The last time I wrote an article on the state of the oil market with regard to the oil market cycle was back in April 2016. At that time, the oil market was still in a depression state, but oil prices had bottomed and things were improving. Based on various factors that were influencing the oil market at that time, I predicted a slow and steady recovery in which it will take a longer time for the oil market to go from bust to boom. That means, it will take oil market a longer time than what we have experienced during the previous downturns to go from depression, into hope, relief and finally reaches optimism and excitement state.

If we look back at how the oil market has performed over the past two years, we can easily see that everything was going according to above expected scenario, until Saudi Arabia and its new allies decided to speed up the oil market recovery process by cutting oil output in an effort to drain global stocks, extending the oil output cut deal beyond its initial period to undermine growing threat from continuous growth in US crude oil production, and discussing the possibility of a longer term collaboration between OPEC and non-OPEC producers in order to regain control over the oil market, and ultimately drive oil prices higher. And despite record production growth from non-OPEC producers particularly from the United States, OPEC/non-OPEC oil producers have continued to support an artificial oil price recovery by all means available.

If we look back at how the oil market has performed over the past two years, we can easily see that everything was going according to above expected scenario, until Saudi Arabia and its new allies decided to speed up the oil market recovery process by cutting oil output in an effort to drain global stocks, extending the oil output cut deal beyond its initial period to undermine growing threat from continuous growth in US crude oil production, and discussing the possibility of a longer term collaboration between OPEC and non-OPEC producers in order to regain control over the oil market, and ultimately drive oil prices higher. And despite record production growth from non-OPEC producers particularly from the United States, OPEC/non-OPEC oil producers have continued to support an artificial oil price recovery by all means available.

The issue with such support to oil prices is the fact that the purpose behind it does not seem to be taking into consideration the long-term consequences of higher oil prices on the oil market and the sustainability of oil prices at such higher levels, but rather more focused on short-term targets which seems to be; achieving a certain level of oil price no matter what are the consequences. For the Saudis, having oil prices at a high level as soon as possible this year is a must for Saudi Aramco’s Initial Public Offering in order to have a better valuation of the company’s oil reserves and prepare the oil market for Aramco’s IPO. This seems to be a logical motive behind the recent change in Saudi Arabia’s oil policy from pursuing market-share to driving oil prices higher. The Russian side of the story seems to be mainly focused on driving oil prices higher to generate more revenues which will help the country especially as it faces U.S. sanctions.

Oil Market Cycle: Where Exactly Are We Now?

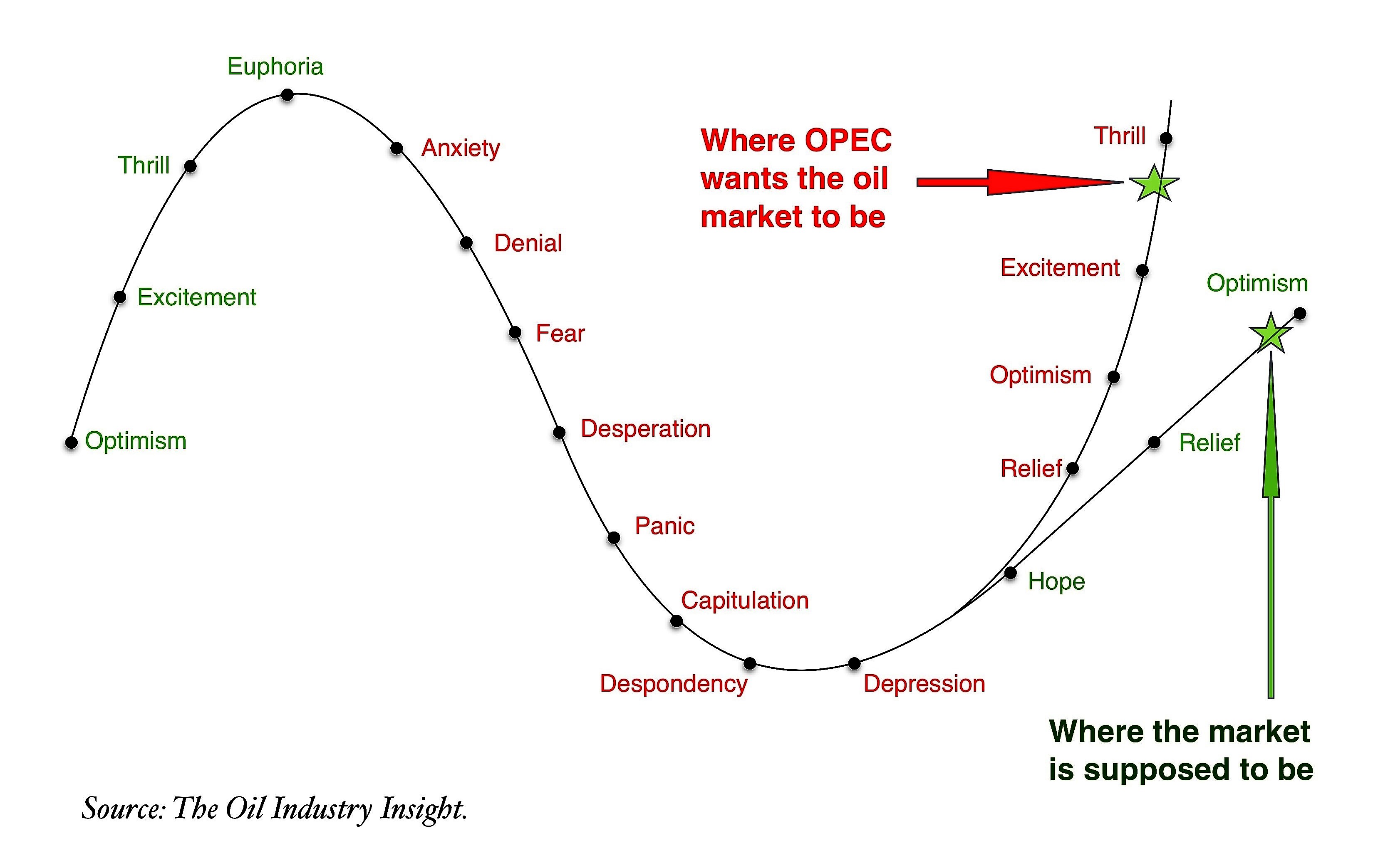

Looking at oil market fundamentals; global crude oil stocks, and supply and demand, the oil market has passed the hope state and is now between relief and optimism state of the oil market cycle. And due to recent changes in the oil and gas industry from the rise of U.S. as a swing producer, to the shift in supply and demand and the fact that major oil producers such as OPEC members lost control over oil prices, the current oil market state is expected to take longer period than it used to during the previous downturns. In fact, if the oil market is let to balance itself without external interference, this state would be extended till the end of 2019 with slow oil price recovery, slower growth of oil supply from non-OPEC producers, accelerating growth of investment and supply and demand balance to be achieved by 2019.

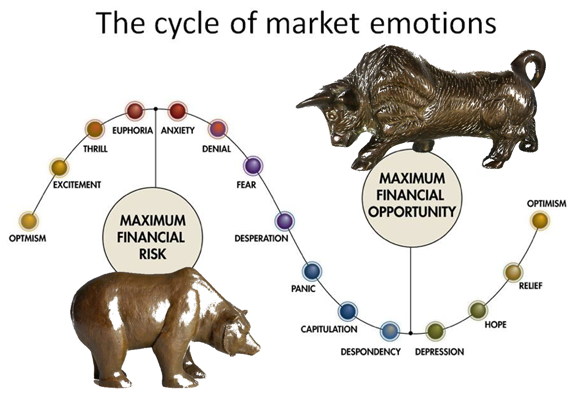

Oil Market Cycle

Taking OPEC/non-OPEC producers’ interference in the oil cycle flow which is done by artificially driving oil prices up through continuous comments and statements of oil output cut extension and future collaboration support to oil prices, the only difference that such support has created is a sharp spike in oil prices which led to an immature excitement in the oil market which is not support by fundamentals. Everything else have remained the same except.

Why OPEC Actions Could Trigger Another Downturn

To get a better understanding of why OPEC’s actions of driving oil prices higher could trigger another downturn in the oil industry, we should look back at the time prior to beginning of 2014 downturn. The only reason that led to the oil price downturn in 2014 was OPEC’s strategy in the years prior to that to keep oil prices above $100/bbl. When higher oil prices were sustained for a long time, it provided an excellent breeding season for few advanced technologies used to develop shale oil such as hydraulic fracturing and horizontal drilling to nurture and flourish over the past years. The use of such technologies led to the U.S. shale oil boom, which threatened OPEC’s market share as more supply is coming from the United States. In response to that, OPEC led by Saudi Arabia decided to pursue market-share strategy instead of stabilizing the market.

Now after three years into the downturn, OPEC led by Saudi Arabia is doing the same exact thing it did prior to 2014. In a new strategy that is focused on driving oil prices higher as fast as possible rather than pursuing market-share, the cartel is collaborating with non-OPEC oil producers to cut oil output in order to artificially balance the oil market and eventually drive oil prices higher. The issue with oil prices at such high levels is that such price levels are not sustainable due to;

- The current oil price spikes are driven by geopolitics, tensions, and OPEC/non-OPEC producers’ statements. The contribution of fundamentals is very limited. In fact, if oil market fundamentals were to set the oil price level, oil prices should fall to level between $55/bbl to $65/bbl.

- The objective of the current support to oil prices from OPEC -particularly Saudi Arabia seems to be a short-term objective that is; preparing the oil market for Aramco’s IPO. The question is, what will happen after that? Will OPEC continue to sacrifice market-share for the sake of higher oil prices while it sees shale oil producers gaining market share? I don’t think so.

- Higher oil prices will encourage more production from either OPEC and non-OPEC oil producers not only in the U.S. but everywhere else. That means higher oil supply in the market. And to keep the market balanced, OPEC and non-OPEC producers will have to deepen their cuts, which I highly doubt it will happen.

While OPEC’s new strategy of driving oil prices higher is working, the outcomes of this strategy does not seem to be in favor of the oil and gas market at all. Yes, oil prices will go higher, producers will make more revenue for few months, Saudi Arabia would succeed in preparing the oil market for its anticipated Aramco’s IPO, but at the same time, supply and demand imbalance will be back, crude stocks will start increasing, non-OPEC production will massively increase due to high oil prices and before we know it, U.S. will be the world largest oil producer and then Saudi Arabia and Russia will wake up to a new reality in which oil prices has to go down.