Oil Prices Overview:

Oil prices held their gains last week as the oil rally has continued its momentum driven by various positive parameters including:

- A decline in U.S. crude oil inventories for the tenth consecutive week. (U.S. crude stocks fell by 1.1 million barrels for the week ending January 19, 2018)

- A decline in U.S. dollar on remarks by U.S. Treasury secretary that a weaker dollar is a good thing for trade and opportunities, which fuelled a significant sell-off for the dollar against other currencies.

- Positive comments from Saudi oil minister on extending cooperation between OPEC & non-OPEC oil producers beyond 2018. And,

- A positive World Economic Outlook for 2018 and 2019 published by the IMF.

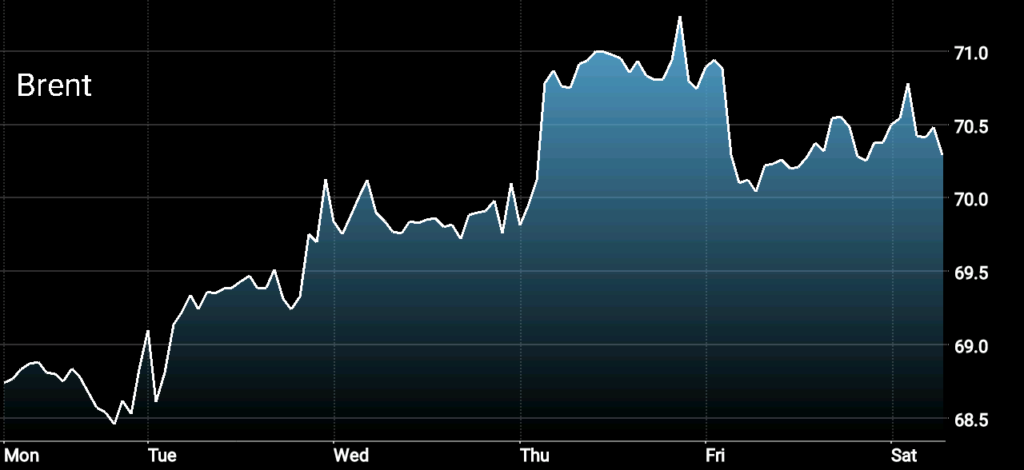

Driven by these positive parameters, Brent crude and WTI closed the week around $70.29 / barrel and $66.10 / barrel respectively. An increase of more than 2 percent and 4 percent for both benchmarks respectively from the previous week.

Brent Crude Oil Price

Where is Oil Price Heading this Week?

Oil Prices and Factors Affecting its Direction for the Week Starting January 29:

Oil Prices Forecast for the Week Ahead:

Oil prices are set for another positive week ahead despite pressure from rising U.S. oil rig count and last week increase in U.S. crude oil production. The main drivers for this week positive outlook for oil prices are but not limited to; a weaker U.S. dollar, positive comments from Saudi Arabia on extending oil output cut beyond 2018, and of course expectations of another decline in U.S. crude oil inventories for the eleventh consecutive week.

Although, Brent crude and WTI could face a little bit of downward movements (falling by 0.5 to 1 percent) early this week on Monday due to the report by Baker Hughes rig count on the addition of 12 rigs in U.S., the upward movement is expected to resume afterward on Tuesday and Wednesday following the reports by API and EIA which are expected to show a decline in U.S. crude inventories.

Brent crude and WTI are expected to hold their current gains throughout the rest of the week and could close the week on Friday February 2, up by 1 to 2 percent around $71.5 /bbl and $67/bbl respectively.

The downside pressure to oil prices this week expected to come from rising oil rig count both in U.S. and Canada, and an increase in U.S. crude oil production, however, the current market emotional state is more focused on positive market drivers which are many at this moment. The impact of growth in oil rig count and oil production in U.S. and Canada could well be felt after 2 to 3 weeks of continuous growth. But for now, OPEC members especially Saudi Arabia will continue to support the upward prices movements by their positive comments every now and then.

Oil Prices Movers to Watch for This Week:

- U.S. dollar movement throughout the week.

- API and EIA data of U.S. crude oil inventories.

- U.S. crude oil production data.

- Canada and U.S. oil rig count data.

Remark: The expectations of oil prices movements in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the movements of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.