Last Week Oil Prices Overview:

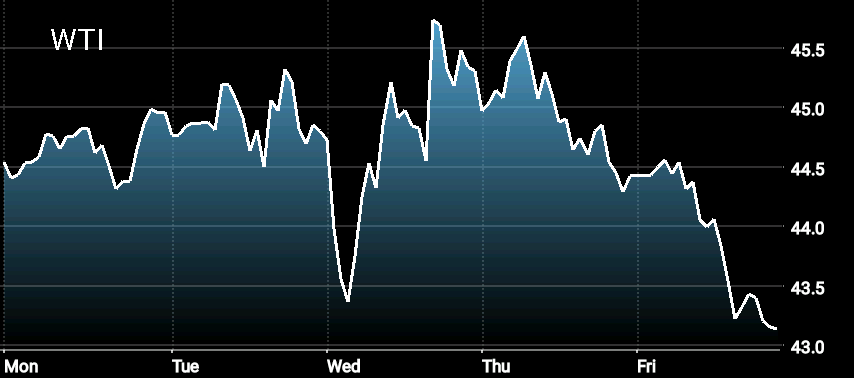

Last week, crude oil prices fell by more than 3 percent touching new lows around $43/bbl as we expected in our last week Oil Price Commentary; Will Oil Prices Crash Again This Week? Here is The Answer. Throughout the whole week, oil prices fluctuated up and down and these fluctuations were driven by OPEC chair’s comment on Monday, U.S. election, and the surprise victory of the republican candidate. However, on Thursday and Friday, oil prices were down by more than 3.7 percent as the focus of the oil market shifted from Trump’s victory to bearish oil market data and news.

WTI Crude Oil Price

The bearish oil market data and news came mostly from the Energy Information Administration (EIA)’s weekly reports. On Wednesday, the EIA -in its Weekly Petroleum Status Report- reported an increase in U.S. crude inventories by 2.4 million barrel. The figure reported by the EIA was more than the analysts estimates for a build of about 1.5 million barrels, but it was also less than the 4.4 million barrel build reported by the American Petroleum Institute (API) after the market closed on Tuesday.

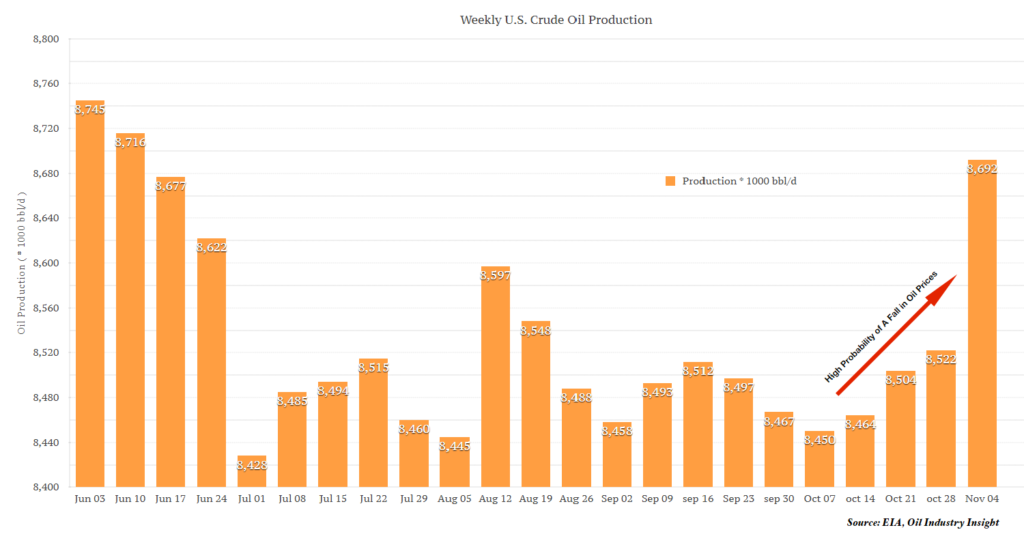

Another bearish oil market data also came from the EIA. In its Weekly U.S. Field Production of Crude Oil, the EIA reported a sharp increase in U.S. crude oil production by 170,000 barrel per day to the week ending November 4. According to the EIA’s data, U.S. crude oil production is now somewhere around 8,692,000 barrel per day. The recent sharp increase in U.S. crude oil production is a direct result of the sustainability of oil prices above $50/bbl for the last few weeks. With oil prices now settling down below $45/bbl, we will start to see a correction to recent shift in U.S. crude oil production in which U.S. crude oil production will reverse a course and will start to experience few declines in the coming weeks.

Weekly U.S. Crude Oil Production

This trend had taken place two times in the last few months and for the same exact reason. As OPEC starts to discuss the possibility of a production cut or output freeze deal, oil prices rise above $50/bbl. The sustainability of oil prices at such levels encourage U.S. crude oil producers to ramp up drilling activities and oil production which leads to the increase in U.S. crude oil production and rig count. Once that happens, conflicts among OPEC’s members over production cut appear and create doubts about the proposed production cut deal which seems to be the way which OPEC’s members use to respond to the increase in U.S. crude oil production and rig count. Doubts about OPEC’s oil deal along with the downward pressure from the increase in U.S. rig count and oil production force oil prices down just like what is happening right now.

Adding to the downward pressure to oil prices, the Organization of the Petroleum Exporting Countries (OPEC) announced on Friday that its October oil output reached another record high. The cartel said that its output rose by 240,000 barrel per day in October reaching as high as 33.64 million barrels per day. The increase in OPEC’s October output was driven by the increase in oil production from countries such as Nigeria, Libya and Iraq. The cartel is now a few weeks away from its November meeting in which its members are planning to agree on production cut, however, their current actions are not supporting what they are saying. Such actions by the cartel’s members are creating more doubts on whether its plan to limit production is achievable or enough to ease persisting oversupply in the market.

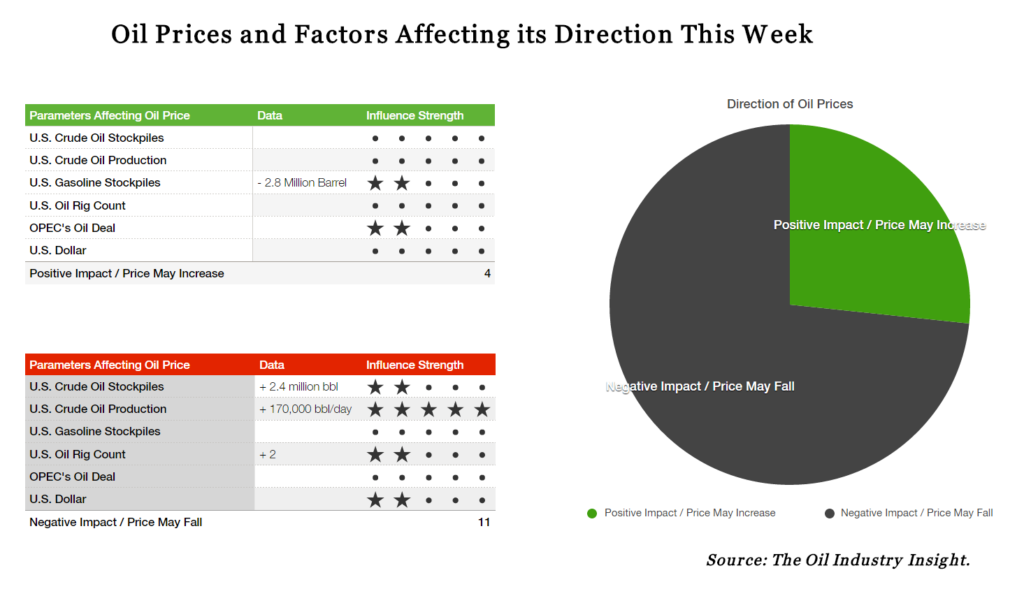

Last Week Oil Market Data and This Week Oil Price Forecast:

Last week oil market data and news point toward a negative oil market outlook this week and in the short-term. Last week’s 170,000 bbl/day increase in U.S. crude oil production, 2.4 million barrel increase in U.S. crude stockpiles and the addition of 2 oil rigs last week in the U.S. will put a huge downward pressure on oil prices this week driving it down to new lows. Additional pressure on oil prices will come from the announcement which OPEC made last week in which it said that its oil output increased by 240,000 barrel per day reaching a record high last month. More pressure to oil prices will also come from the strengthening U.S. dollar regardless of the fact that it will not be much, but it will still put some pressure on oil prices along with the other negative oil market factors.

Oil Prices Forecast

Almost all oil market parameters are putting a huge downward pressure on oil prices this week. Even OPEC’s oil deal which is supposed to support oil prices, it is now a source of downward pressure to oil prices due to the actions of OPEC’s members -in continuing to increase their oil output- which are inconsistent with what the cartel’s members say. For instance, at the beginning of last week, OPEC’s chair said that Russia is on-board to cut oil output. The purpose of the comments was to support oil prices. What was funny is that, at the end of the same week, OPEC said that its oil output reached a record high in October, a news which brought oil prices 2 percent down on Friday.

It is obvious now that despite the willingness of many OPEC’s members to make the oil deal a success, there appears to be no solid ground that can support such deal in the current state of the oil market. The current conflict between the two biggest oil producers within OPEC; Saudi Arabia and Iran, the willingness of a few of OPEC’s members to increase their oil production and the concerns of Saudi Arabia over the return of its rivals -shale oil producers to the market, all these are factors that will lead to the failure of OPEC’s oil deal at the end of this month.

Will Oil Prices Fall Below $40/bbl?

The overall oil market outlook for this week and in the short-term is quite gloomy. Oil prices are at risk of another fall this week. Brent crude and WTI are set to lose 1 to 2 percent in the first two days of trading. The fall could further intensify on Wednesday if the EIA reported another increase in US crude inventories. There is a high probability that oil prices could dip below $40/bbl level this week especially if more negative data were reported by the EIA. It is expected that the EIA will report another increase in U.S. crude oil production this week as well, such news will also further intensify the fall in oil prices at the end of the week leading oil price to end the week 2-3 percent lower than where it started.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.