Oil Prices Overview:

The oil prices rally has continued last week fueled by OPEC Talk. And as expected in our previous week’s Oil Price Commentary, Brent crude oil price reached to $50/bbl last week after getting more support from the Energy Information Administration (EIA)’s reports.

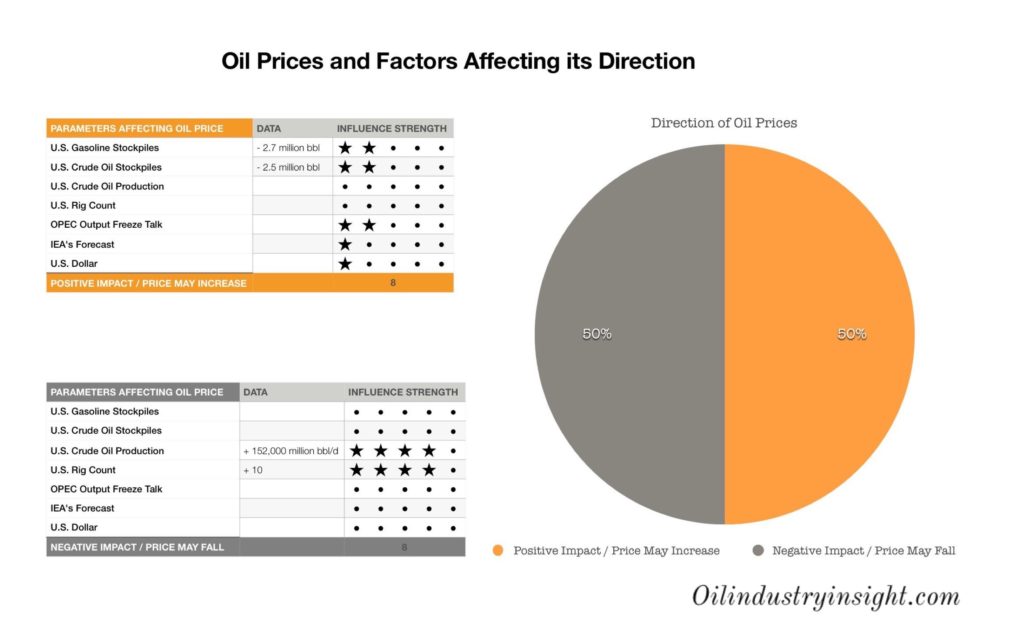

In its last week Weekly Petroleum Status Report, the EIA reported a decrease in both U.S. crude oil and gasoline inventories by 2.5 million bbl and 2.7 million bbl respectively. The news supported oil prices to continue its upward movement. Both Brent and WTI crude closed the week well above $50/bbl and $48/bbl respectively.

The current resurgence in oil prices has been irrationally driven by hollow comments from some OPEC’s members on a possible meeting to discuss output freeze deal by the end of September. Since the comments were made public around two weeks ago, both Brent and WTI have risen more than 20 percent off of their August lows.

The issue with such a huge rise in oil prices is the lack for a sufficient fundamental justification and the fact that there is too much skepticism that OPEC oil production freeze agreement could be achieved in September. There are doubts that Iran, Iraq, and Nigeria will be joining the agreement. The three countries have plans to boost their output especially Nigeria which has lost a lot of its oil output due to attacks by militant groups.

Another risk to the sustainability of the current oil prices rally that is growing right now is the strong return of U.S. rig count and oil production’s increase. Oil prices at $50/bbl and above will encourage the return of shale oil producers. In fact, we don’t have to wait much like last time, it is already taking place right now as more U.S. shale oil producers are adding more rigs and oil production is increasing. For more details on this topic, you may want to read my recent commentary.

Last Week Data and How It Will Affect Oil Prices this week:

The performance of oil prices this week is at a considerable risk and will be highly fluctuated with more favor toward the down side. Last week’s data and news will highly influence oil prices this week especially driving it down. While the decrease in U.S. crude oil and gasoline inventories support oil prices along with OPEC talk, the rise in U.S. rig count and oil production will drive oil prices down.

U.S. rig count increased by 10 rigs last week according to Baker Hughes rig count. U.S. oil production also increased sharply last week as reported by the EIA around 152,000 bbl/d. These news will dominate the oil market this week and concerns over supply glut will resurface putting negative pressure on oil prices.

The overall oil prices outlook for this week is slightly negative. Bent and WTI crude oil prices will be traded at +/- $1 to its last week level around $50/bbl and $48/bbl respectively with more favor toward the down side. This week data and news will determine the overall direction of oil prices this week. We expect more positive comments from OPEC’s members to assure the oil market about their talk in order to prevent oil prices from falling.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.