Last Week Oil Market Data:

Last Week Crude Oil Price Movement: Crude oil prices closed last week at almost the same level where it started on Monday, July 31, 2017. Oil price started the week higher on support from falling US crude oil and gasoline stocks, weakening US dollar, draw-down in US crude oil production during the week before and possible US embargo on Venezuela’s oil exports. However, oil erased support on Tuesday through Thursday due to less than expected decline in US crude oil inventories and an increase in US crude oil production before closing the week higher on Friday as a result of support from a slight decline in the number of US rig count. Brent crude and WTI closed the week around $52.46/bbl and $49.57/bbl respectively.

Brent Crude Oil Price

U.S. Crude Oil Inventories: US crude oil inventories for the week ending July 28, 2017 fell by 1.5 million barrels to 481.9 million barrels. Given the previous weeks’ sharp declines in US crude inventories, last week US crude stockpiles decline was less than expected and therefore didn’t give much support to oil prices rally.

US Crude Oil Stockpiles

U.S. Gasoline Stocks: As reported by the EIA, U.S. gasoline inventories for the week ending July 28, 2017 fell by 2.5 million barrels. The decline in gasoline stockpiles supported oil prices on Wednesday.

US Gasoline Inventories

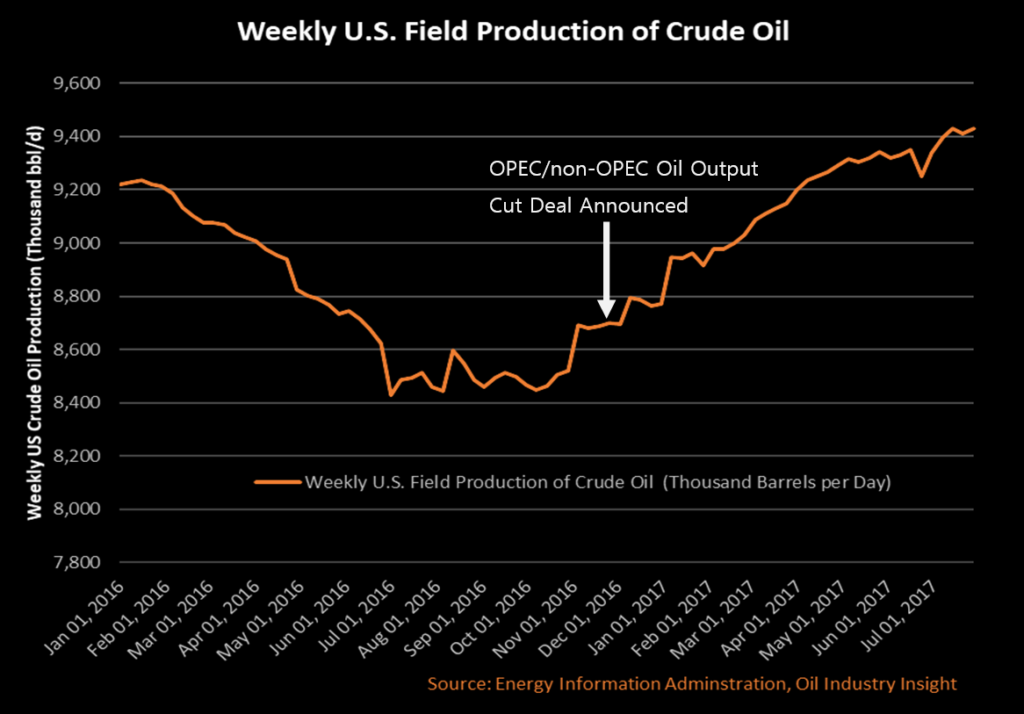

Weekly US Crude Oil Production: According to the weekly US crude oil production, US oil output increased by 20,000 bbl/day to 9,430,000 bbl/day as of July 28, 2017. At its current level, US crude oil production is 731,000 bbl/day up since November 2016’s OPEC/non-OPEC oil deal, and almost 1 million barrels up from the same time a year ago. With oil prices remaining around $50/bbl and the possibility of OPEC and non-OPEC producers deepening their oil output cuts, US crude oil production will continue to grow and we could see it touching 10 million barrels/day in the first quarter of 2018.

Weekly US Crude Oil Production

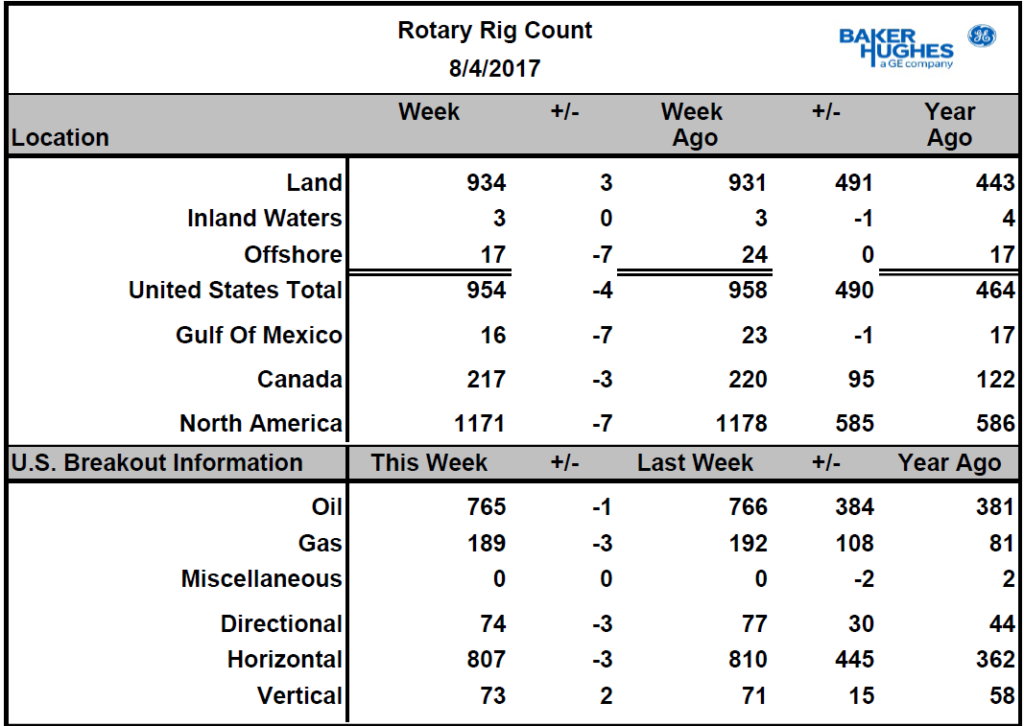

U.S. Rig Count: As a normal response to the recent fall in oil prices, US rig count growth is currently slowing down. Last week, Baker Hughes reported that US rig count fell by 4 rigs to 954 rigs. Oil rig count fell by 1 rig to 765, while gas rig count fell by 3 rigs to 189. At its current level, US rig count is twice what it was a year ago, and that is 490 rigs up. Rising rig count will continue to put pressure on oil prices. The recent slowdown in Us rig count growth was just a response to the fall in oil prices. Now that oil prices are up above $50/bbl, rig count is expected to continue climbing and putting more pressure on oil prices.

US Rig Count

This Week Oil Price Forecast:

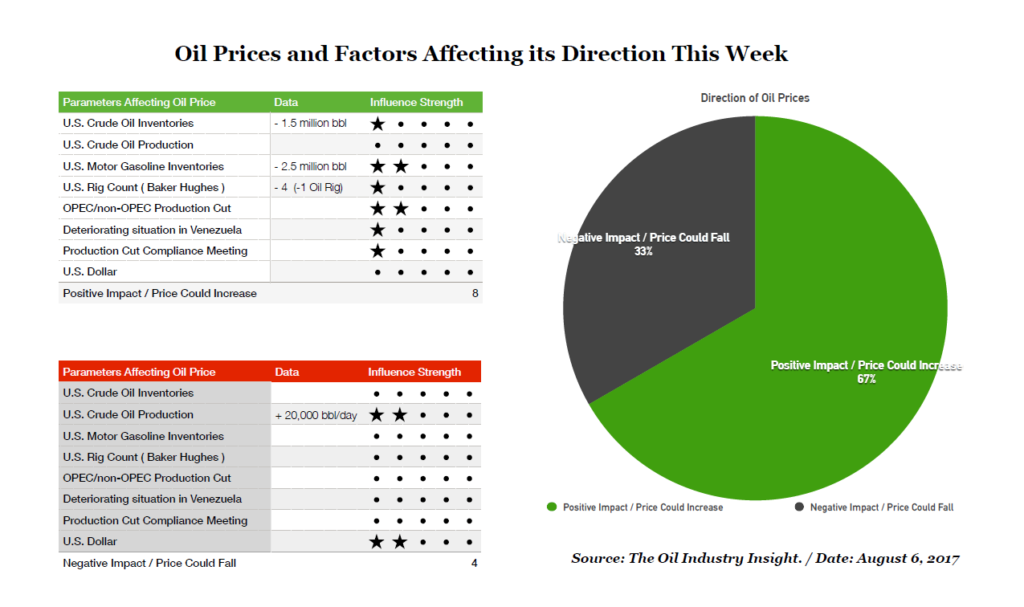

Most of last week’s oil market data and news were quite positive and that explains why oil prices held to the level where it started the week with. Taking these data into account and looking ahead at oil prices movement this week, oil price is expected to have a good week ahead. Support to oil this week is coming from last week’s decline in US rig count, crude oil stockpiles, deteriorating situation in Venezuela, and this week’s OPEC/non-OPEC joint technical meeting in UAE on Monday where they will be discussing the compliance of OPEC/non-OPEC members with regards to the oil-output cuts.

On Monday and Tuesday -the two days in which the OPEC/non-OPEC meeting is due to take place- Brent crude and WTI are expected to rise by 1 to 2 percent. That could change on Wednesday through Friday where we expect bearish data to come from the EIA. We expect US crude stockpiles to decline, however with a small amount. We also expect another increase in US crude oil production and a rise in US rig count which could erase the early week gains. US dollar will also contribute to the pressure on oil prices, however its impact will not be significant as the overall outlook for the greenback looks bearish.

Oil Price Movers to Watch For:

- OPEC/non-OPEC oil output cuts compliance meeting on Abu Dhabi (Monday) / Positive signal

- US crude oil and gasoline inventories data by the EIA (Wednesday) / Mixed signal, positive and negative

- US weekly crude oil production report by the EIA (Wednesday) / Negative signal

- US rig count data published by Baker Hughes (Friday) / Negative signal

- Nigerian government effort in making peace talks in Niger Delta

- Venezuela political situation

Stay ahead of oil prices movements by subscribing to the Weekly Oil Price Commentary published every Monday. Click here to subscribe.

Remark: The expectation of oil prices’ direction in this commentary are based on the oil market data and news up until the time of writing this commentary. As the week starts, new data and news are reported and could influence oil prices differently. Therefore, the direction of oil prices cloud be different from what was expected here. It is important to stay updated with oil market data and events as they occur.