Last Week Oil Prices Overview:

Driven by the return of oversupply concerns, strengthening US dollar, and OPEC’s oil deal uncertainty, last week crude oil prices saw their biggest weekly loss since 6 months ago. Brent crude and WTI ended the week below the market threshold of $50 per barrel as it was expected in our last week Oil Price Commentary; Oil Price This Week: The Downward Pressure is High. Crude Oil prices fell by around 4 percent last week. Brent crude and WTI fell from $51.46/bbl and $50.52/bbl where it started on Monday to $49.71/bbl and $48.70/bbl by Friday respectively.

Brent Crude Oil Price

The fall in oil prices at the beginning of the week was driven by the strengthening US dollar which found support from the high probability of rate hike in the Fed’s December meeting. The fall in oil prices was intensified as Iraq commented on Monday that it wants to be exempt from any deal of production cut. While oil prices found some support on Tuesday and Wednesday from both; the rally in Wall Street shares and a small draw in crude inventories reported by the EIA on Wednesday, oil prices paired its gains shortly after these two events took place as doubts about OPEC production cut are growing fast following Iraq’s comments last week.

Last Week Oil Market Data and News:

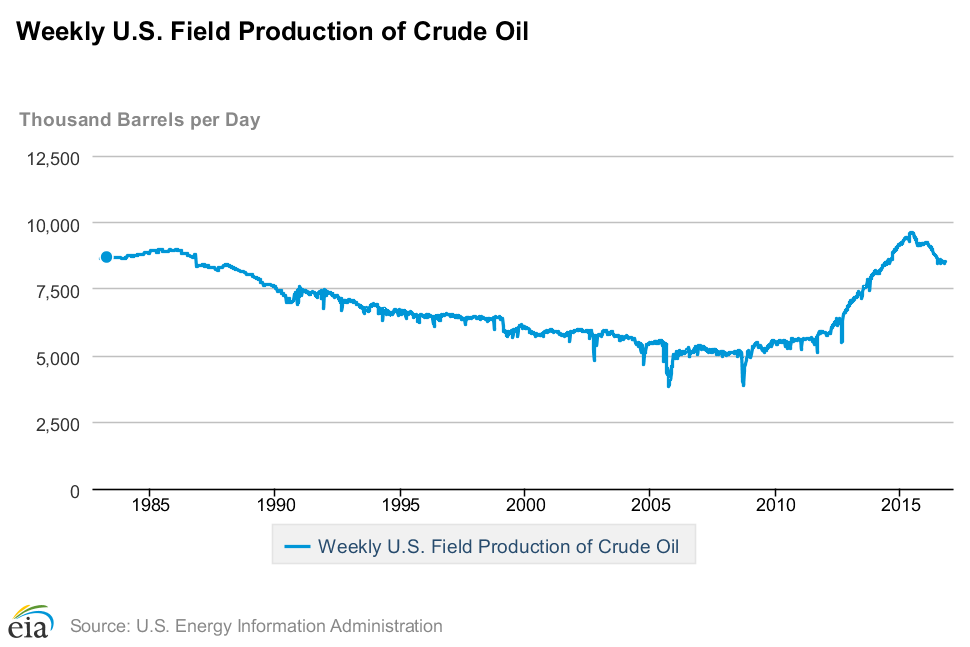

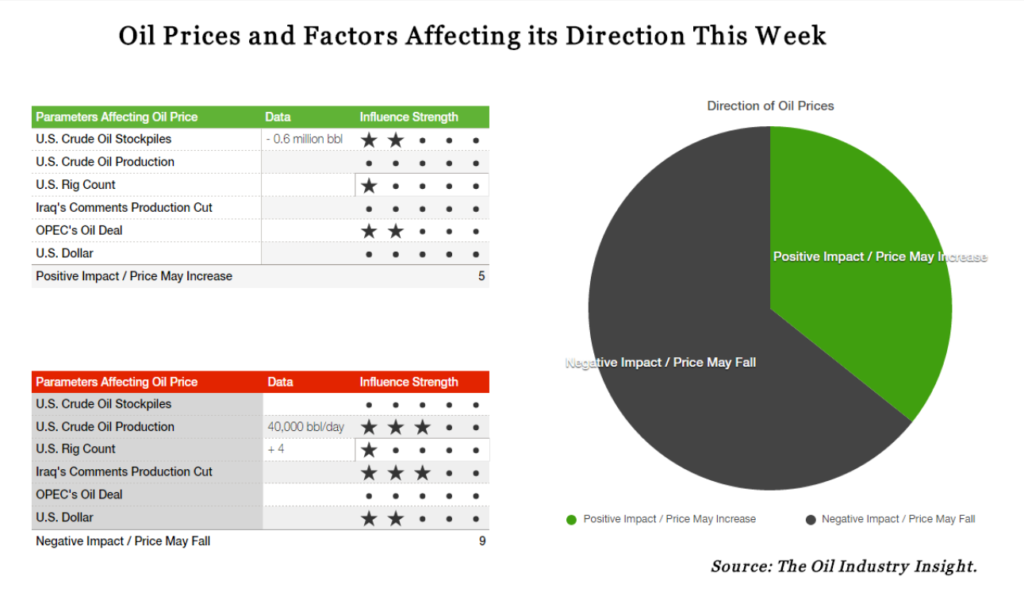

Last week data and news point toward a negative oil prices direction this week and in the short-term as well. First of all, despite the fact that the Energy Information Administration – EIA reported a small draw in US crude inventories by 0.6 million barrels last week, the EIA, in its Weekly U.S. Field Production of Crude Oil data reported a huge increase in US crude oil production by 40,000 barrels per day. This is a shift in US crude oil production which was expected in our previous analysis “The Threat Awaiting Oil Prices At $50/bbl” as oil prices stabilized above $50/bbl for the past few weeks. This is the second week US crude oil production increases, and now it seems that shale oil producers are able to ramp up production faster than many analysts are expecting especially if oil prices remain above $50/bbl.

Weekly U.S. Crude Oil Production

Adding to the downward pressure, Iraq appears to be the cartel’s member which will lead to the failure of OPEC’s oil deal. Besides its comments last Monday where it said that it wants to be exempt from any production cut, the country is now disputing the accuracy of the data used to calculate OPEC members’ production levels, and it is looking for a revision of the data by OPEC and energy watchers. Iraq claims it is not getting a fair treatment in terms of restraining its production level by inaccurate data and the country aims to increase its production level. A step that threatens the already weak OPEC oil deal. Another sign that the country is not ready to be part of any production cut is the fact that Iraq is seeking bids for 12 small to medium sized oil fields and provided incentives to encourage international oil and gas companies to increase the oil production from those fields rapidly.

In a similar context, Nigeria and Libya appear to be the two countries that will follow Iraq’s path. Despite the recent attack of the Niger Delta Avengers on Chevron pipeline, Nigeria is working to bring back its oil production to 2.2 million barrel per day which now stands at 1.9 million barrel per day. Libya and Nigeria are not producing at full capacity as they face geopolitical turmoil. But that may not last for long and we may see their production brought back at any time soon. It is therefore hard to expect both countries to join the OPEC oil output deal and limit their oil production at the current level. And even if OPEC gave them the green light to be able to restore their oil production if they can, then what is the point of OPEC oil deal in the first place.

On the other hand, Baker Hughes reported an increase in US rig count by 4 rigs to the week ending October 30. However that increase was not in the oil-rig count. In fact US rig count declined by 2 rigs to 441 last week as reported by Baker Hughes. Regardless of the fact that this is the first decline of US oil-rig count in 4 months, the decline was not big and it does not represent a change in the upward trend as we may see US oil-rig count up this week as oil prices are still at a level that encourage US drillers to add more rigs. This trend could only be changed if oil prices fall back to around $45/bbl.

In general, last week data and news highlight 4 important points:

- Oil prices will not break above $53/bbl anytime soon. Oil prices may continue to fall further reaching to $45/bbl as oversupply concerns are growing.

- US shale oil producers are controlling oil prices indirectly. They will keep limiting the upward movement of oil prices as they continue to increase their drilling rigs and ramp up their oil production.

- The probability of OPEC oil deal’s failure is high. OPEC’s members seem not to be able to do anything other than to keep the ‘talking game’ to support oil prices. However, as time goes and their credibility decreases, their talk will have no profound effect on oil prices unless they take real actions.

- US dollar and US oil production and rig count will determine the short term oil prices movements more than anything else. Therefore, forget about OPEC’s nonsense and focus on these factors which are leading to the return of oversupply concerns.

This Week Oil Price Forecast: “Oversupply Concerns Dominate the Market”

The overall oil prices outlook for this week is highly negative. Driven by OPEC’s uncertainty, increase in US crude oil production and the return of oversupply concerns, oil prices are at risk of another fall toward $47/bbl. Brent crude and WTI may lose around 1 to 2 percent in the first and second day of trading. That fall in oil prices could further be intensified if the EIA reported an increase in US crude inventories. But if the opposite was to happen, the upward movement will be limited by OPEC uncertainty. In fact if oil prices could maintain the current level or around $50/bbl this week, it is enough.

Oil Prices Forecast

The impact of OPEC oil deal on oil prices this week is very low, and even if some of OPEC members made positive comments this week to support oil prices, the direction in which Iraq is heading and how it will impact OPEC oil deal is negatively dominating the oil market and making OPEC oil deal at risk of ending up as a failure like the previous deal. Not to add the negative impact of the increase in US oil production which is increasing the oversupply concerns. All these factors will impact oil prices negatively this week and will put huge pressure driving it down.

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.