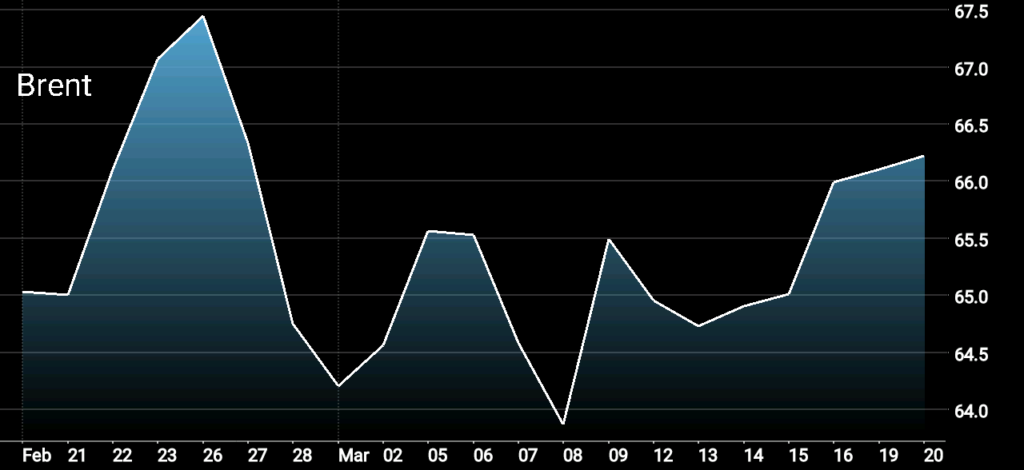

Apparently, not only OPEC members are in a “Wait & Watch” state to see how the current oil market unfolds -while keeping a close eye on shale oil production growth, investors and traders are in a similar state too. The state of “Wait & Watch” that the oil market is undergoing right now is clearly reflected in the small range of oil price fluctuations over the last few weeks. A clear example is the fluctuations of Brent crude oil price over the last three weeks in which the international crude oil benchmark has been fluctuating between $64/bbl and $66/bbl.

WTI Crude Oil Price

It is clear that the oil market is currently in a consolidation state. A state where the oil market players, investors and traders are looking for a clear signal that will determine the direction of oil price in the next few months. While it is good that oil prices are holding to their current levels above $60/bbl with small fluctuations around these levels, the worry now is that the current oil market state is similar to the calm before the storm.

While OPEC acknowledged the potential growth in shale oil production, its members are closely watching shale oil supply growth, and based on that, OPEC members will determine their next step, either to continue to support the oil price or admit the failure of their oil output cut deal and go back to let the market balance itself. If they stick with their decision to continue to cut their oil output in order to support the oil price recovery -which is highly unlikely given the faster than expected growth in shale oil production, oil price could remain above $60/bbl. On the other hand, if OPEC members reached to a conclusion that a balanced supply and demand will not be achieved as long as non-OPEC oil producers continue to ramp up their oil output, then the oil market could face a storm that will bring oil prices down again.

In a similar way, investors and traders are currently watching both sides; shale oil production growth and OPEC’s reaction in response to this growth. And if OPEC members chose to continue to support the oil price recovery, investors and traders’ confidence in the oil market recovery will be boosted and that will be translated into higher oil prices. But if the opposite was to happen, investors and traders’ confidence in the oil price recovery will fall and that will drag oil prices further down.