Overview of Oil Prices

Last week, crude oil prices hit one year high on Monday following a positive comment made by Russia which said it was ready to join OPEC in its November’s oil deal. Brent crude hit its highest level since a year ago, reaching $53.73/bbl, while WTI reached to its highest level since June 9 at $51.60/bbl. However, the surge in oil prices did not last for long as oil prices retreated back throughout the rest of the week on various negative news and oil market data.

Brent Crude Oil Price

On Tuesday, oil prices fell around 2 percent on OPEC doubts. The cartel is trying to reach a global agreement to cap oil output at least for six months as it somehow doubts the effectiveness of the current expected oil deal to reduce the current crude glut. Adding to the downward pressure on oil prices, on Wednesday oil prices fell another 1 percent after OPEC reported that its September’s oil output reached eight-year highs. The fall in oil prices was also driven by a strengthening U.S. dollar as the U.S. dollar index’s reached to a seven-month peak.

Adding to the pressure on oil prices, on Thursday oil prices fell slightly after the EIA reported a sharp increase in U.S. crude oil stockpiles after 6 weeks of decline. In its Weekly Petroleum Status Report, the EIA reported a 4.9 million barrel increase in U.S. crude inventories to the week ended October 7. Crude oil prices fell slightly following the EIA’s report, however, the prices bounced back as the oil market turned its attention from the sharp fall in U.S. stockpiles to focus more on the product inventory drawdowns. In the same report, the EIA reported a decline of 3.7 million barrels and 1.9 million barrels for distillates and gasoline respectively.

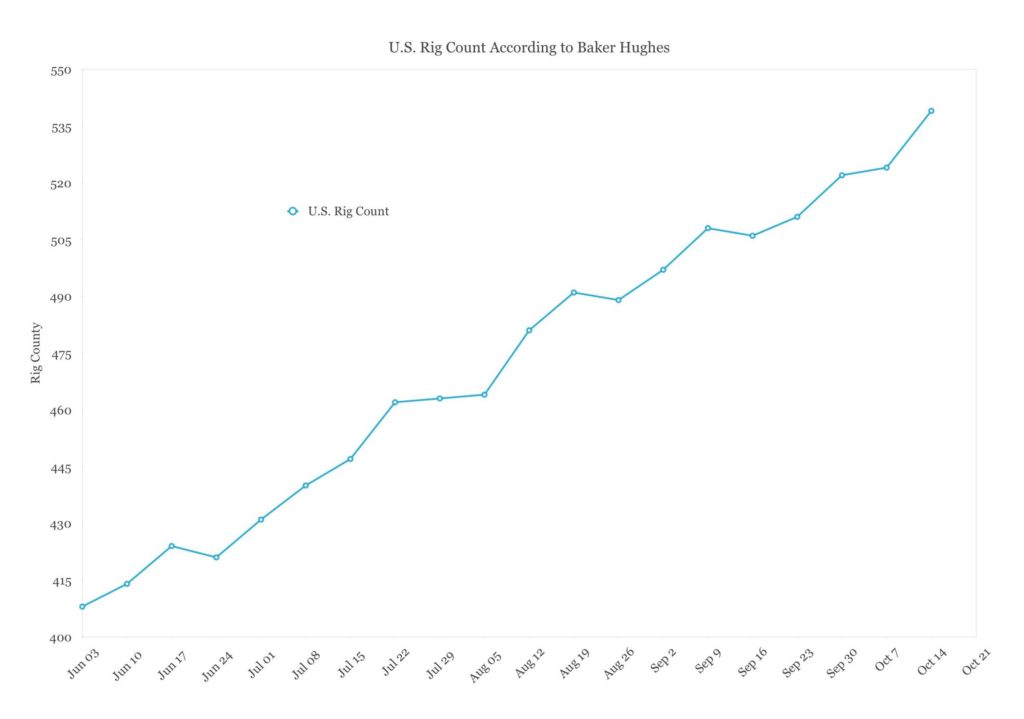

U.S. Rig Count

On Friday, oil prices closed the week falling slightly on strengthening U.S. dollar and another sharp increase in U.S. rig count reported by Baker Hughes. The U.S. dollar weighed on oil prices as it posted its best weekly performance in seven months. And Baker Hughes reported an increase in U.S. rig count by 15 last week which also weighed on oil prices.

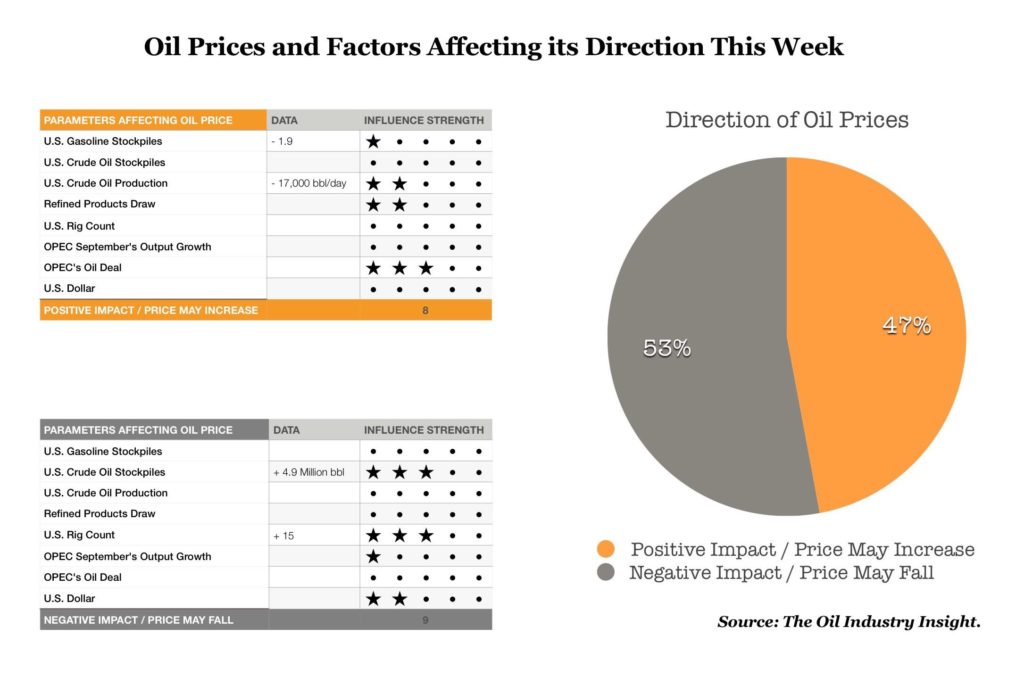

Last Week Data/News & This Week Oil Prices Forecast

Last week’s data and news are mixed between positive and negative, however, the majority of the news are pointing more toward the negative side. While OPEC’s oil deal and the recent support it received from Russia are supporting oil prices intensively, many of last week’s data and news are pressuring oil prices down with the same intensity and even more.

Oil Price Forecast for This Week

The sudden sharp increase in U.S. crude inventories, the continuous rise in U.S. rig count, strengthening U.S. dollar, and OPEC’s September oil output growth; all these news and data put a huge pressure oil prices last week and prevented it from going above its Monday’s highs and will continue to put pressure on oil prices this week as well. In fact, balancing all these negative news and data against the positive news from OPEC’s oil deal tells us that oil prices are at a slight risk this week.

OPEC’s oil deal news is already there. It has driven oil prices all the way up to this level, but it is gradually losing its impact on oil prices unless new support comes in. However, last week’s negative news and data are fresh and its pressure on oil prices is high. In fact, the negative impact of some of these news and data such as U.S. rig count and U.S. crude inventories will be extended for a couple of weeks. This is simply because these negative data and news represent a shift in trend which usually continues for few weeks.

What Will Drive Oil Prices This Week?

This week, crude oil prices will be slightly driven downward by U.S. rig count, crude inventories and U.S. dollar. Oil prices are at risk of losing 1 percent in the first and second day of trading. And this week, instead of driving oil prices up above last week’s highs, OPEC’s oil deal might only prevent oil prices from dipping below $50/bbl.

The overall oil prices outlook for this week is slightly negative. However, that could change on Wednesday if the EIA reported a decline in U.S. stockpiles which seems to be highly unlikely. Another way this forecast could be wrong is if there is new positive comments from OPEC’s members such as Iraq and Iran supporting the deal.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.