Last Week Oil Market Data:

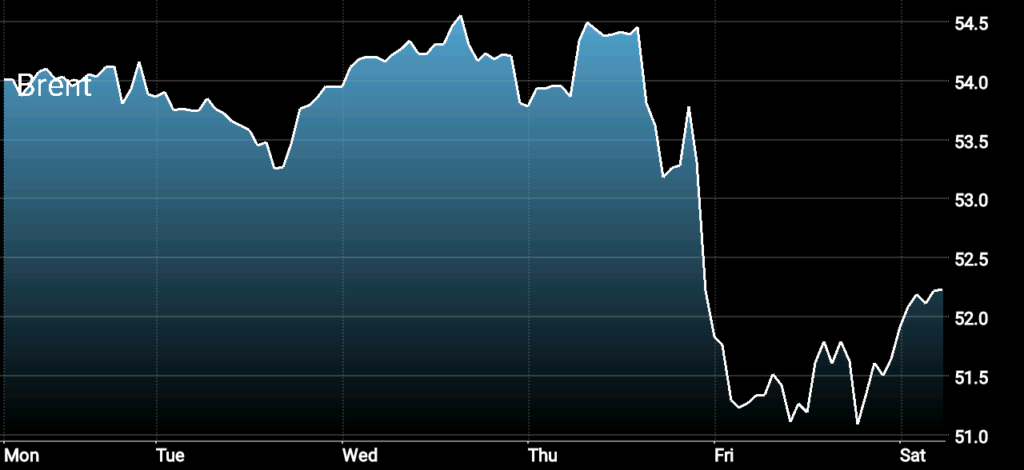

Last Week Crude Oil Price Movement: Oil prices closed the week approximately 3 percent lower as the outcomes of OPEC’s meeting last week were obviously less than what the market was expecting. It is obvious that the oil market now realizes that OPEC’s output cut extension will not change the deteriorating oil market fundamentals. The only thing it will do is preventing the oil market from getting worse. Following the meeting, Brent crude and WTI fell by approximately 5 percent and closed the week the week around $52.23/bbl and $49.86/bbl respectively.

Brent Crude Oil Price

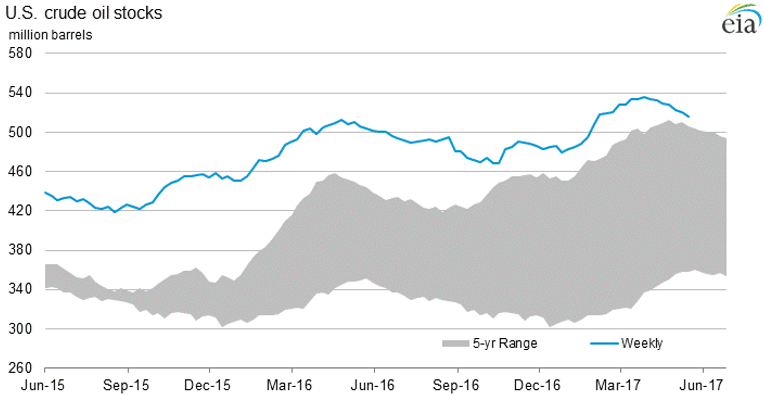

U.S. Crude Oil Inventories: U.S. crude inventories fell by 4.4 million barrel to the week ending May 19. The sharp fall in U.S. crude inventories last week came after two weeks of drawdown in U.S. crude inventories. The fall in U.S. crude inventories supported oil prices to maintain the same level where it started on Monday, but oil prices fell sharply following OPEC’s meeting on Thursday.

US Crude Oil Inventories

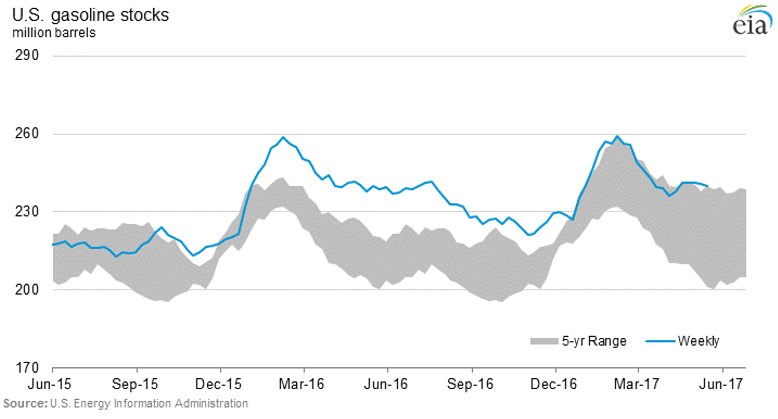

U.S. Gasoline Stocks: Following two weeks of decline, U.S. gasoline inventories fell again last week by 0.8 million bbl. Along with other positive market data and news, the fall in gasoline inventories supported oil prices last week.

US Gasoline Stockpiles

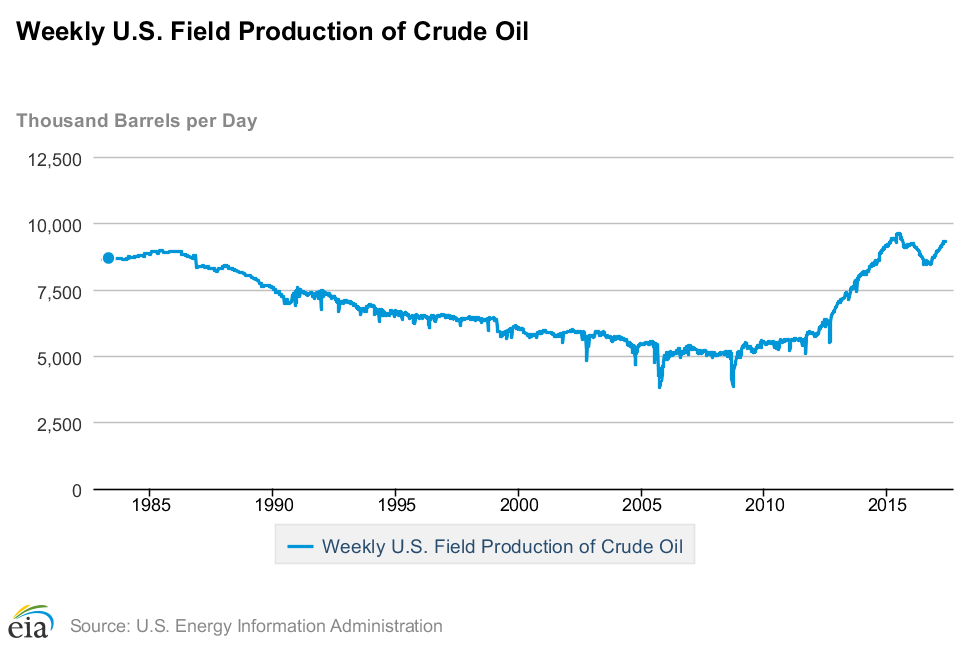

Weekly U.S. Crude Oil Production: U.S. crude oil production increased by 15,000 bbl/day to the week ending May 19. The increase in U.S. crude oil production came as a confirmation of the continuous growth in US crude oil output especially after a slight decline during the week before. At its current level, U.S. crude oil production stands at 9,320,000 bbl/day, up by 553,000 bbl/day from the same time a year ago. The current growth in U.S. crude oil production is a threat to oil prices sustainability above $50/bbl as well as to the efforts made by OPEC and non-OPEC’s members to balance the oil market. The increase in U.S. oil production put pressure on oil prices last week and will continue to put huge pressure on oil prices from now onward especially as OPEC’s meeting is over and obviously nothing will change for 9 months. Assuming a steady supply from OPEC with slight changes, the increase in U.S. crude oil production will lead oil prices to fall below $50/bbl in the coming weeks.

US Crude Oil Production, EIA

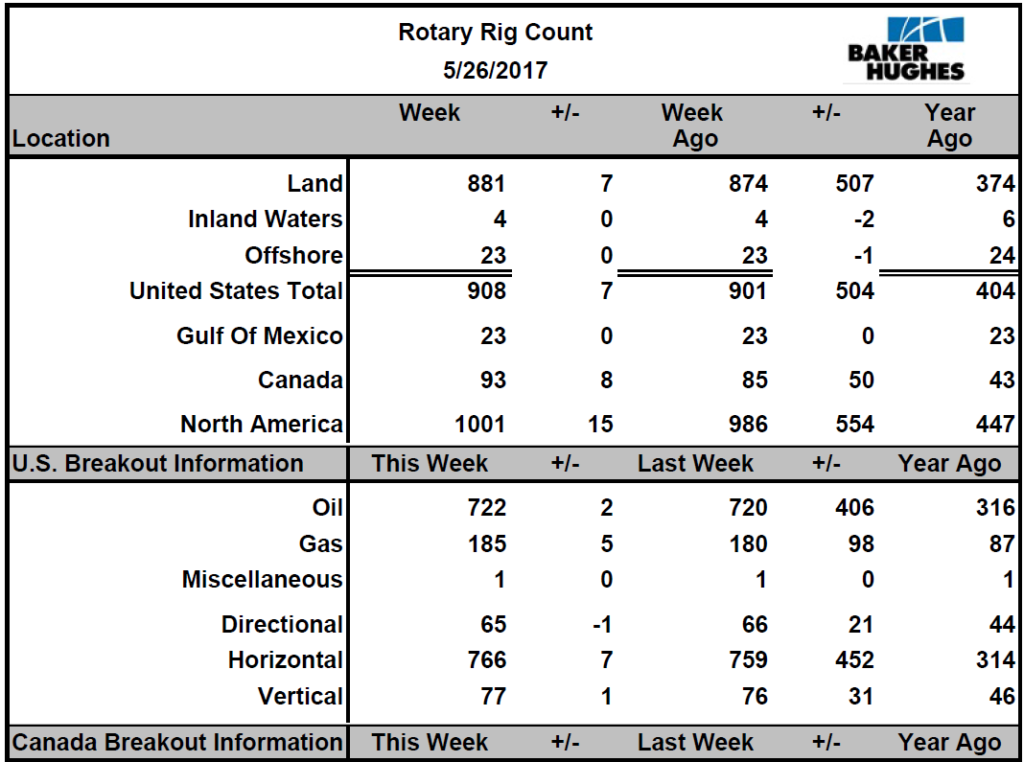

U.S. Rig Count: Last week, U.S rig count increased by 7 rigs to 908. Oil rig count was up by 2 rigs to 722, while gas rig count was up by 5 rigs to 185 as well. U.S. rig count is currently 504 up from the same time a year ago.

Given the recent decision by OPEC to extend its oil output cut for 9 more months, it is expected that U.S. rig count will continue growing in the coming weeks. And since there is no more hope of any positive actions by OPEC to cut more oil output, the increase in U.S. rig count and crude oil production will have a significant and instant impact on oil prices. It is also expected that in few months, oil prices will fall below $50/bbl due to the continuous increase in rig count and oil output, which will lead to a slowdown in drilling activities in the U.S.

US rig Count, Baker Hughes

Last Week’s Takeaways:

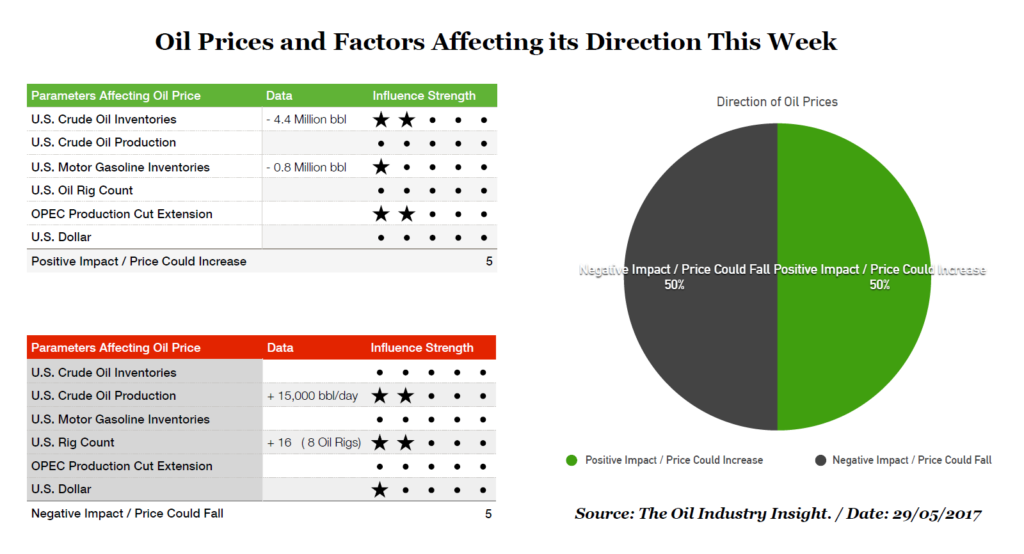

Last week’s oil market data and news were mixed between positive and negative data and news. While U.S. crude oil and gasoline inventories declined, giving more support to oil prices, U.S. crude oil production and rig count increased and put more pressure on the already pressured oil prices.

One factor that played an important role in oil prices last week was OPEC meeting’s outcome. OPEC and non-OPEC’s members agreed to extend their current oil output cuts for 9 more months until the first quarter of 2018. Although the oil market was waiting for this decision, the movement of oil prices following the announcement of the news showed that the oil market was in fact hoping for more bullish measures to be taken. And because there was nothing new about the meeting’s outcome, oil prices fell sharply by nearly 5 percent following OPEC’s meeting.

It is obvious that the oil market has now realized how complicated the situation is and now that OPEC’s support is off the table and already accounted for, risks and uncertainty are back again due to the continuous growth in U.S. crude oil production and rig count.

Moving ahead now, we have an oil production cut from OPEC and non-OPEC’s members which is approximately around 1.8 million barrels. Based on OPEC’s recent meeting, this figure will be kept unchanged until the first quarter of 2018. This is good news for the market for sure as it helps drive the oil market into balance. However, that will not be possible giving the growing oil supply from other producers who are not participating in the oil production cut agreement. And this is a serious problem facing the oil market ahead.

U.S. oil production continues to increase and that is not going to change anytime soon. The return of market oversupply concern will not be driven by U.S. oil producers alone, oil supply is expected to increase due to the increase in production from other producers such as Brazil, Canada, North Sea and few other countries where projects are coming online this year. This trend is expected to pressure oil prices down driving it below $50/bbl threshold in the coming months. We expect OPEC to be forced to take further meaures to prevent oil prices from falling to around $40/bbl in the fourth quarter of 2017, that is if it wishes to maintain oil prices around its current levels.

This Week Oil Price Forecast:

Looking at last week oil market data and news, we see oil prices fluctuating around their current levels of $52.23/bbl and $49.86/bbl for Brent and WTI respectively. The current price levels for both Brent and WTI seem to be a reasonable level giving the fact that OPEC’s hope is already off the table. Downward pressure to oil prices this week will be coming from concern over the growth in U.S. crude oil production and rig count. Strengthing U.S. dollar -as U.S. first-quarter economic growth was revised up is also expect to put pressure on oil prices this week.

Weekly Oil Price Forecast

Oil prices are expected to fall slightly in the first two days of trading by nearly 1 percent. On Wednesday, we expect prices to slightly recover as there is a high possibility of decline in both U.S. crude oil and gasoline inventories, however these gains will be erased by the growth in U.S. crude oil output and rig count by end of the week.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.