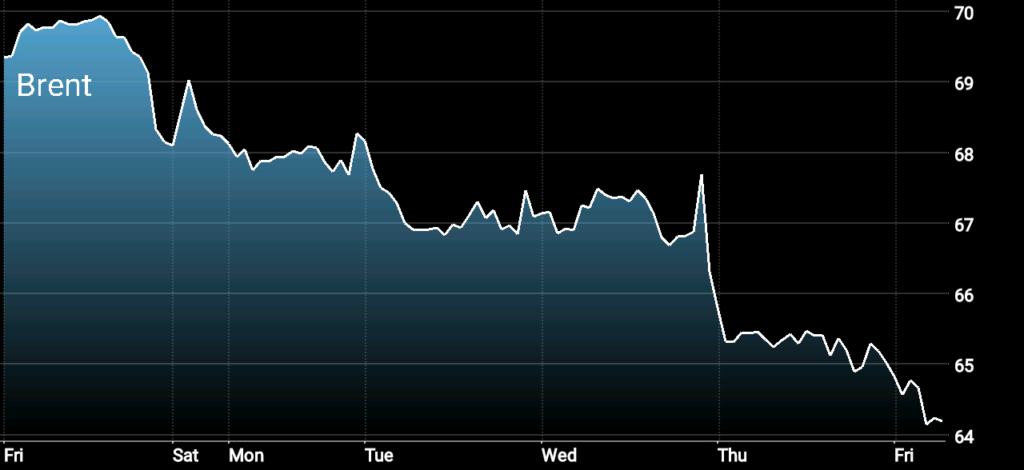

Brent crude and WTI started the week on February 5, approximately around $68.23 per barrel and $65.14 per barrel respectively. However, today -Thursday, February 8- both global benchmarks -Brent crude and WTI are down by more than 6 percent to around $65/bbl and $61/bbl respectively. In fact, today, Brent crude fell to as low as $64 per barrel.

Brent Crude Oil Price February 8

In this week’s Oil Price Commentary -published on Monday -February 5, I expected oil price to fall by approximately 2-3 percent by the end of this week, touching new lows. However, the current plunge in oil prices has exceeded my expectations. And that poses an important question; what is really driving the current fall in oil prices?

Here are the main factors driving oil prices down this week:

- Global stock market selloff, and the strengthening U.S. dollar

- Worse-than-expected data coming from the EIA that showed an increase in U.S. crude oil production increased by 332,000 bbl to reach all times high of 10,251,000 million barrel per day.

- The EIA also reported another weekly increase in U.S. crude inventories of around 1.9 million barrel to reach to 420.3 million barrels for the week ending February 2. This increase in U.S. crude inventories could signal a change in the recent positive trend in the oil market that was created as a result of the continuous decline in U.S. crude oil inventories for the past few months. The recent reserve in course will definitely drive oil prices further down, and if it continues in the next coming weeks, we could see Brent crude touching the $60/bbl threshold.

- U.S. gasoline inventories increased by 3.4 million barrels.

What is expected for oil price ahead?

Pressured by these negative factors, oil is expected to close the week around its current level if not lower as it is expected that Baker Hughes to report another increase in U.S. oil rig count tomorrow. This could further put pressure on oil prices driving it further down. Will we see WTI below $60/bbl soon? Highly likely.