Last Week Oil Price Overview

Last week, crude oil prices hit what appears to be their highest level for 2016. On Monday, Brent crude and WTI spiked by more than 4 percent to around $57/bbl and $54/bbl respectively. The support to oil prices came from the agreement reached between OPEC and non-OPEC producers to jointly cut oil output in order to ease the global glut and help the oil market recover.

Brent Crude Oil Price

Despite the support to oil prices from the OPEC and non-OPEC agreement, oil prices did not hold to the level it reached earlier on the week. Driven by the news of OPEC’s production hitting all times high in November and the Feds rate hike, oil prices paired its gains. By Thursday, Brent and WTI crude were somewhere around $53/bbl and $50/bbl respectively before rising again on Friday to end the week where they started.

Last Week Brent Crude Oil Price Movement

The support to oil prices on Friday came as a result of the renewed faith on OPEC oil deal after Qatar and Kuwait announced their commitment to the OPEC oil deal and that both countries will cut their oil output as agreed during the OPEC oil deal. This news along with the news of non-OPEC oil deal to cut oil output added more credibility to the OPEC oil deal.

Last Week Oil Market Data and News

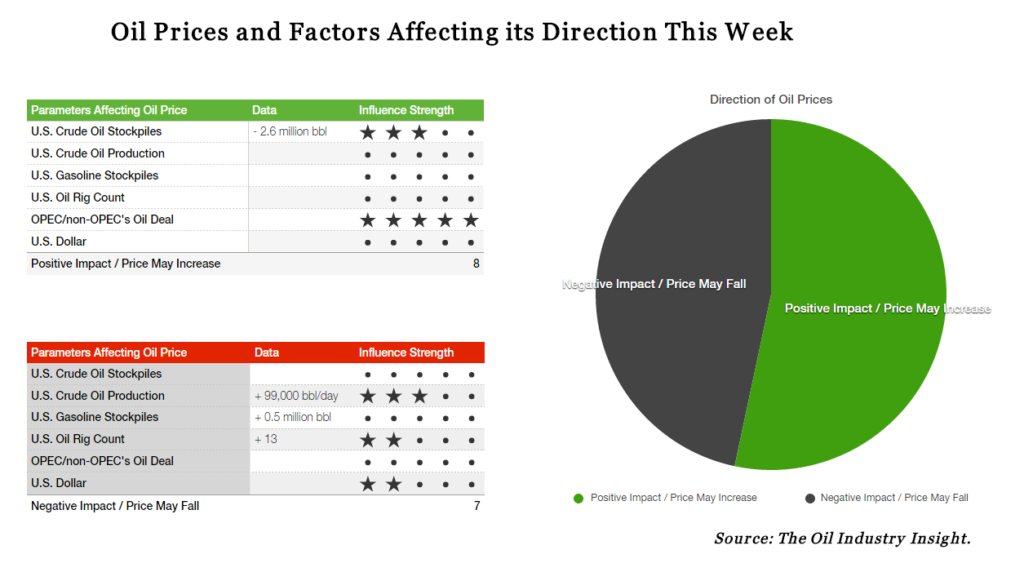

Last week oil market data and news point toward a growing threat to the upward movement of oil prices. First of all, the U.S. Energy Information Administration ( EIA ) reported a huge increase in US crude oil production last week. According to its Weekly U.S. Field Production of Crude Oil data, US crude oil production rose by 99,000 barrel per day to 8,796,000 barrel per day as of December 9, 2016.

Adding to the negative sentiments, US rig count continues to increase as oil prices remain above $50/bbl. According to Baker Hughes rig count, US rig count increased by 13 rigs last week, bringing the total number of active rigs to 637 rigs. Around 12 rigs of the drilling rigs added last week were oil rigs.

Adding to the negative sentiments, US rig count continues to increase as oil prices remain above $50/bbl. According to Baker Hughes rig count, US rig count increased by 13 rigs last week, bringing the total number of active rigs to 637 rigs. Around 12 rigs of the drilling rigs added last week were oil rigs.

The negative impact of the increase in US crude oil production and rig count on oil prices may not be too obvious right now as the oil market is more focused on the positive impact of OPEC and non-OPEC deal to cut output, however, these two factors will play a huge role in limiting the oil price gains in the coming weeks. It will be hard for OPEC and NON-OPEC producers -who are cutting their oil output- to stick to their deal while they watch shale oil producers increase their oil output and capturing new market share.

Adding to the pressure on oil prices, the recent decision by the U.S. Federal Reserve to raise interest rate sent oil prices tumbling as the dollar rallied to a 14-year high. With the Feds signalling possible interest rate hikes in 2017, oil prices will face a continuous pressure from the strengthening US dollar in the coming weeks. That means, US dollar will play a vital role in determining how high oil prices can go.

On the other hand, US crude stockpiles fell slightly last week. According to the EIA Weekly Petroleum Status Report, U.S. crude oil production decreased by 2.6 million barrel to 483.2 million barrel. However, the oil market ignored this positive sentiment as the focus was more toward the negative impact of the Feds rate hike.

This Week Oil Price Forecast

Despite the downward pressure from the strengthening US dollar, rising US rig count and oil production, oil prices are expected to go higher this week. The support to oil prices will come from the recent announcement by Qatar and Kuwait which showed their commitment to cut oil output in order to make OPEC’s oil deal a success. Add to support, the recent non-OPEC agreement to join OPEC in cutting oil output will also support oil prices this week. We also expect other OPEC members to make positive comments next week in order to push oil prices further and prevent any retreat due to the increase in US rig count, oil production and a stronger US dollar.

Oil prices are set to go higher in the first two days of trading with Brent crude and WTI rising by around 2 percent. On Wednesday, depending on the outcomes of EIA Weekly Petroleum Status Report, oil prices are expected to either continue increasing if the EIA reported a decrease in US crude stockpiles, or decline slightly with a fast bounce back as the oil market is dominated by positive sentiments.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.