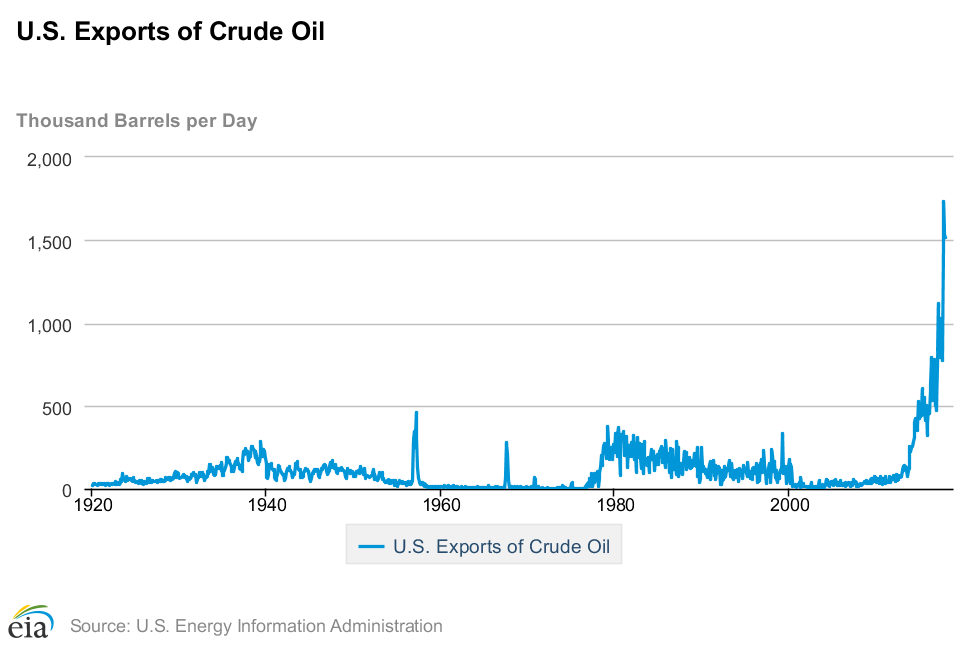

Since the United States lifted its ban on crude oil exports on December 2015, after the Congress voted to put an end to the 40-year-old export ban, U.S. crude oil exports has more than tripled from 392,000 bbl/day in December 2015, to almost 1.5 in December 2017, reaching to more than 3o countries in the last two years.

U.S. Crude Oil Exports

Lifting the ban on U.S. crude oil exports has:

- Given the green light for a change in the oil market dynamics, flow of crude oil exports and imports and marked the beginning of a market share war between U.S. crude oil producers and OPEC members.

- Encouraged U.S. crude oil producers to increase drilling activities and ramp up crude oil production as they have a market for their crude oil output.

- Put a considerable pressure on oil prices due to the threat of U.S. shale oil producers flooding the oil market with their crude oil output which could trigger another supply glut.

- Created an export boom that has filled pipelines and sparked a surge of investment in new shipping infrastructure in the United States.

- Eroded the clout of the Organization of Petroleum Exporting Countries (OPEC) and seized market share from many of its member countries.

- Opened the floor for U.S. producers to make new customers out of some of the world’s biggest oil-importing nations in Asia and Europe.

Going Forward:

With OPEC/non-OPEC producers cutting their oil output in an effort to support the oil price recovery, U.S. crude oil production is expected to continue to grow, and with it, U.S. crude oil exports will continue to grow as well. Under these circumstances, it is expected that U.S. crude oil exports to reach between 2 to 3 million a day in 2019. U.S. crude oil exports will continue to reach new destination and a direct competition between U.S. crude oil producers and OPEC producers will continue to accelerate mainly in Asian and European markets. The global crude oil trading and export/imports flow will be reshaped with U.S. play a important role.