Without doubt, there will be various parameters that will play its role in setting the direction of oil prices in 2018. However, the most parameter and the one that will significantly impact the oil prices and determines its direction is the response of OPEC’s members, particularly Saudi Arabia to the expected growth in US crude oil production driven by Shale oil output growth.

As oil prices are now hovering around $60/bbl, U.S. crude oil production is expected to continue its upward movement and we could possibly see it reaching 10 millions bbl/day by the second quarter of 2018. In a similar trend, U.S. Rig count is also expected to grow significantly in 2018. Both parameters have a negative impact on oil prices and tend to drive the oil prices down. But the intensity of such negative impact on oil prices seems to be dependent on the response of OPEC’s members and in particular Saudi Arabia to the growth in US crude oil output.

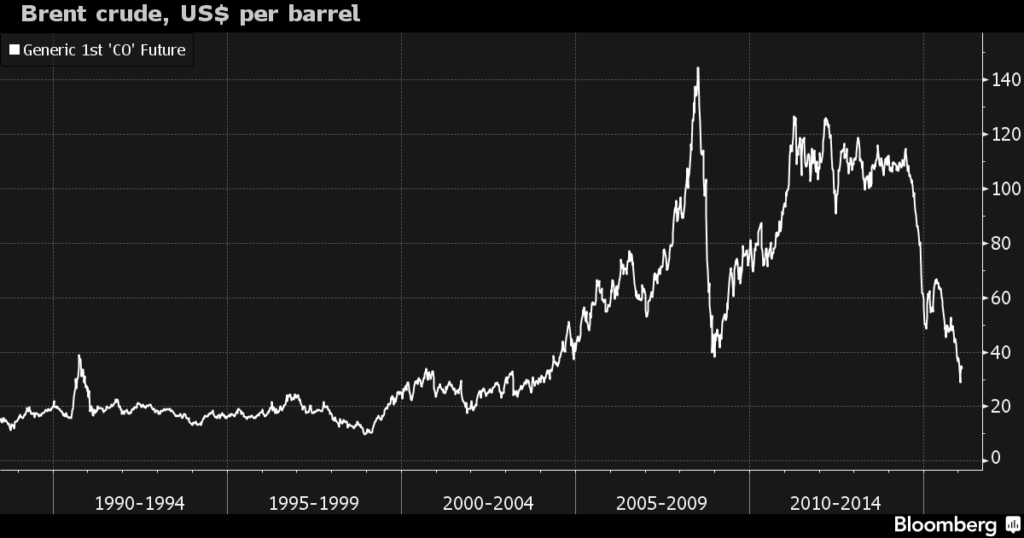

A clear example of that is what happened during the period from mid of 2009 to end of 2014 when oil prices increased from around $60/bbl in mid 2009 to over $100/bbl by early 2011 and remained relatively above $100/bbl for the following three years.

Brent Crude Oil Price

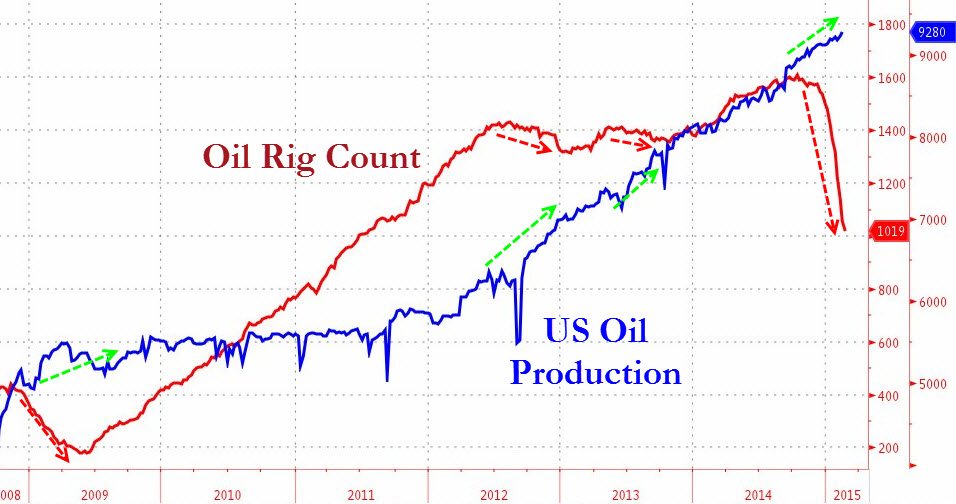

During the same period from mid 2009 to end of 2014, U.S. crude oil production increased from 5.2 million bbl/day to 9.1 million bbl/day, and U.S. oil rig count increased from 183 rigs over 1500 rigs. However, oil prices continued to increase and remained relatively above $100/bbl for most of that period. The growth in U.S. crude oil production and oil rig count during that time surely had a negative impact on oil prices and were supposed to drive the prices down, but it didn’t. Why?

U.S. Crude Oil Production and Oil Rig Count, 2009 – 2014

The reason is simple, OPEC’s members -specifically the cartel’s largest oil producer Saudi Arabia were happy about the high revenues they were cashing in. They supported the increase in oil prices, and managed to maintain it above $100/bbl for a few years. And therefore, the negative impact of the growth in U.S. crude oil production and rig count were diminished by OPEC’s support to higher oil prices.

Oil prices only started to collapse by the end of 2014 when Saudi-led OPEC realized the threat posed by the growth in U.S. crude oil production and decided to not to cut oil output aimed balancing the oil market supply and demand as it always did. Instead OPEC’s members led by Saudi Arabia decided to let the market balance itself. Only then the negative impact of the growth in U.S. oil production and rig count were felt and oil prices collapsed.

Now, three years after such decision by OPEC and we are back to square one where OPEC members and few non-OPEC producers are again supporting the increase in oil prices and consequently, U.S. oil production and oil rig count are increasing.

Oil Price Direction in 2018:

Oil prices will continue to improve this year given the support it receives from the oil output cuts. At the same time U.S. crude oil production and rig count will continue to grow as well. However, its negative impact on oil prices will again be diminished by OPEC/non-OPEC’s support to higher oil prices. Oil prices could only collapse if the market was let to balance itself and no further extension to the oil output cut is reached. But that seems highly unlikely for 2018.

One of the oil producers that has a big say on supporting the oil output cut and driving oil prices up is Saudi Arabia. While the country was the one who engineered the market-share war strategy back in 2014 and led the decision by OPEC not to cut oil output and let the market balance itself, the same country is now cutting its oil output to support oil prices. A big shift in its oil strategy, and it is all due to internal political changes. Lucky for the oil market this year, there is a new young prince in the oil Kingdom who is hungry for power and eager to do anything to get it. He needs money and support. And both comes when oil prices are high.