Overview of Oil Prices

Crude oil prices spiked sharply last week following a decision by OPEC to cut its oil production after two years of market share war with U.S. shale oil producers. In its meeting last week -which took place in Algiers- the cartel decided to cut its production from 33.24 million barrels per day to a range of between 32.5 and 33.0 mb/d.

Brent Crude Oil Price

The news about OPEC oil deal was a surprise to the oil market. And while the meeting was an informal meeting where no deal was finalized yet, and cartel’s may or may not seal the deal in Vienna in November, oil prices were boosted by more than 6 percent on Wednesday, and ended the week around $50/bbl.

Both Brent crude and WTI started the week around $46/bbl and $44/bbl and by Friday prices had risen to $49/bbl and $48/bbl respectively. Support to oil prices last week also came from a considerable decline in U.S. crude stockpiles of around 1.9 million barrels.

OPEC Oil Deal, Last Week Data/News & This Week Oil Price Forecast

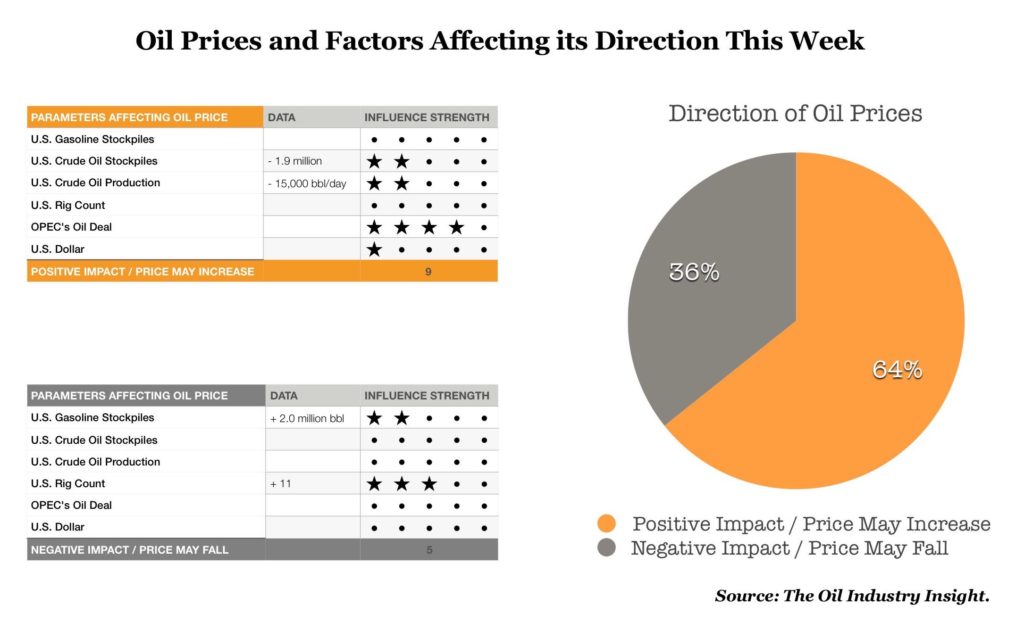

The majority of last week oil market data and news point toward a positive oil prices direction. Therefore, oil prices are set to rise above the $50/bbl and continue its upward movement this week. The first and the most important supporter to oil prices this week is OPEC oil deal. Oil prices could reach new levels above $50/bbl this week supported by OPEC’s oil deal.

Oil Prices Forecast

Despite the fact that OPEC oil deal is uncertain, and that allocating production cuts to the cartel’ members will be the biggest obstacle facing this deal, the support to oil prices comes from the fact that the decision by OPEC was unexpected. Oil market traders and investors are still excited about the news, and this excitement could drive oil prices to levels around $55/bbl in the coming weeks.

Oil prices will also be supported by last week’s market data which show declines in U.S. crude oil production and stockpiles of around 15,000 bbl/day and 1.9 million barrels respectively. Adding to the support, crude oil prices may also be supported by a weakening U.S. dollar. These combination of factors provide a perfect ground for oil prices to reach new levels above $50 per barrel.

On the negative side, some of last week data and news such as the increase in U.S. rig count by 11 rigs to 522 and the sharp increase in U.S. gasoline stockpiles could limit how high oil prices can go. But it all depends on this week’s crude oil and gasoline inventories data. If the data are positive, it will boost oil prices, but if the data are negative, it will limit how high oil prices can go.

US Gasoline Stockpiles

More downward pressure and price resistance to go higher above $50/bbl will be coming from the fact that as oil prices reach to $50/bbl, U.S. shale oil increase their drilling activities and their oil production starts to reverse a course. This will be the next challenge for oil prices this week and in the next few weeks. And it will also be the OPEC oil deal breaker unless Saudi Arabia is ready to admit defeat and lose some of its market share.

The overall oil prices outlook for this week is positive. Bent and WTI crude oil prices are set to go higher this week adding $1 to $2 a barrel. U.S. crude oil production and and market data, as well as rig count should be watched closely as these data are what will determine if oil prices will continue its upward movement or will face a huge resistance at $50/bbl as it did before.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.