7.5K

An Overview of LNG Market in 2017:

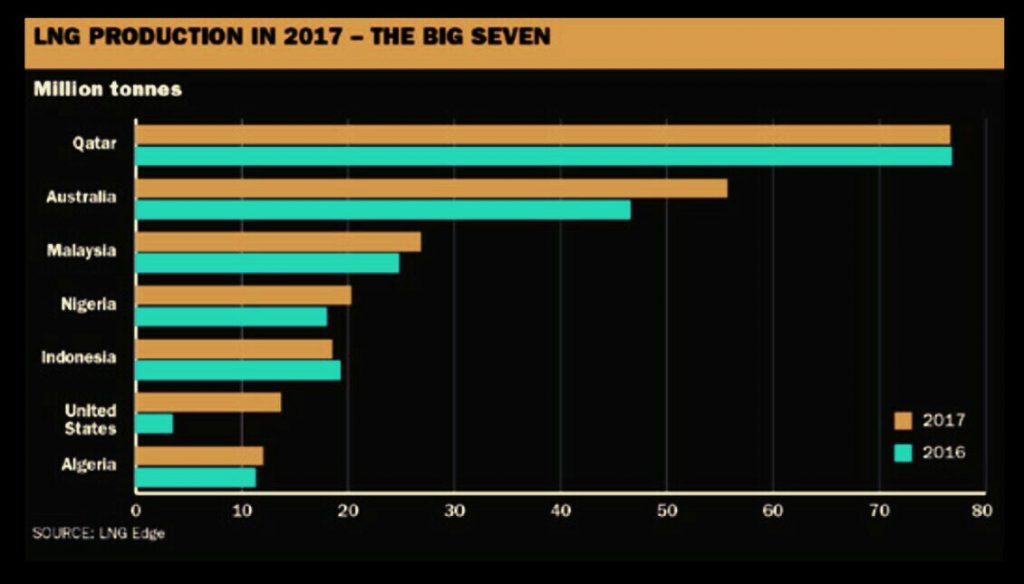

- LNG production in 2017 jumped to a record high of 290m tonnes, up by 12 percent from 2016.

- The increase in LNG production in 2017 was mainly driven by the rapid growth of LNG production from both; Australia and the United States.

- In 2017, Australia and the United States contributed an additional of 22m tonnes combined, according to the LNG Edge.

- LNG production from Qatar, the largest LNG producer, was the almost the same for both 2016 and 2017. No LNG production growth recorded.

- LNG production from Malaysia, Angola, Nigeria and Algeria slightly grew in 2017 with more consistency in supply.

- Among the top LNG producers, Indonesia saw its LNG production decline in 2017.

- Driven by its shale gas drilling boom, U.S. become the seventh largest LNG exporter globally.

- As the LNG supply share war intensifies, Australia’s supply share in East Asia grew by 3 percent in 2017 from 25% to 28%, while Qatar, the largest LNG producer, saw its supply share in the same region decline from 22 percent in 2016 to 20 percent in 2017.

LNG Production in 2017

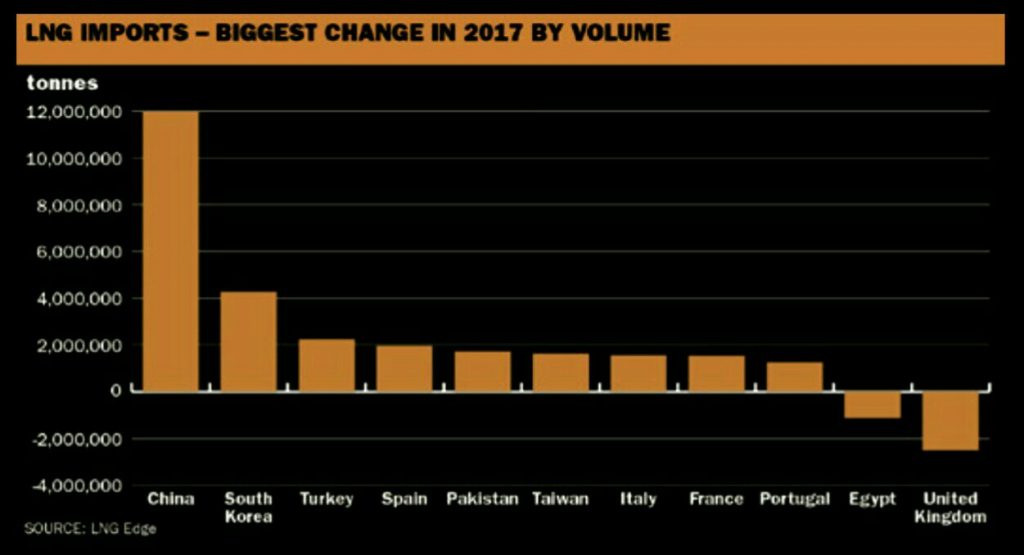

- New LNG production volumes was absorbed largely by East Asia.

- In 2017, China absorbed around 40 percent of the new LNG production making the country the second largest LNG buyer.

- As the Chinese government pushes towards gas and away from coal, China’s LNG imports in 2017 increased by 12m tonnes to reach 28.4m tonnes.

- When it comes to LNG imports, the four big East Asia buyers; China, Japan, South Korea and Taiwan absorbed almost 61 percent of the global LNG production.

LNG Imports

What to expect for 2018:

- LNG production to exceed 300m tonnes in 2018, with production coming mainly from Australia and the US.

- A growing competition for LNG supply share between Qatar, Australia and USA to intensify.

- United States to lead the growth in LNG production in 2018.

- Qatar to face a competition for its LNG exports from Australia in East Asia, and In Europe from USA and Russia.

- Qatar is expected to boost its LNG exports to Pakistan and start exporting LNG to Bangladesh.

- Australia to continue to grow its supply share in the East Asia.

- Qatar to aggressively boost LNG exports as part of its plans to enhancing its LNG production by 30% to 100mn tonnes per annum (Mta).

- Demand for LNG in East Asia to continue rising as countries move away from coal.