Overview of Oil Prices

Last week, crude oil prices started the week losing around 1 percent in the first two days of trading as expected in our last week oil price forecast. On Tuesday, Brent crude and WTI traded around $51.49/bbl and $49.95/bbl respectively. However, oil prices skyrocketed on Wednesday following the release of the Energy Information Agency’s Weekly Petroleum Status Report. In its report, the EIA reported a surprise draw to U.S. crude inventories of around 5.2 million barrels versus analyst expectations for another build in US stockpiles of about 2.5 million barrels.

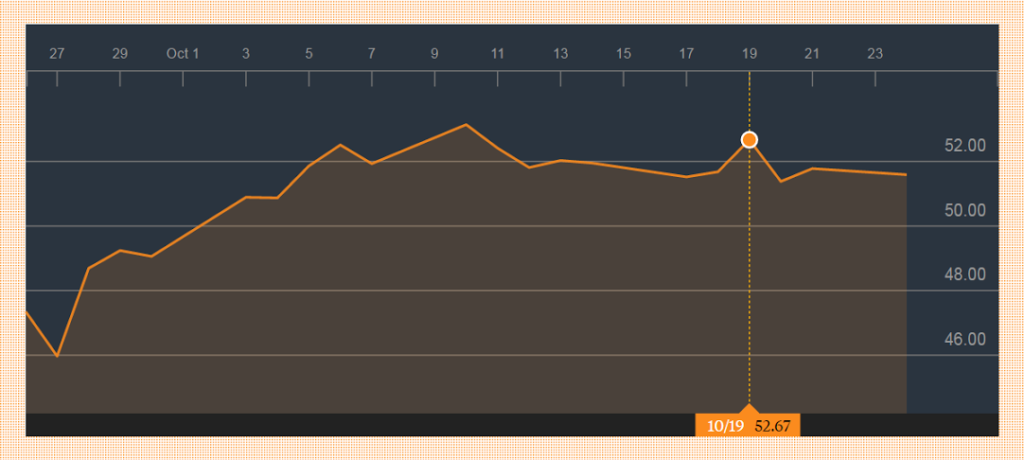

Brent Crude Oil Price

Following the release of the report, oil prices reversed a course and hit 15-months highs. Brent and WTI were traded at some of the highest levels seen in over a year at around $52.67/BBL and $51.6/bbl respectively. However, oil prices paired its gains on Thursday as US dollar hit months-high. Brent crude and WTI fell to around $51.30/bbl and $50.50/bbl respectively. But oil prices were slightly up on Friday on hope that Russia and OPEC could reach agreement during the weekend on market support initiatives in order to keep oil prices above $50 a barrel. Oil Prices ended the week flat with no major changes from where it started the week.

Last Week Data/News & This Week Oil Prices Forecast

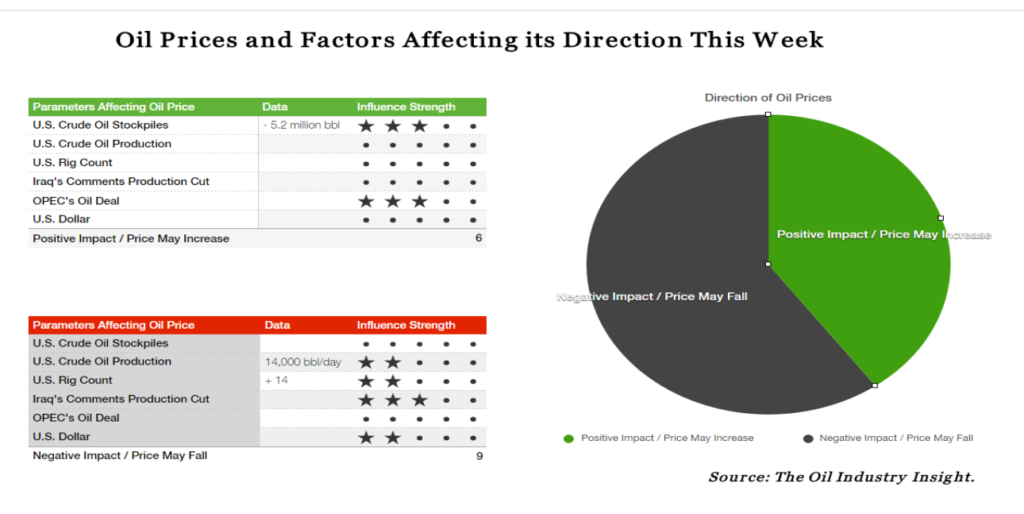

Despite a surprise draw in US stockpile which drove oil prices up last Wednesday, the overall oil market data and news were negative and not only limited how high oil prices could have gone last week, but it also put a huge pressure pulling it down to close the week flat.

Last week, Baker Hughes rig count service reported an increase in US rig count by 14 rigs to 553. Around 11 of the new rotary rigs added last week were oil rigs. Such an uptick in US oil rig count indicates that shale oil producers are now ready to ramp up drilling activities at the current oil price levels. More stability to oil prices above $50/bbl would result in a fast comeback of shale oil drilling activities.

Adding to the negative sentiments, the EIA reported an increase in US oil production to the week ending October 14 by 14,000 bbl/day. According to the EIA, US crude oil production now stands at 8,464,000 bbl/day. With oil price around $50/bbl, it is expected that US crude oil production will continue increasing as more drilling activities will take place and shale oil producers will start taping some of the many DUCs that are waiting for oil prices to go up.

Oil Price Forecast

The downward pressure to oil prices will be supported by the Iraqi comments that were made earlier today. The country is looking to be exempted from participating in the oil production cut. The Iraqi comments will create a lot of doubt about OPEC oil deal, which in turn will drive oil prices down.

Oil Price This Week: Where to?

Based on last week data and news, Iraqi negative comments and the strengthening US dollar, oil price this week is at a huge risk of falling below $50/bbl. Adding to the pressure from a continuous increase in US rig count and the new increase in US crude oil production, US dollar will be the main reason for the fall in oil prices. The overall oil prices outlook for this week is quite negative. Brent and WTI are set to fall 1 to 2 percent during the first two days of trading. On Wednesday, the fall in oil prices could be extended if the EIA reported an increase in US crude stockpiles. However, if the EIA reported another surprise decline in US crude stockpiles, the fall in oil prices will only be limited. Another way this forecast could be wrong is if there is new positive comments from OPEC’s members such as Saudi Arabia, Iran or even Russia supporting the deal which is highly expected.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.