Last Week Oil Market Data:

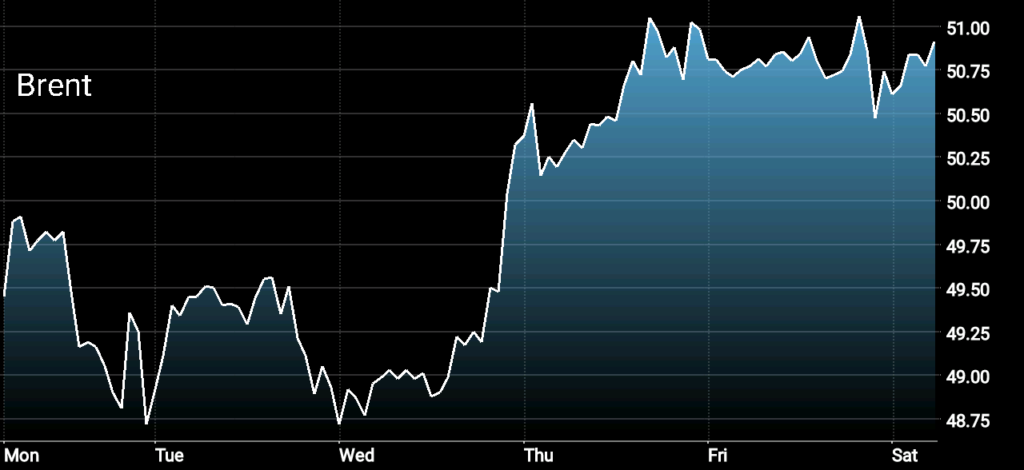

Crude Oil Price Movement: Oil prices reversed course last week following a sharp decline in U.S. crude inventories reported by the EIA. Brent crude and WTI jumped up from their six-month low to end the week around $50.91/bbl and $47.90/bbl respectively.

Brent Crude Price

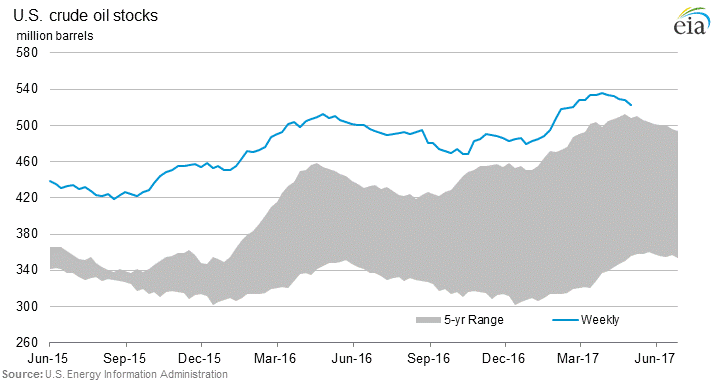

U.S. Crude Oil Inventories: U.S. crude inventories decreased by 5.2 million bbl to the week ending May 5. The drawdown in US crude inventories was more than expected and encouraged oil prices to edge higher despite negative market sentiments.

US Crude Inventories, EIA

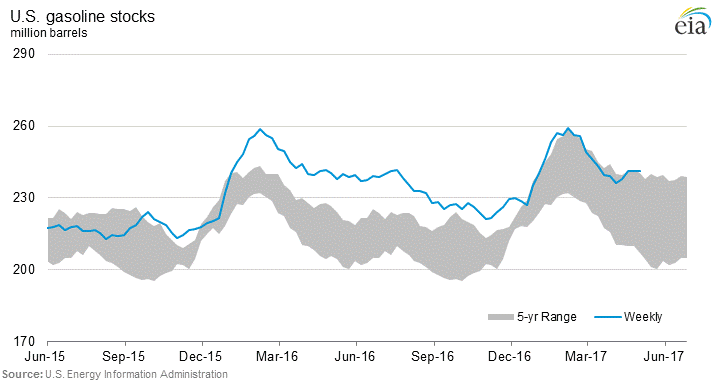

U.S. Gasoline Stocks: U.S. gasoline stockpiles fell by 0.2 million bbl to the week ending May 5. Even though the decline in U.S. gasoline stocks was quite small, it confirmed a significant fall in storage and represented a change in the recent trend in which we saw crude oil and gasoline stocks increasing for the past few weeks.

US Gasoline Stocks, EIA

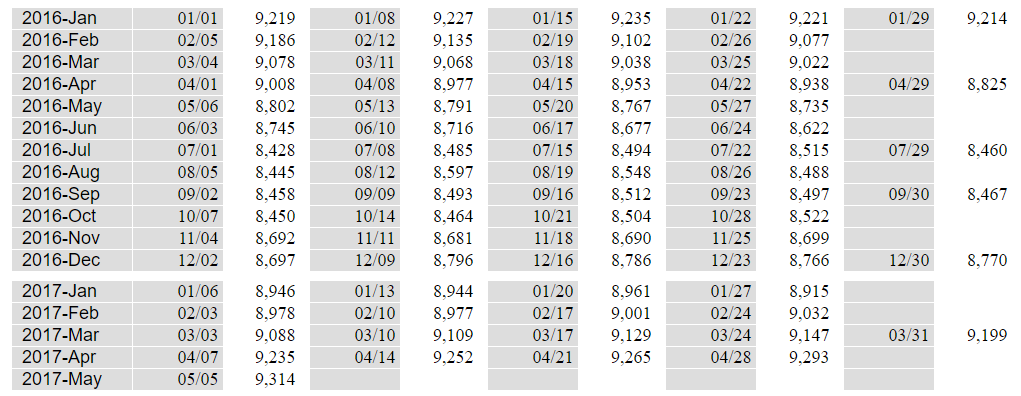

Weekly U.S. Crude Oil Production: U.S. crude oil production continued its growth as expected. For the week ending May 5, U.S. crude oil production increased by 21,000 bbl/day to 9,314,000 bbl/day. US crude oil production is up by more than 500,000 bbl/day from the same time a year ago. The growth in in US crude oil production is expected to continue accelerating and consequently putting huge pressure on oil prices.

U.S. Crude Oil Production, EIA

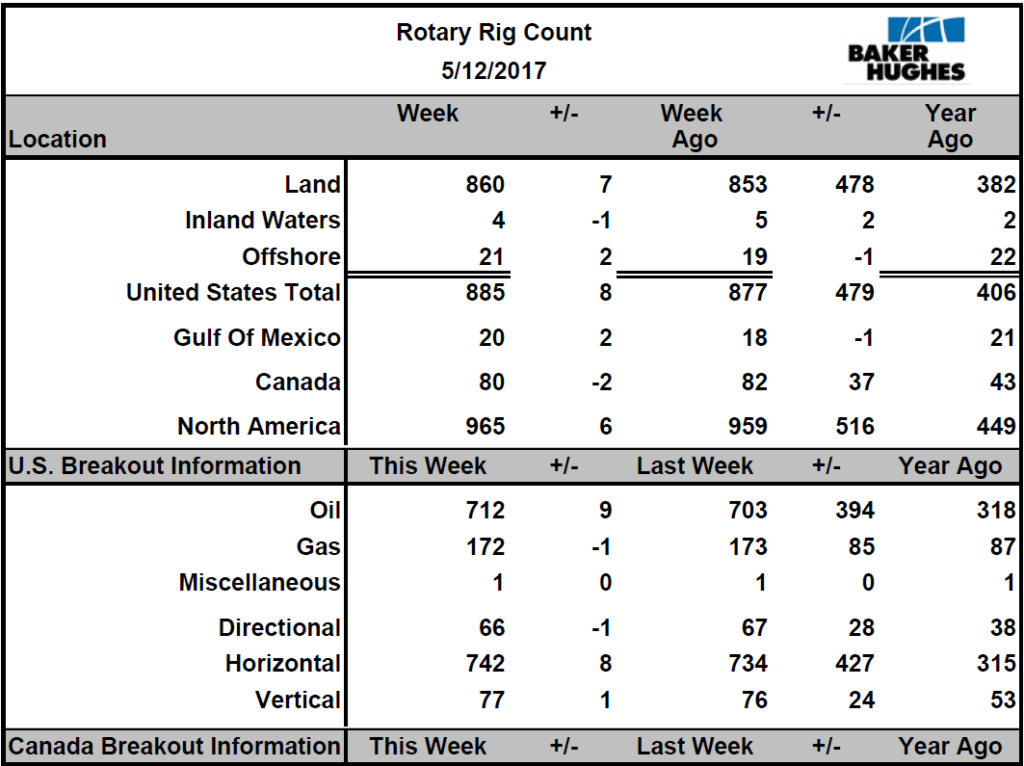

U.S. Rig Count: U.S rig count increased by 8 rigs to 885. Oil rig count was up by 9 rigs to 712, while gas rig count was down by 1 rig to 172. U.S. rig count is up by 479 rigs from the same time a year ago. U.S. rig count number is expected to continue its growth especially if OPEC members agreed to extend their production cut in during the cartel meeting next two weeks.

US Rig Count, Baker Hughes Rig Count

This Week Oil Price Forecast:

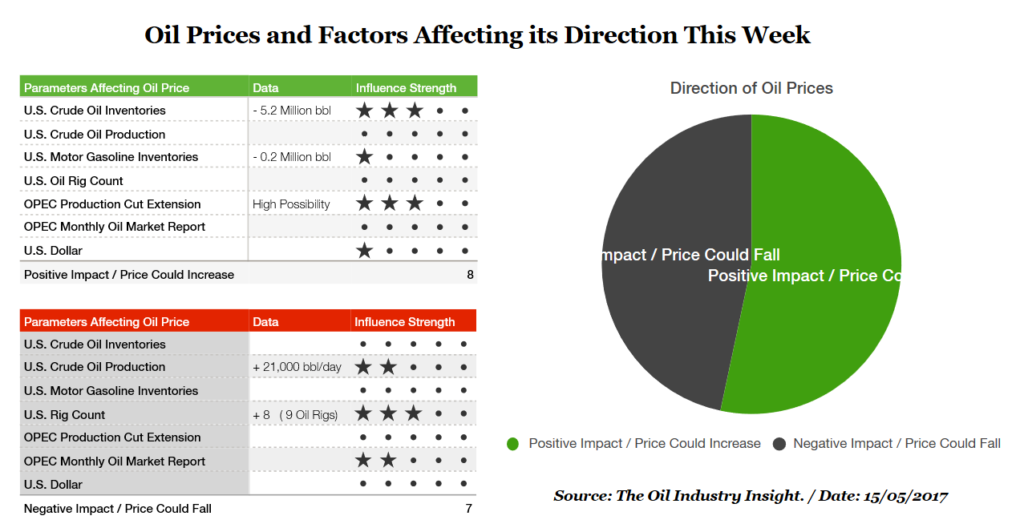

Looking at the overall outlook for oil prices this week and the following weeks prior to OPEC meeting, it appears that oil prices will continue to recover from their recent fall to go up closer to where it was prior to the collapse. Once the OPEC meeting takes place in two weeks time, the direction of oil prices afterward will depend on the outcomes of the meeting, but for now, oil prices will continue to get support from the comments of OPEC’s members about possible production cut extension.

Last week oil market data and news were mixed between negative and positive. The fall in U.S. crude inventories and gasoline stocks supported oil prices recovery last week and could continue to support oil prices to sustain that level throughout this week. Oil prices will also be supported by positive comments from OPEC’s members which show that the cartel could agree to extend its production cut despite the fact that OPEC members are worried that the boost to oil prices will again allow shale oil to lock in hedges for their production and consequently boost their oil supply further. Adding to the support, the fall in U.S. dollar last week on Friday following less than expected retail sales and inflation data will give oil prices a better chance to recover or at least maintain its current level.

Oil prices are expected to have a better week ahead. Brent crude and WTI are expected to continue trading around their current levels; $50.91/bbl and $47.90/bbl respectively, and could go up by 1 percent in the first two days of trading. If the EIA’s crude oil and gasoline stockpiles data for this week showed a similar decline trend like last week, oil prices could edge higher by around 3 percent.

The support to oil will be limited by last week data which showed an increase in U.S. crude oil production and rig count. These negative sentiments could limit the upward movement in oil prices. Oil prices will also experience some pressure at the end of the week once the data about U.S. crude oil output and rig count are released which are expected to continue rising, but these data are not expected to drive oil prices down much as the market’s is now more focused on OPEC production cut extension.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.