reported a worse-than expected data which showed that U.S. commercial crude oil inventories (excluding those in Strategic Petroleum Reserve) increased by 6.8 million barrels from the previous week to level at 418.4 million barrels. Despite the fact that U.S. crude oil stocks have been in a steep decline for few months, if the increase in crude stockpiles continues in the next a few weeks, OPEC and non-OPEC efforts to reduce the global crude stocks and eliminate the oil surplus could be undermined and oil prices could again be under pressure.

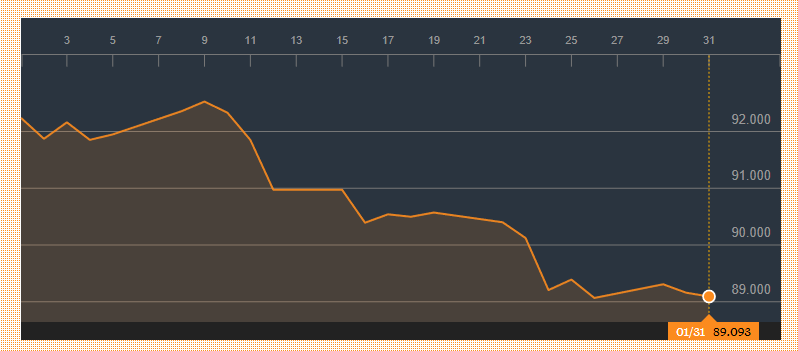

Federal Reserve Leaves Rates Unchanged

At its final meeting under its outgoing chairman, Janet L. Yellen, the U.S. Federal Reserve held its meeting on Tuesday and Wednesday and made a decision as widely expected to leave its benchmark interest rate unchanged. U.S. dollar has strengthened in the last two days prior to the meeting after few weeks of decline which has provided support to oil prices. While the Fed is expected to raise its benchmark rate at its meeting in March this year, for now, U.S. dollar may remain under pressure, and that would provide support to oil prices.

US Dollar Index

Impact of Current Oil Market Data on Oil Prices:

Weighting the impact of these recent data and news, along with previous oil market data -either positive or negative, oil prices are expected to be under pressure throughout the rest of this week. It is highly unlikely that Brent crude could break above $70/bbl again this week.

Adding to the pressure, U.S. rig count is expected to increase as well this week, putting further pressure on oil prices. Brent crude and WTI are expected to close the week around $69/bbl and $65/bbl respectively.