If the oil price war between Saudi Arabia and Russia was really intended at destroying U.S. oil industry, then it is currently achieving its target.

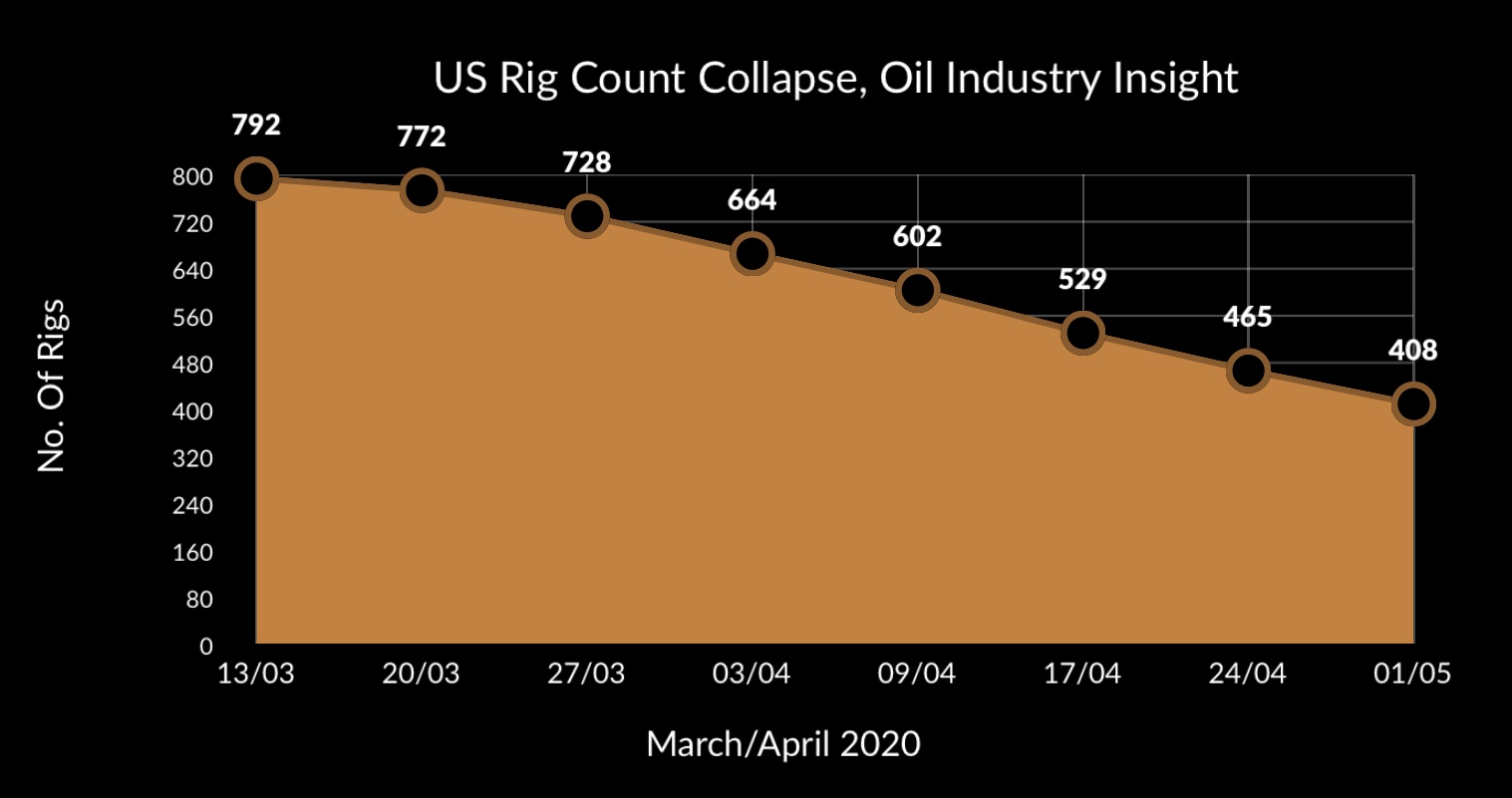

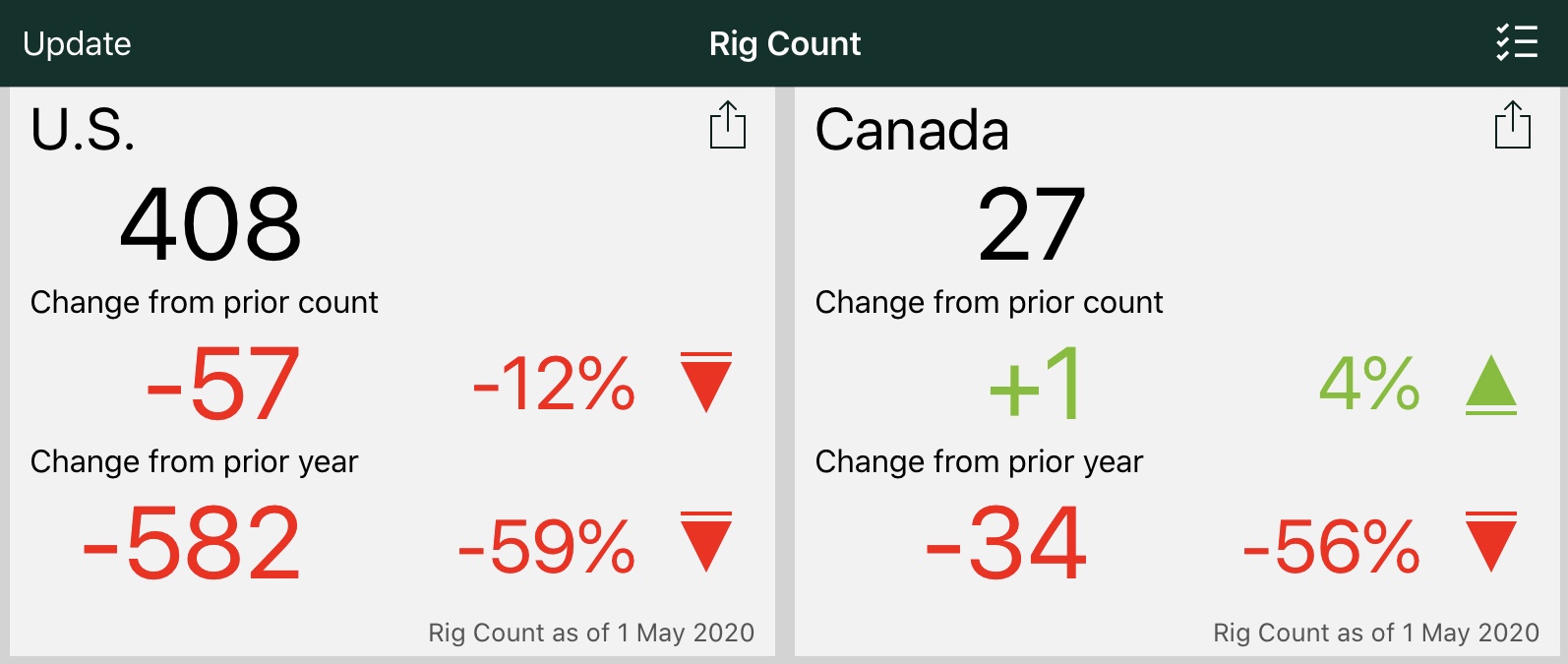

U.S. oil industry continues to suffer the consequences of the oil price collapse as rig counts falls to levels seen during the 2015 downturn, and it is expected rig count will fall below 400 rigs next week.

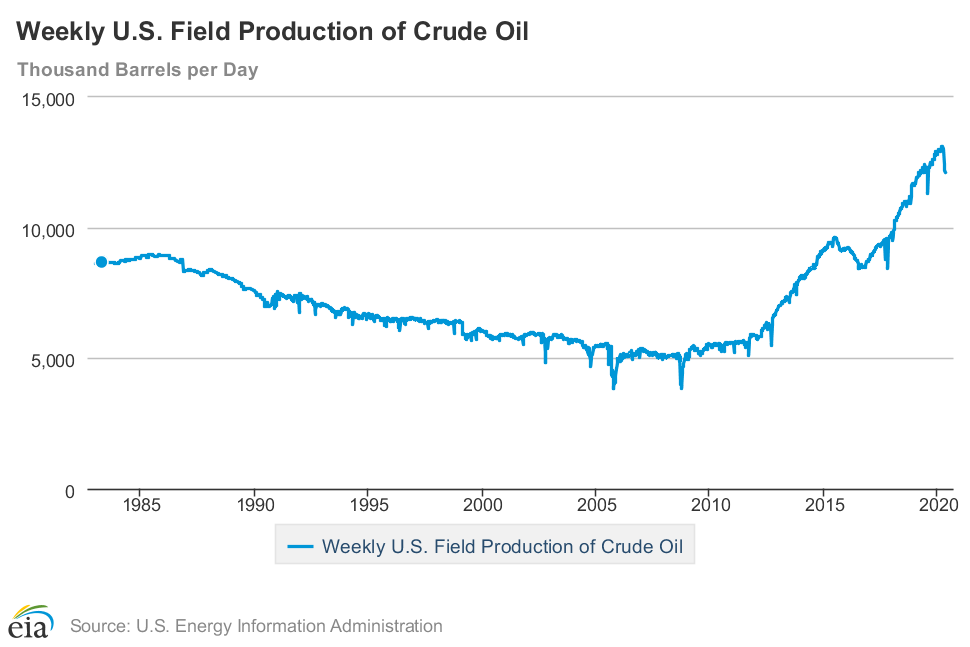

U.S. crude oil production is also beginning to fall from its highest level achieved back in March 2020 of 13.1 million barrel per day. According to Energy Information Administration (EIA), U.S. crude oil production has now fallen by 1 million barrel per day to 12.1 million bbl/day as of 24th of April 2020.

Will U.S. crude oil production decline stops there? Highly unlikely. There will be more decline ahead as the global economy continues to face the consequences of COVID-19 which has resulted in sharp decline in oil demand. More companies will be forced to partially shut down their oil output due to limited demand, logistical issues related to transport and storage of crude oil in the current saturated oil market.

So far only two U.S. based companies -Whiting Petroleum and Diamond Offshore- filed for bankruptcy. But it highly likely that the number of of companies going bankrupt will only grow going forward.

During downturns, companies comes and goes, but oil remains in the ground. Those who can’t survive will be taken over by the big fishes, and soon oil will be produced. It is not going anywhere.