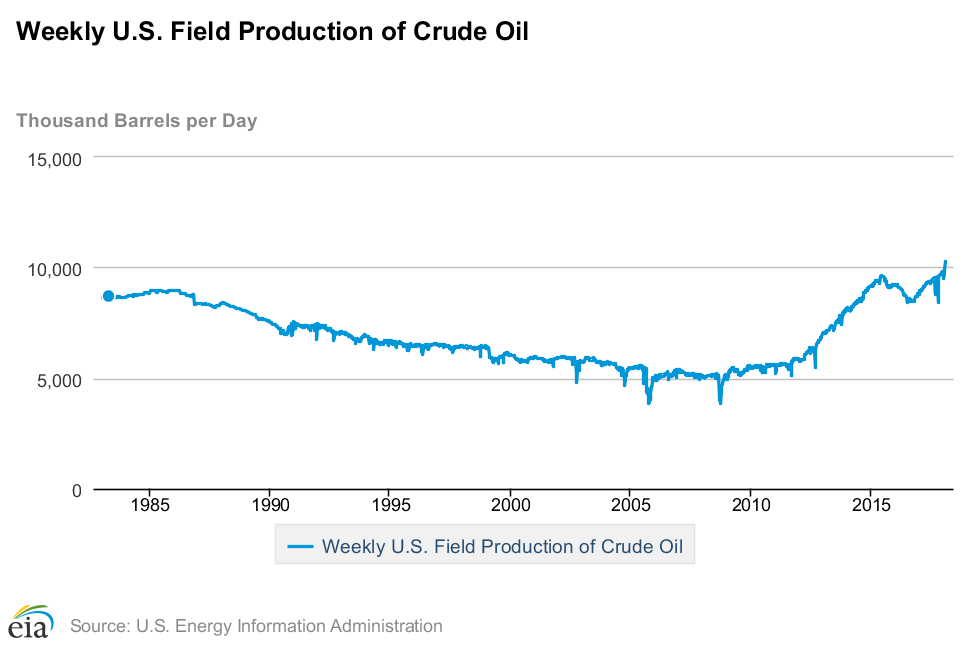

U.S. crude oil production continues to grow, and it continues to surprise everyone on its accelerating growth momentum to the fact that many oil market watchers, including the Energy Information Administration (EIA) and Organization of Petroleum Exporting Countries have revised their forecasts for U.S. crude oil production growth multiple times to accommodate the increasing growth potential in U.S. crude oil output.

U.S. crude oil production stands at 10.251 million bbl/day as reported by the EIA last week

The recent forecasts revisions came form both; EIA and OPEC. In its February Short-Term Oil Energy Outlook (STEO) published last week, the EIA revised upward its forecasts for U.S. crude oil production by 0.3 million bbl/day to average 10.6 million barrels per day (b/d) in 2018 and 11.2 million b/d in 2019, higher than forecast in the January STEO.

Similarly, in its Monthly Oil Market Report published today, Monday 12, OPEC revised upward its forecast for non-OPEC supply growth by 250,000 bbl/day, expecting non-OPEC supply growth to stand at 1.4 million bbl/day in 2018. The upward revision was led by bullish expectations of faster than expected production growth in U.S. shale oil.

The current accelerating growth in U.S. crude oil production poses a huge threat to the efforts made by OPEC and non-OPEC producers to try to finish clearing the global glut of crude oil and stabilize the oil market by balancing supply and demand. While OPEC/non-OPEC output cut deal has helped clear some of the global glut of crude oil and supported oil price to rally to as high as $70/bbl, the current ramp up of drilling activities and oil production growth in the United States threatens to reverse that direction sending oil prices down to around $50/bbl and renewing concerns of supply glut. In fact, the current oil price collapse that started last week is a clear example of the negative impact of rising U.S. oil rig count and crude oil production growth on oil prices.

What to Expect Ahead?

Moving forward, the most important questions to be answered are not whether U.S. crude oil production and oil rig count will continue to rise or not or what will be their impact on oil prices -because that is already clear. U.S. crude oil production and oil rig count will continue to rise positioning U.S. as the world largest oil producer, and consequently it will drive price down-, but rather on what will be OPEC/non-OPEC next move? Will OPEC/non-OPEC continue to cut their oil output while they watching their rival taking their market-share? How long it will take for OPEC/non-OPEC to realize that their current strategy is not working? How far Saudi Arabia is willing to go to support the oil price in preparing the market for Aramco IPO and funding its social and economic reforms?

My answer is very brief: I expect U.S. crude oil production to reach 11 million bbl/day in the second quarter of 2018, OPEC/non-OPEC oil output cut deal to fall apart this year, and oil prices to remain between $50/bbl to $65/bbl. And in case OPEC/non-OPEC producers are so desperate to continue to support oil price despite losing market share, then I expect the positive impact of OPEC/non-OPEC oil output deal to be offset by growth in U.S. crude oil production.