Is there really a positive side for low oil prices? Yes there is, it is just that not many people can read between the lines and look at the big picture in the long term. While low oil prices could be bad for oil companies and their profits in the short term, it is good for the oil industry itself in the long term. How is that so?

When a market downturn happens and oil prices start to fall, companies’ profits decline and eventually they start losing money. However, as times goes, oil companies start to adapt to the new oil price reality and they manage to make profits at the new low oil price, whatever it is.

This happens due to the fact that many oil companies are not operating efficiently in high oil prices environment. They get used to high oil prices to the point where they are no longer able to realize that they can do more with less. But when they are hit with harsh reality, and the fact that they either improve, or leave, they become able to realize that many things can be improved and done more efficiently. Eventually, they become able to survive and make profits at whatever the oil price is, it just takes time.

Unlike oil companies, when a market downturn happens, the oil industry is usually not in a good state. Higher oil prices discourage consumers and make them look for cheaper alternatives instead. When that happens, the global oil market share decreases and the future of the oil industry becomes under threat, even though it is still the supplier of the world’s leading fuel.

The opposite is absolutely true. When oil prices fall and remain at a level that is suitable both for producers and consumers, its global market share increases. When oil becomes cheap, at an affordable price, its consumption increases. In fact, this is exactly what happened during the current oil market downturn.

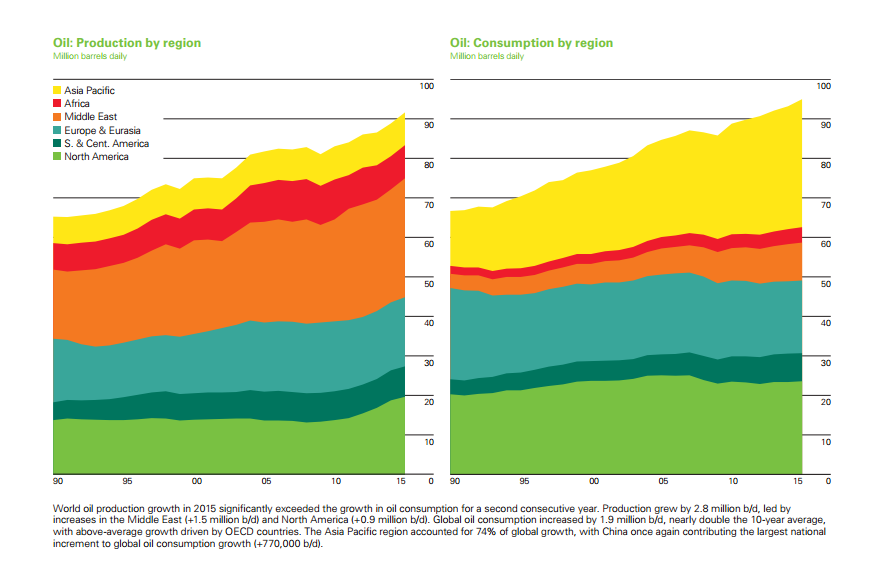

According to the 65th edition of BP Statistical Review of World Energy, in 2015 crude oil gained market share for the first time since 1999. The gain in crude oil market share in 2015 is a direct result of low oil prices. It is obvious that low oil prices prompted adjustments in the energy markets where oil demand was lifted in some markets.

Source: BP Statistical Review of World Energy, June 2016

In 2015, global oil consumption grew by 1.9 million b/d, ( 1.9% ). Such growth in the global oil demand is significantly stronger than the increase of 1.1 million b/d seen in 2014, and nearly double the historical average of 1%. Generally, crude oil remained the world’s leading fuel, accounting for 32.9% of global energy consumption.

The above figures reported by BP Statistical Review of World Energy prove that low oil prices environment benefits the oil industry more than high oil prices’ does. The oil industry is in a good state as long as the global oil market share is growing. The ones who benefit from high oil prices are cash-thirsty producers not the industry itself.

With the raising threat to the oil industry from other industries especially electric vehicles industry, the best option for oil prices is to remain low at a level that benefits both producers and consumers. After all, our goal is to fuel the world not to purely make money. If we stick with the first goal, we can still make money, but once we focus on the second, we may just lose all.