Last Week Oil Prices Overview:

Last week, oil prices had to say its goodbyes for $50/bbl. It was really a bad week for oil prices. Driven by the growing tension between OPEC’s members -which is fueling doubts about OPEC’s oil deal and last week’s EIA data -which showed a record build up in US crude inventories, oil prices crashed last week during five days of consecutive declines which sent oil prices down by more than 9 percent. The fall in oil prices last week wad the biggest weekly oil prices decline since January 2016 as it sent oil prices down to where they were prior to OPEC’s oil deal.

Brent Crude Oil Price

The major factor that drove oil prices down last week was the escalating tension within OPEC itself and few other negative oil market sentiments. Following the downward pressure imposed on oil prices after Iraq made comments two weeks ago in which it requested to be exempt from participating in any oil deal, signs of tensions between Saudi Arabia and Iran -which for the record was the reason for the failure of the previous oil deal- resurfaced again. In a meeting of OPEC experts last week, Saudi Arabia said it could bring oil prices down by increasing its oil production if Iran did not agree to limit its oil production.

Adding to the downward pressure, the fall in oil prices last week was intensified on Wednesday after the EIA reported a sharp and surprise build up in U.S. crude oil stockpiles. According to the EIA, U.S. oil inventories increased by 14.4 million barrel last week. The figure represents the largest gain of crude inventory in a single week since years. The sharp increase in U.S. crude inventories was mainly driven by a spike in the weekly imports as U.S. crude imports rose by more than 2 million barrels per day last week.

WTI Crude Oil Price

Brent crude and WTI started last week around $50/bbl and $48/bbl respectively on Monday. During the first two days of trading, both oil pricing benchmarks fell by more than 4 percent as we expected in our last week oil prices commentary “Oversupply Concerns & OPEC Uncertainty Are Driving Oil Prices Down“. The fall in oil prices continued throughout the week, and by Friday, Brent crude and WTI settled down around $45/bbl and $44/bbl respectively.

Last Week Oil Market Data and News:

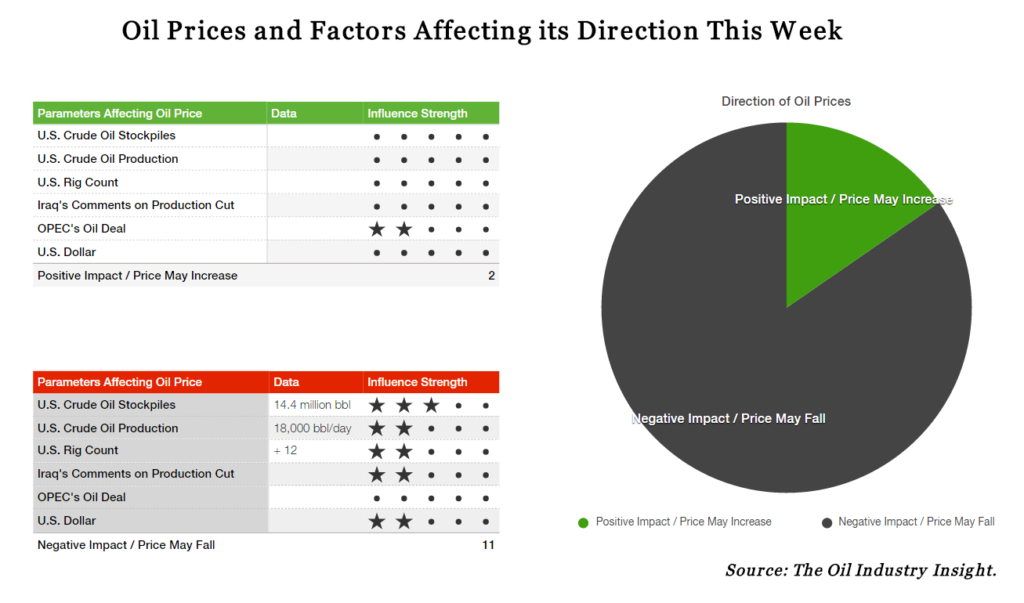

Last week oil market data and news are not different from the previous week in terms of the direction they are driving the oil market into. Oil market data and news still point toward a negative oil prices direction in the short term. In fact, negative sentiments are growing further and the oil market now appears gloomy and prepared for further fall in oil prices.

In addition to that, besides the huge build up in U.S. crude oil inventories reported by the Energy Information Administration (EIA), last week the EIA also reported another increase in U.S. crude oil production by around 18,000 barrel per day. Last week’s increase in U.S. crude oil production came after a large increase in the week before by more than 40,000 barrels per day. The recent shift in U.S. crude oil production is a direct result of the sustainability in oil prices above $50/bbl in the past few weeks. We have expected this shift in U.S. crude oil production in our previous analysis “The Threat Awaiting Oil Prices At $50/bbl”, and we said, it will be the reason for the fall in oil prices below $50/bbl. We didn’t have to wait for a long time to see it come true.

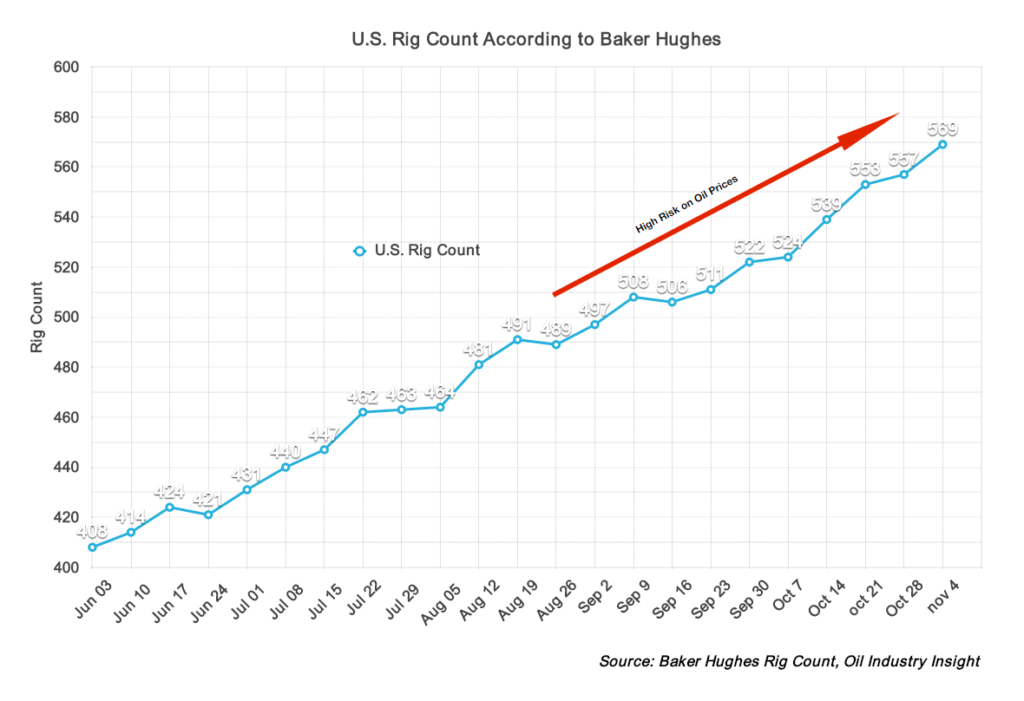

Adding to the negative sentiments, Baker Hughes reported an increase in U.S. rig count by 12 rigs last week to 569. Around 9 of these rigs were rigs drilling for oil. And since rig count is viewed as a measure of activities in the oil and gas industry, the continuous increase in U.S. rig count at oil prices around $50/bbl and above means that if oil prices are sustained at $50/bbl, more drilling activities will take place in the United States, and that will result in increasing the U.S. crude oil production. But this is not what Saudi Arabia wants right now, and therefore it will be the main reason for the fall and sustainability of oil prices below $50/bbl for the medium term.

US Rig Count

Another negative news which will impact oil prices negatively this week and in the short-term is the escalating tension within OPEC. Starting with Iraq’s demand to be exempt from participating in any production cut two weeks ago, and then the current growing tension between Saudi Arabia and Iran. But that is not the whole story which we should be concerned about. In fact, the biggest concern right now is the growing oil output of OPEC and the anticipated return and ramp up of oil production from few of OPEC’s members.

When OPEC’s members agreed in Algeria to cut oil production to support oil prices, their production level was less than what it is right now. In fact they needed to cut between 850,000 and 1.35 million barrels to achieve the target range of around 32.5 million to 33 million oil output. That has changed. Now, for OPEC’s members to achieve their target range, they need to increase their previous production cut by around 150,000 barrels due to the growth of OPEC oil output in October. The production cut’s figure could also get bigger as Angola’s oil production will return back this month after it was down by 230,000 barrels a day due to maintenance activities. That means, by the time OPEC meets on November 30, they will need to cut an additional oil output around 380,000 bbl/day above what they agreed upon in Algeria.

The picture gets worse knowing that there are two OPEC’s members namely; Libya and Nigeria which could increase its production output anytime soon. In fact, both countries are working on ramping their oil output in the coming days. Nigeria reached 2 million barrels a day last month, while Libya increased its output by 180,000 bbl/day. Both countries are still aiming to further increase to their oil output in the coming days.

The issue of increasing oil supply is not only happening within OPEC. In fact, oil supply is growing elsewhere as well. Last month, Kazakhstan started producing oil from its Kashagan field. The country expects to reach an oil production of 370,00 barrel per day by the end of next year. Russia -the country which supports OPEC’s oil deal and is expected to participate in the production cut- hit another post-Soviet record of 11.2 million barrels a day last month. With such a growing oil supply, a question arises; even if OPEC agreed on any production cut, what could that do to help the oil market when the oil production growth is not only coming form OPEC.

This Week Oil Price Forecast: “Will Oil Prices Crash Again This Week?”

The overall oil prices outlook for this week is quite negative. We are talking here about the current negative oil market data and news which will put a huge pressure on oil prices this week. Therefore, oil prices are set for another fall this week and could touch new lows around $43/bbl. There will be a lot of positive comments from OPEC’s members to support oil prices and prevent it from heading to $40/bbl, because that is what they recently seem to be experts on, but unfortunately, it will not help much. It could bring oil prices up by 1 to 2 percent, but the negative sentiments and the gloomy state of the oil industry will drive it down again. There is a growing doubt about OPEC’s oil deal right now. There is also a growing believe that oil prices are not going to go above its recent highs due to the nature of the competition between U.S. shale oil producers and Saudi Arabia.

Oil Prices Forecast

An example of such support from OPEC is the recent comments which were made today by OPEC’s chief where he said that Russia is on board with OPEC’s oil deal to limit the oil production. Oil prices are responding positively to the news because everyone is desperate for a positive support. But in fact, his comment is not adding anything new. We all know that Russia is on board. The issue is not mainly about if Russia is on board or out, the issue is within OPEC itself. Therefore, it is just a matter of time before oil prices return to its downward movement as OPEC’s chief is just giving another hollow comment.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.